Should You Buy Delta (DAL) After Its Recent Dividend Hike?

Delta Air Lines DAL management recently announced a 50% hike in its quarterly dividend payout. This was the first dividend increase announced by DAL since its resumption of quarterly dividend payments last year following the COVID-induced hiatus. Under the CARES Act, airlines were prohibited from paying dividends or buying back shares till Sep 30, 2022.

Coming back to Delta’s shareholder-friendly move, the airline heavyweight raised its quarterly dividend to 15 cents per share (annualized 60 cents per share) from the previous payout of 10 cents per share (annualized 40 cents per share). The new dividend will be paid out on Aug 20 to shareholders of record as of the close of business on Jul 30.

Financial prosperity owing to strong passenger revenues may have led to the dividend hike. The airline ended the first quarter of 2024 with cash and cash equivalents of $4.46 billion, much higher than the current debt level of $2.81 billion. This implies that the company has sufficient cash to meet its current debt obligations.

Delta is not the only player from the Zacks Transportation sector to have hiked quarterly dividends in 2024. In June, FedEx’s FDX board of directors approved a dividend hike of 10%, thereby raising its quarterly cash dividend to $1.38 ($5.52 annualized). In January, GATX Corporation's GATX board of directors announced a dividend hike of 5.5%, raising its quarterly cash dividend to 58 cents per share. Notably, 2024 marks the 106th consecutive year of GATX paying out dividends.

Robust Price Performance

Driven by upbeat passenger volumes, DAL shares have gained 22.7% year to date compared with its industry’s 11.9% growth. DAL shares have also outperformed the broader Zacks Transportation sector, which has declined 4.5%.

Image Source: Zacks Investment Research

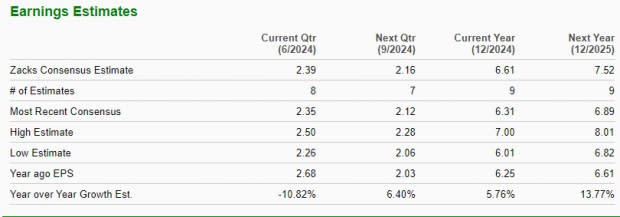

With air travel demand likely to gain further strength in the ongoing summer season and beyond, DAL stock should remain in good shape. The Zacks Consensus Estimate for current-year revenues and earnings per share is currently pegged at $61.12 billion and $6.61, respectively, implying an increase of 5.3% and 5.8% from the 2023 respective actuals.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The substantial dividend hike may boost the stock further. We note that investors are always on the lookout for companies that regularly hike dividends, as these provide an avenue for a steady income and a cushion against market uncertainty like the current scenario.

Given the positive development, investors may be wondering whether this is the right time to buy Delta shares for potential upside. Let’s take a closer look at the stock’s fundamentals to answer the question.

Schedule-Related Adjustments to Meet Demand Growth

To meet the anticipated demand swell, DAL is expanding capacity. It recently announced the most expansive winter schedule yet to popular ski destinations. The 2024-25 winter schedule, operative between Dec 21, 2024 and Mar 30, 2025, is likely to see a nearly 10% increase in seat capacity from the year-ago levels.

Additionally, DAL recently announced that from this fall, it would start selling Premium Select seats on New York-Los Angeles flights to meet the increasing demand for premium travel experience. Management’s decision to offer this premium product to passengers on domestic U.S. trans-continental flights is a prudent move in the current scenario of rosy air travel demand.

Headwinds in the Flight Path

Despite the abovementioned positives, the DAL stock has its share of headwinds. The increase in oil price is not a welcome development for the company as fuel expenses represent a key input cost for any airline player. The production cut announced by major oil-producing nations and geopolitical tensions directly impact Delta. As of now, second-quarter 2024 oil prices are expected to be in the $2.70-$2.90 band, which will affect the company’s profitability.

The northward movement in expenses on labor is also hurting DAL’s bottom line by pushing up operating costs. The March 2023 agreement with pilots meant continued increases in non-fuel unit costs (likely to increase another 2% year on year in the June quarter). The Zacks Consensus Estimate for second-quarter earnings, currently pegged at $2.39 per share, indicates a decrease of 10.8% from the year-ago actuals, likely due to the high costs.

Based on the trailing 12-month EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), a commonly used multiple for valuing airline stocks, DAL is currently trading at 5.93X, above the 5.32X five-year median.

Final Thoughts

We can safely conclude that investors should refrain from rushing to buy DAL now as it is facing quite a few challenges. Instead, they should monitor the company’s developments closely for a more appropriate entry point. The stock’s Zacks Rank #3 (Hold) supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance