C3.ai Earnings: The AI Revolution is Just Beginning

Don’t get it twisted, the AI hype is real. Some of the most influential investors in the world have commented on the topic and the consensus is, “this could be bigger than the internet.” So no, it isn’t too late to get involved.

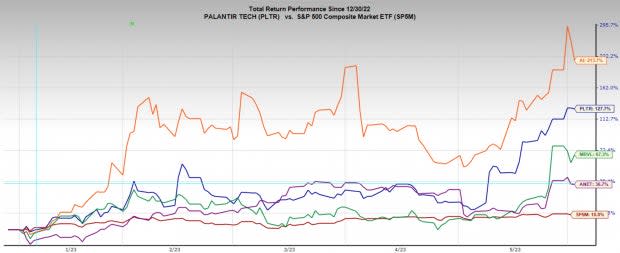

In this article I will cover C3.ai AI earnings and three AI stocks that investors may be overlooking. Palantir PLTR, Marvell Technology MRVL, and Arista Networks ANET have been extremely strong stocks this year and should benefit hugely from developments in generative AI.

Image Source: Zacks Investment Research

C3.ai

One company that has been ahead of the curve regarding AI technology is C3.ai, who reported earnings Wednesday after the market closed. Just so its clear, C3.ai has the ticker symbol AI.

C3.ai beat expectations reporting EPS of -$0.13 vs expectations of -$0.17, and sales of $72.4 million vs expectations of $71.3 million for the quarter.

The stock took a hit on Thursday following the report; however, you can see in the chart below just how strong AI stock has been, up 213% YTD. It should also be noted that although the stock gapped lower investors were buying all day and traded more than 10% off the low.

Image Source: TradingView

C3.ai is an enterprise AI application software company. It has built and deployed a portfolio of industry specific AI enabled SAAS products that enable organizations to take advantage of the new technology. C3.ai customers include Baker Hughes BKR, Koch Industries, Bank of America BAC, Consolidated Edison ED, the US Air Force, and a number of other heavy hitters.

AI has developed dozens of different software applications used throughout industries. They range from supply chain production schedule management to property appraisals, and energy management. By collaborating with companies, and organizing their data, these SAAS products provide insights that have previously gone unnoticed.

More than anything, they’re proprietary tools that enable analysts, investigators, and executives to be better at their jobs.

In the press release, Tom Siebel, a Silicon Valley veteran, and former founder, made several strong exclamations regarding the future of Artificial Intelligence, and his company.

Siebel noted that “We believe it is generally agreed today that the market for enterprise AI applications is substantially larger and growing at a much greater growth rate than experts predicted.” And that “As the enterprise AI market develops, it appears that the bulk of the demand is increasingly for turnkey enterprise AI applications, rather than development tools,” which would be huge for the business.

C3.ai boasts a considerable cash position of $812 million and projects business profitability by the end of FY24. C3.ai currently has a Zacks Rank #3 (Hold), indicating mixed earnings revisions.

Image Source: C3.ai Investor Relations

Palantir

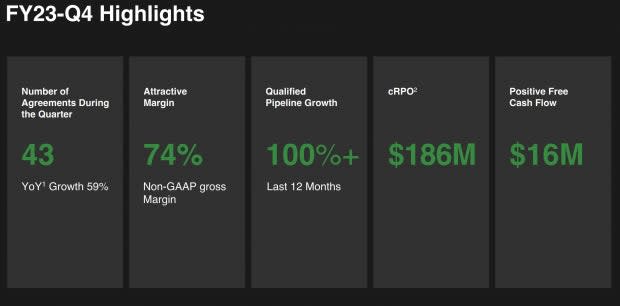

Palantir stock has been on a massive run since its recent quarterly report, rallying nearly 100% in less than a month. In that report PLTR announced that they ran the business profitability for the first time in a year and expect to be profitable in each quarter for the remainder of the year.

It also noted that “The depth of engagement with and demand for our new Artificial Intelligence Platform (AIP) is without precedent.” Like C3.ai, Palantir has been way ahead of the curve in working with AI technologies.

Image Source: TradingView

Palantir is a software company specializing in data analysis and artificial intelligence. Founded in 2003 by a group of entrepreneurs, including Peter Thiel, the company has gained significant attention for its innovative approach to handling large and complex data sets.

Palantir's software platforms, such as Gotham and Foundry, empower organizations to integrate, analyze, and visualize vast amounts of data, enabling them to make more informed decisions and solve intricate problems. The company serves a diverse range of sectors, including government agencies, defense, finance, healthcare, and more.

Because of its early adoption of generative AI technology, Palantir believes they can easily integrate the newest iterations on top of its current software. PLTR also believes in the intense power this new technology possesses and is thus focused on designing its products to involve human oversight of all applications.

Palantir has increased revenue by 28% annually since its IPO in 2019 and earned $1.23 billion in the last twelve months. PLTR currently has a Zacks Rank #3 (Hold), indicating mixed earnings revisions.

Marvell Technology

Marvell Technology is a leading semiconductor company that designs and develops integrated circuits for diverse markets, including data storage, networking, and wireless communications. Marvell's high-performance semiconductor solutions power data centers, cloud computing, IoT devices, and automotive systems. Their portfolio includes Ethernet switches, storage controllers, wireless connectivity solutions, and custom SoC designs.

During MRVL’s most recent earnings report on May 25, Marvell's CEO Matt Murphy stated that "AI has emerged as a key growth driver for Marvell, which we are enabling with our leading network connectivity products and emerging cloud optimized silicon platform. While we are still in the early stages of our AI ramp, we are forecasting our AI revenue in fiscal 2024 to at least double from the prior year and continue to grow rapidly in the coming years."

AI applications, particularly deep learning, and machine learning algorithms, require substantial computational power to process large datasets and perform complex calculations. Chip makers play a crucial role in developing specialized processors, such as graphics processing units (GPUs) and application-specific integrated circuits (ASICs), optimized for AI workloads.

Marvell Technology currently earns a Zacks Rank #3 (Hold). It also has rather pricey valuation, trading at a one-year forward earnings multiple of 68x, well above its 10-year median of 32x, and just above the industry average of 60x.

Arista Networks

Arista Networks is a leading provider of cloud networking solutions, offering high-performance network switches and software for data centers and cloud computing. Their innovative and scalable solutions, powered by the Extensible Operating System (EOS), enable enterprises, cloud service providers, and large-scale data centers to build efficient and scalable networks. Arista Networks' focus on software-driven networking, interoperability, and open standards has positioned them as a trusted provider for the evolving demands of cloud computing and data-intensive applications.

ANET will be a direct beneficiary of the AI revolution. AI generates vast amounts of data that need to be processed, stored, and accessed efficiently. Data centers form the backbone of AI infrastructure, providing the necessary computational resources and storage capacity to support AI workloads. The AI revolution is driving the need for more powerful and scalable data center infrastructure to handle the massive influx of data and ensure low-latency processing.

ANET currently has a Zacks Rank #3 (Hold), indicating mixed earnings revisions. It is currently trading at a one-year forward earnings multiple of 32x, which is above the industry average 23x, but below its 10-year median of 37x.

Image Source: Zacks Investment Research

Conclusion

Chip makers like Marvell Technology, and data infrastructure businesses like Arista Networks stand to benefit significantly from the AI revolution due to the growing demand for advanced computational power, efficient data processing, and robust storage capabilities.

Furthermore, as the volume of data continues to increase, organizations will require robust resources for effectively wrangling, analyzing, and extracting insights from that data. In this regard, Palantir and C3.ai emerge as logical and innovative solutions.

It is impossible to predict the immense change these new technologies will bring the business world and society; however, these businesses have a good chance of being important parts of that change. While these stocks currently have mixed earnings expectations and have already rallied considerably, they are certainly worth putting on your watchlist.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance