C3.ai (AI) Q3 Loss Narrower Than Expected, Revenues Rise Y/Y

C3.ai, Inc. AI reported an adjusted loss of 7 cents per share in third-quarter fiscal 2022, beating the Zacks Consensus Estimate of a loss of 27 cents. The company had reported a non-GAAP loss per share of 23 cents in the prior-year quarter.

Revenues of $69.8 million beat the consensus mark by 4.18% and increased 42.2% year over year, driven by the rapid adoption of its model-driven AI architecture and services.

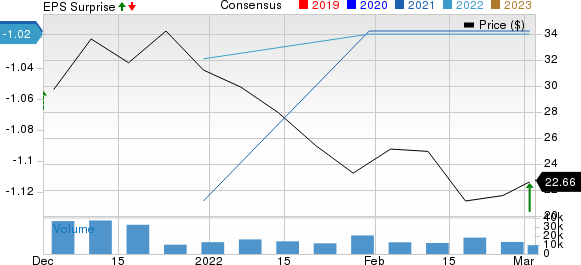

C3.ai, Inc. Price, Consensus and EPS Surprise

C3.ai, Inc. price-consensus-eps-surprise-chart | C3.ai, Inc. Quote

Quarter Details

C3.ai’s subscription revenues (81.8% of revenues) increased 33.8% year over year to $57.1 million. Professional service revenues (18.2% of revenues) increased 98% year over year to $12.7 million.

In the reported quarter, the non-GAAP gross margin expanded 400 basis points (bps) on a year-over-year basis to 79.9%.

Non-GAAP sales and marketing (S&M), research and development (R&D) and general and administrative (G&A) expenses increased 32.9%, 52.3% and 65.9% on a year-over-year basis to $34.1 million, $27.3 million and $9.3 million, respectively.

For the fiscal third quarter, C3.ai reported a non-GAAP loss from operations of $15.7 million compared with the non-GAAP loss from operations of $11.9 million reported in the year-ago quarter.

User Details & Partnerships in Q3

The total number of C3 AI enterprise customers at the end of the fiscal third quarter was 218, up 82% year over year.

Business from contracts executed in the reported quarter showcased a substantial increase in the industry diversification. 32% was from utilities, 30% of C3.ai’s business was from the chemical industry, 20% from agribusiness and 12% from financial services.

C3.ai continued to accelerate customer momentum and expanded its enterprise AI footprint in Defense, Chemicals, Financial Services, Manufacturing, Oil & Gas, Energy Sustainability and Utilities, with new enterprise production deployments at LyondellBasell, Shell, ENGIE, Royal Philips, Cargill and Swift.

Balance Sheet & Cash Flow

As of Jan 31, 2022, C3.ai had total cash, cash equivalents and short-term investments of $968.64 million compared with $970.42 million as of Oct 31, 2021.

Cash used by operating activities totaled $73.3 million in the reported quarter compared with $17.88 million used in the previous quarter.

Non-GAAP remaining performance obligation was $295.9 million, up 81% year over year.

Guidance

For full-year fiscal 2022, C3.ai expects revenues between $251 million and $252 million. Non-GAAP loss from operations is expected between $90 million and $94 million.

Zacks Rank & Stocks to Consider

Currently, C3.ai carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Computer and Technology sector are Model N MODN, LivePerson LPSN and Paycor HCM PYCR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Model N has an Earnings ESP of +5.0% and a Zacks Rank #2.

MODN is down 39% in the past year compared with the Zacks Internet - Software industry’s decline of 44.3% and the Computer and Technology sector’s rise of 5.3% in the past year.

LivePerson has an Earnings ESP of +4.69% and a Zacks Rank #2.

LPSN is down 57.2% in the past year against the Zacks Internet – Services industry’s rise of 10.7% and the Computer and Technology sector’s increase of 5.2%.

Paycor HCM has an Earnings ESP of +9.82% and a Zacks Rank #2.

PYCR is up 7.5% in the past year compared with the Zacks Internet – Software industry’s decline of 44.3% and the Computer and Technology sector’s rise of 5.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C3.ai, Inc. (AI) : Free Stock Analysis Report

LivePerson, Inc. (LPSN) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Paycor HCM, Inc. (PYCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance