Should You Buy Facebook (FB) Stock At New All-Time High?

Facebook FB stock climbed over 2.2% on Wednesday to touch a new all-time high after the company announced that its Instagram platform rolled out a new long-form video feature in a move that will see it compete more directly against the likes of Google’s GOOGL YouTube. Cleary, it didn’t take many investors too long to move on from Facebook’s data scandal woes. But let’s take some time to see if Facebook stock seems like a buy at the moment.

Instagram introduced its new IGTV yesterday that will allow users to upload hour-long video content up from its previous one-minute limit. The new features are available through the current Instagram app and a new standalone IGTV app (also read: Instagram Launches Long-Form Video: Should YouTube Worry?).

Investors should be happy to note that Instagram also announced that reached 1 billion monthly active users, up from 800 million in September 2017, which crushes Twitter’s TWTR 336 million MAUs. The photo-sharing app’s daily active user base also surpassed 500 million, topping Snapchat’s SNAP 191 million DAUs.

All of this is fantastic news for Facebook, which bought Instagram for $1 billion in 2012. Instagram’s popularity can hardly be understated in a world where mobile advertising is king. So a quick review of just how important advertising is for Facebook is in order—because, like CEO Mark Zuckerberg now famously said when asked how Facebook makes money at his congressional hearing, “senator, we run ads.”

Advertising

Facebook reported first quarter revenues of $11.97 billion, with ad sales making up $11.79 billion or nearly 99% of total Q1 revenue. Furthermore, Facebook’s mobile advertising revenue accounted for roughly 91% of its total ad revenue.

Facebook closed the first quarter with 1.45 billion DAUs, up 13% from the year-ago period. Meanwhile, the company’s flagship social media platform’s MAUs also climbed by 13% to 2.20 billion. And investors should remember these figures don’t include Instagram or the widely popular WhatsApp.

With roughly 40% of the world’s population using a Facebook-owned platform, the company can clearly grab a ton of advertising dollars, especially now that linear TV has become less popular and print continues to slowly fade. Facebook is reportedly set to grab19.6% of all U.S. digital ad dollars in 2018, according to eMarketer—with Google expected to capture 37.2%. Meanwhile, Instagram is projected to pull in 5%.

These figures help demonstrate why Facebook has become a Wall Street powerhouse and why it is expected to continue to grow.

Price Movement & Valuation

Shares of Facebook have climbed 138% over the last three years, which actually falls well short of fellow tech giant Amazon’s AMZN 300% surge. Facebook stock has only popped by roughly 30% over the last year, which does top the S&P 500’s 14% climb. All of which means the company might have some room to climb.

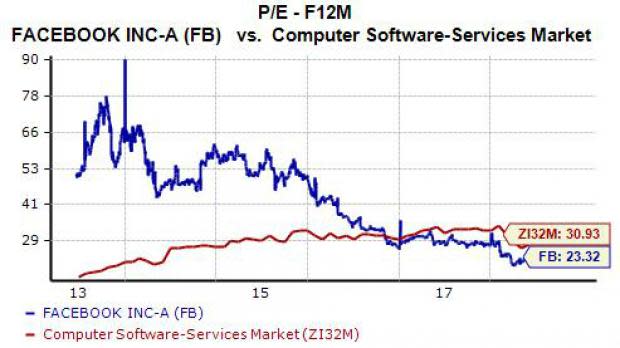

Investors should also take a look at Facebook’s current valuation picture, which looks rather attractive at its current level. Facebook stock is currently trading at 23.3X forward 12-month Zacks Consensus EPS estimates, which marks a substantial discount compared to its industry’s 30.9X average.

Over the last year, Facebook stock has traded as high as 31.5X and as low as 19.9X—which it hit near the end of March after its stock price plummeted—with a one-year median of 27.3X.

Investors will also see that Facebook is currently trading near its five-year low, and therefore it is hardly a stretch to say that FB stock appears to be rather attractive, if not flat out cheap—especially considering its massive growth prospects.

Growth

Facebook’s second-quarter revenues are projected to soar by 43.7% to touch $13.39 billion, based on our current Zacks Consensus Estimate. Looking ahead to the full-year, Facebook revenues are expected to climb by 40.5% to touch $57.12 billion.

Moving onto the other end of the income statement, Facebook’s adjusted quarterly earnings are projected to pop by 30%, while its full-year EPS figure is expected to expand by 24% to reach $7.67 per share.

Investors should also note that Facebook has received 17 full-year earnings estimate revisions, with 100% agreement to the upside, all within the last 60 days. Facebook is currently a Zacks Rank #3 (Hold) that sports an “A” grade for Growth in our Style Scores system, and looks like it might be worth considering at the moment.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance