C-Com Satellite Systems Inc. (CVE:CMI) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

C-Com Satellite Systems' (CVE:CMI) stock is up by a considerable 28% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Particularly, we will be paying attention to C-Com Satellite Systems' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for C-Com Satellite Systems

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for C-Com Satellite Systems is:

6.6% = CA$1.6m ÷ CA$24m (Based on the trailing twelve months to February 2021).

The 'return' is the yearly profit. So, this means that for every CA$1 of its shareholder's investments, the company generates a profit of CA$0.07.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of C-Com Satellite Systems' Earnings Growth And 6.6% ROE

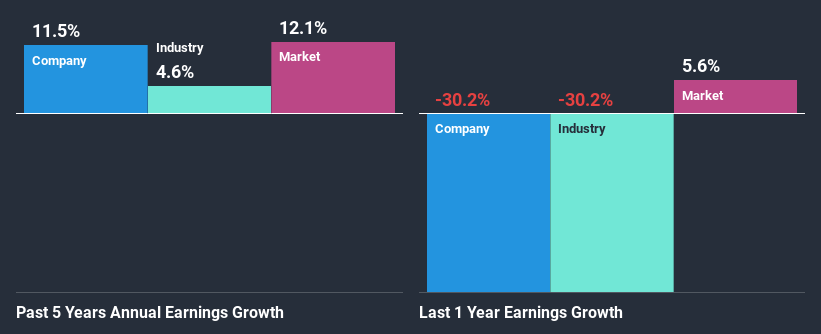

When you first look at it, C-Com Satellite Systems' ROE doesn't look that attractive. Yet, a closer study shows that the company's ROE is similar to the industry average of 6.4%. On the other hand, C-Com Satellite Systems reported a moderate 12% net income growth over the past five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared C-Com Satellite Systems' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 4.6% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if C-Com Satellite Systems is trading on a high P/E or a low P/E, relative to its industry.

Is C-Com Satellite Systems Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 93% (or a retention ratio of 7.3%) for C-Com Satellite Systems suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Additionally, C-Com Satellite Systems has paid dividends over a period of nine years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

On the whole, we feel that the performance shown by C-Com Satellite Systems can be open to many interpretations. Although the company has shown a pretty impressive growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into C-Com Satellite Systems' past profit growth, check out this visualization of past earnings, revenue and cash flows.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance