Buy the shop, not the pot: Cannabis retail chains may outshine producers

Canadian cannabis retail chains see themselves as the kingmakers of brands, and the growth engine driving the sector as more store locations broaden access to legal pot. Analysts expect a strong performance from pot shop chains in 2020, as producers seek to wedge pricier products into limited store space. However, the capital crunch of 2019 may haunt those without deep pockets.

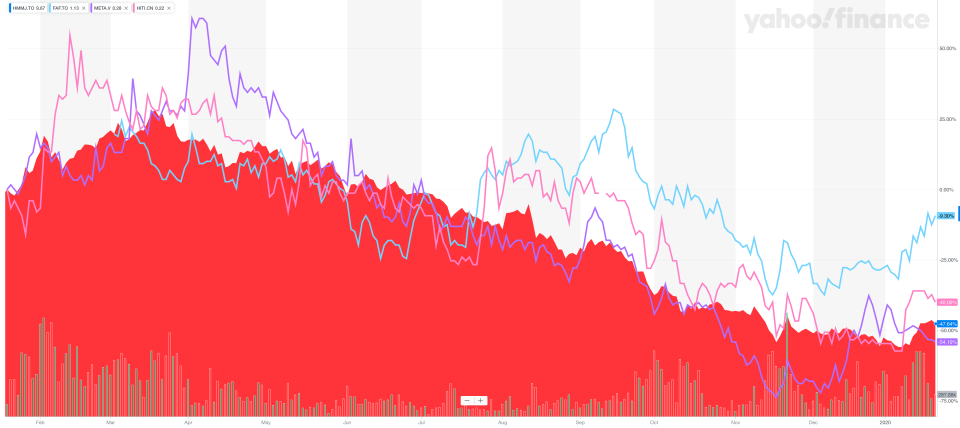

Fire & Flower (FAF.TO), Meta Growth (META.V) (formerly National Access Cannabis), and High Tide (HITI.CN) collectively oversee more than 100 stores, and they all plan to grow their retail footprints in 2020. Chief executives from the three companies participated in a panel hosted by AltaCorp Capital last week, where they discussed how they see cannabis retail evolving in 2020.

The rollout of physical stores in Canada has been anything but smooth thus far, with Ontario opening about two dozen since recreational legalization. That’s compared to the more than 300 serving Alberta’s far smaller population. Last year, AltaCorp analysts estimated Canada would need 3,640 locations to match the store density of Colorado’s mature recreational cannabis market.

“I’m really glad 2019 is over,” High Tide CEO Raj Grover told attendees at Toronto’s Shangri-La Hotel. “We learned a lot of valuable lessons.”

Meta Growth CEO Mark Goliger joked that he learned to assume that “government is not going to get it right,” referring to Ontario’s much-derided lottery-based store authorization system that was recently abandoned for an open allocation model.

For Fire & Flower CEO Trevor Fencott, it was the mood change among lenders that stood out, as the high-flying stocks that saw retail investors pile into pot in 2018 returned to earth in 2019.

“There was a lot of access to growth capital, and all of a sudden it completely dried up,” he said. “I think the biggest lesson that we can take from 2019 is to focus a lot more on profitability.”

With a tough year behind them, Fire & Flower, Meta Growth and High Tide expect 2020 will be a banner year as more stores open for business, consumers get a taste of pricier next generation products, and licenced producers compete for limited shelf space.

Earlier this month, AltaCorp Capital analyst David Kideckel named Fire & Flower his top pick in the cannabis retail sector, noting a better profitability outlook for retailers compared to licenced producers. Analysts at Stifel also named Fire & Flower their top cannabis pick in a lengthy 2020 outlook research note.

The analysts highlight the company’s strategic ties to Alimentation Couche-Tard (ATD-B.TO). The global retail operator announced a deal for 9.9 per cent of Fire & Flower’s equity for $26 million in July, with the potential to up its stake to 50.1 per cent of the company for $380 million. The partnership is aimed at helping Fire & Flower develop its digital retail platform and expand its store network.

“We expected a move to a more privatized model in Ontario, and see Fire & Flower as being a large beneficiary with already 13 strategic lease locations in high traffic areas (mainly in Toronto) ready to go,” Stifel analyst Justin Keywood wrote in a recent note to clients. “We see a compelling investment case with the growth profile ahead and strategic support from Couche-Tard.”

Kideckel praised the company for opening 46 stores ahead of its own timeline. He expects more stores and increased spending from cannabis 2.0 products like edibles and vapes to increase sales to $160 million in 2020, from $58 million in 2019.

The company expects to expand its store network to 135 locations in 2021.

Meta Growth plans to open 90 locations by the end of 2020. The Toronto-based company currently has 34 stores and 36 licences secured. CEO Mark Goliger sees power in the hands of retailers as licenced producers push new and unfamiliar products wrapped in government-mandated bland packages.

“We can king-make brands through distribution and budtender advice,” he said. “Ultimately, success and failure is going to be driven by the retailer. We have a finite amount of shelves. I would ask you to think, how many [chocolates] do you think we are going to carry? This is going to be a massive bottleneck.”

High Tide’s Grover is equally optimistic about the position of retailers in the cannabis value chain. However, he’s willing to slow the pace of new store openings in favour of a tidier balance sheet.

“Our complete focus in 2020 is to become cash-flow positive, even if it means we curtail a little bit of growth and go after selective locations,” he said. “It’s not only about ‘here’s what we’ve got on the map’. It’s about sustainable growth.”

His comments come days after the company secured a $10 million credit facility from Windsor Private Capital, a Toronto-based merchant bank, to open more stores in Ontario and Alberta.

Andrew Udell of the cannabis research firm TheCannalysts expects many retailers will have to go “cap in hand and raise money in a pretty tough market” in order to fuel growth.

He estimates new stores cost around $2 million to open, depending on location and other variables, with $1 million required for initial inventory alone.

“If you take a look at the cash balance of these companies, and their current run rates, they cannot incrementally open more than several stores,” he told Yahoo Finance Canada. “I just don't see them having enough capital runway to fulfil their promises.”

Fire & Flower, Udell said, is in the best position. Although, he notes Couche-Tard acquired its stake in the company “cheaply on the backs of shareholders.”

“Ultimately, Couche-Tard has given them the platform to have as much capital and runway they need to deploy exactly how many stores they need,” he said. “Despite the amount of loss of control, at least they have access to capital to be able to realize a breakeven stance and bring in knowledge and infrastructure from a well-established retailer.”

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance