Buy This Institutional-Quality Oil Stock Ahead of EPS

Did you know the Invesco S&P 500 Equal Weight ETF (RSP) is up a measly 1.79% year-to-date? Meanwhile, RSP’s market-weighted brethren, the S&P 500 Index ETF (SPY), is up a healthy 13.07% for the year. In other words, the gains in the leading indices can largely be attributed to mega-cap tech stocks, which have dominated 2023’s performance and lifted the indexes on their shoulders. For example, the Nasdaq 100 Index ETF (QQQ), which is home to tech juggernauts such as Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOGL), is up a staggering 39% thus far this year. Conversely, the Utilities Select SPDR Fund (XLU) and the SPDR S&P Regional Banking ETF (KRE) are down double-digits for the year, while the SPDR S&P Retail ETF (XRT) and the Russell 2000 Index ETF (IWM) are drastically underperforming, and is essentially flat.

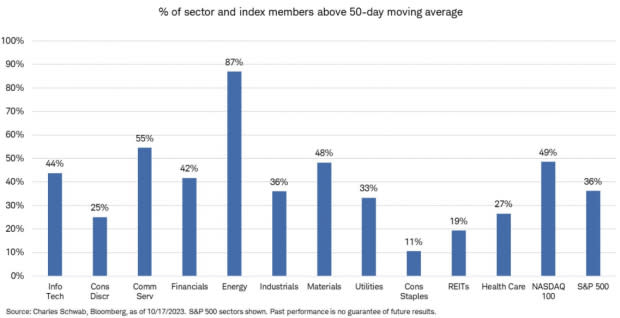

However, even with the perceived outperformance in tech, the most robust sector uptrend in the current market belongs to the energy sector. An overwhelming 87% of energy stocks are trending above their 50-day moving averages (the best gauge of the intermediate trend). Conversely, out of the other twelve sectors tracked by the study, only one sector is above the 50% threshold.

Image Source: Charles Schwab/Bloomberg

The Path to Profitability: Latch on to Existing Trends

Latching onto an existing uptrend is often easier than predicting one because it involves observing and following the current market momentum. When an uptrend is already in progress, market sentiment and investor confidence are positive, leading to higher stock prices. In my two decades of experience, I have learned that it is best to interpret current trends rather than trying to predict them. By joining an existing uptrend, investors align their trades with the prevailing market direction, reducing the guesswork associated with predicting future price movements. Below is the most attractive energy trend to latch onto:

Occidental Petroleum (OXY)

Coming into 2023, oil was already strong and had fully recovered from its pandemic-induced bear market. Thus far, the United States Oil ETF (USO) is building on those gains and is up 16.50% for the year. However, the momentum is picking up – the past six months are responsible for 11.41% of those gains. Why should investors choose Occidental Petroleum?

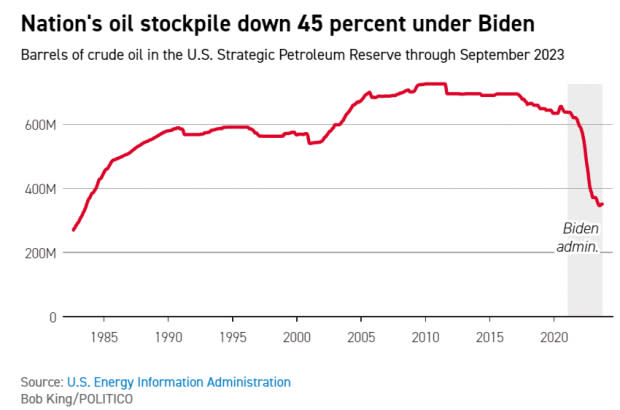

The Strategic Petroleum Reserve is Drained: The United State’s oil stockpile is down 45% during the Biden administration. Very soon, the SPR will need to be refilled for national security purposes, adding a floor of demand for oil prices.

Image Source: US EIA, Politico

Geopolitical Tensions are Rising: As the war in Ukraine drags on, conflict is escalating in the Middle East – home to the world’s most oil-rich countries. Supply disruptions have occurred already, but there is little sign of tensions slowing, and thus investors should expect more.

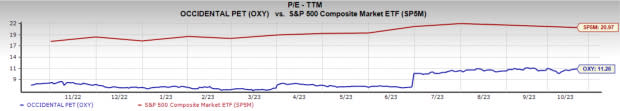

Attractive Valuation: Valuation is likely among the reasons that Warren Buffett, the most successful value investor of all time, has been building a massive position in OXY. OXY’s p/e ratio of 11.26x compares favorably to the S&P 500’s 20.97.

Image Source: Zacks Investment Research

Likely to Beat EPS 11/6: Occidental earns a positive Zacks Earnings ESP score.Stocks with a positive earnings ESP Score + a Zacks Rank of Hold or better tend to deliver positive earnings surprises 70% of the time. Furthermore, the Oil and Gas – Integrated Group, which OXY belongs to, is a top 11% industry, further solidifying the bullishness in the stock.

Image Source: Zacks Investment Research

Bottom Line

Energy has been the unequivocal leading sector in 2023. The strong energy backdrop is just one of several factors that contribute to OXY’s bullish outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

United States Oil ETF (USO): ETF Research Reports

SPDR S&P Retail ETF (XRT): ETF Research Reports

Utilities Select Sector SPDR ETF (XLU): ETF Research Reports

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

SPDR S&P Regional Banking ETF (KRE): ETF Research Reports

Invesco S&P 500 Equal Weight ETF (RSP): ETF Research Reports

Yahoo Finance

Yahoo Finance