Should You Buy The RMR Group Inc. (NASDAQ:RMR) For Its 2.2% Dividend?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

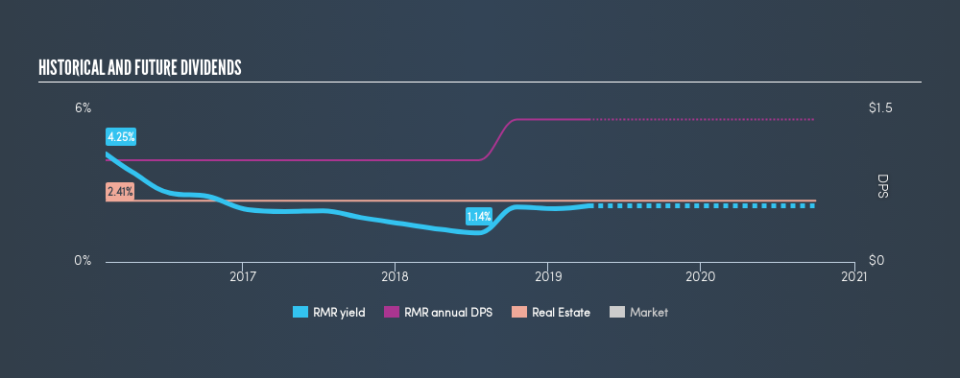

A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. The RMR Group Inc. (NASDAQ:RMR) has recently paid dividends to shareholders, and currently yields 2.2%. Should it have a place in your portfolio? Let's take a look at RMR Group in more detail.

See our latest analysis for RMR Group

5 questions to ask before buying a dividend stock

When assessing a stock as a potential addition to my dividend Portfolio, I look at these five areas:

Is its annual yield among the top 25% of dividend-paying companies?

Has it paid dividend every year without dramatically reducing payout in the past?

Has dividend per share amount increased over the past?

Does earnings amply cover its dividend payments?

Based on future earnings growth, will it be able to continue to payout dividend at the current rate?

Does RMR Group pass our checks?

RMR Group has a trailing twelve-month payout ratio of 25%, meaning the dividend is sufficiently covered by earnings. Furthermore, analysts have not forecasted a dividends per share for the future, which makes it hard to determine the yield shareholders should expect, and whether the current payout is sustainable, moving forward.

If you want to dive deeper into the sustainability of a certain payout ratio, you may wish to consider the cash flow of the business. Companies with strong cash flow can sustain a higher payout ratio, while companies with weaker cash flow generally cannot.

Reliablity is an important factor for dividend stocks, particularly for income investors who want a strong track record of payment and a positive outlook for future payout. Unfortunately, it is really too early to view RMR Group as a dividend investment. It has only been consistently paying dividends for 3 years, however, standard practice for reliable payers is to look for a 10-year minimum track record.

Relative to peers, RMR Group produces a yield of 2.2%, which is on the low-side for Real Estate stocks.

Next Steps:

Now you know to keep in mind the reason why investors should be careful investing in RMR Group for the dividend. But if you are not exclusively a dividend investor, the stock could still be an interesting investment opportunity. Given that this is purely a dividend analysis, I recommend taking sufficient time to understand its core business and determine whether the company and its investment properties suit your overall goals. Below, I've compiled three relevant factors you should further research:

Future Outlook: What are well-informed industry analysts predicting for RMR’s future growth? Take a look at our free research report of analyst consensus for RMR’s outlook.

Valuation: What is RMR worth today? Even if the stock is a cash cow, it's not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether RMR is currently mispriced by the market.

Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance