Buy the Opportunity in These Stocks After Earnings

Investors are always on the lookout for stocks that present buying opportunities after reporting quarterly earnings.

There are many catalysts and factors that can make stocks more attractive after releasing their quarterly results. Rather it be strong top or bottom line figures, positive guidance, or an overreaction in the market that leads to a quality stock being oversold.

With that being said, here are three top-rated Zacks stocks that may offer good buying opportunities right now.

Crocs (CROX)

First up is Crocs, the footwear and apparel leader sports a Zacks Rank #2 (Buy) and appears to be somewhat oversold following its first-quarter results last Thursday.

Despite beating top and bottom-line expectations, Crocs stock fell more than 11% after the company issued a profit warning in its outlook for the second quarter. Crocs now expects Q2 earnings between $2.83-$2.98 per share which is below many analysts’ forecasts and the current Zacks Consensus of $3.15 a share.

Still, Crocs beat its first-quarter earnings expectations by 22%. Crocs Q1 earnings were $2.61 per share compared to estimates of $2.13 a share. First-quarter earnings were also up 27% year over year with EPS at $2.05 in Q1 2022.

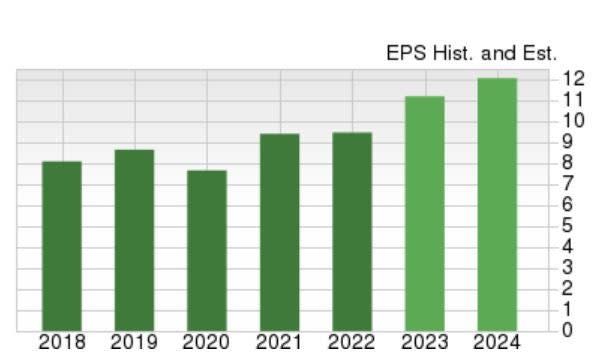

Although Crocs Q2 guidance was modest, annual earnings estimate revisions have continued to trend higher as the company raised its full-year revenue outlook for fiscal 2023. To that point, Crocs is still expanding and has beaten earnings expectations for 12 consecutive quarters. Furthermore, earnings are now forecasted to rise 5% this year and jump another 10% in FY24 at $12.69 per share.

Image Source: Zacks Investment Research

Rockwell Automation (ROK)

Another stock that looks attractive after earnings is industrial automation and information solutions provider Rockwell Automation which also has a Zacks Rank #2 (Buy). Rockwell topped its fiscal second-quarter earnings expectations by 15% last Thursday.

Rockwell’s Q2 EPS came in at $3.01, compared to estimates of $2.62 per share. More impressive, earnings climbed 81% from the prior-year quarter with Q2 2022 EPS at $1.66. Rockwell attributed the strong growth to continued improvement in component availability and strong execution in delivering critical solutions to customers.

Rockwell earnings are now forecasted to climb 22% in fiscal 2023 at $11.55 per share compared to EPS of $9.49 in 2022. Fiscal 2024 earnings are expected to rise another 7%. Earnings estimate revisions have continued to rise over the last week with FY23 earnings estimates now up 6% over the last quarter while FY24 EPS estimates are up 4%.

Image Source: Zacks Investment Research

United States Steel (X)

Last but not least is United States Steel which boasts a Zacks Rank #1 (Strong Buy) and surpassed its bottom line expectations by 26% last Thursday.

United States Steel stock makes the case for being undervalued despite the large inflationary boost that steel producers received from higher commodity prices beginning to fade. First-quarter EPS came back to reality and dropped -78% from the prior-year quarter at $0.77 per share but still blasted estimates of $0.61 per share.

Better still, fiscal 2023 earnings estimates are still up a very intriguing 210% over the last 90 days with FY24 estimates up 15%. With United States Steel stock trading at just 5.8X forward earnings, the rising EPS estimates and Q1 earnings beat makes now look like an opportunistic time to buy.

Image Source: Zacks Investment Research

Bottom Line

Following their strong quarterly results these stocks look more attractive and may be underappreciated at the moment. The rising earnings estimates are a great sign that Crocs, Rockwell Automation, and United States Steel will continue to have a strong year and this could lead to more upside in their stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Steel Corporation (X) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance