Should You Buy BK Stock as it Hits All-Time High on Fed Cuts Rates?

Shares of The Bank of New York Mellon Corporation BK, popularly known as BNY Mellon, have performed well this year. The stock touched its all-time high of $71.80 during Wednesday’s trading session as the Federal Reserve announced a cut of 50 basis points (bps) in interest rates.

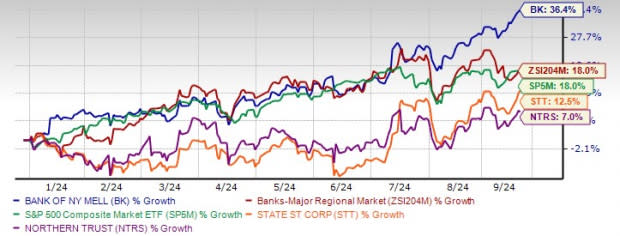

The BK stock finally closed yesterday’s session at $71.04, soaring 36.5% year to date. It has outperformed its industry, the S&P 500 Index and its close peers —Northern Trust NTRS and State Street STT— so far this year.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Interest Rate Cuts: A Major Driving Force for BK Stock

BNY Mellon’s shares hit a 52-week high repeatedly in the past month. The bullish investor sentiments are driven by the shift in the Fed’s monetary policy.

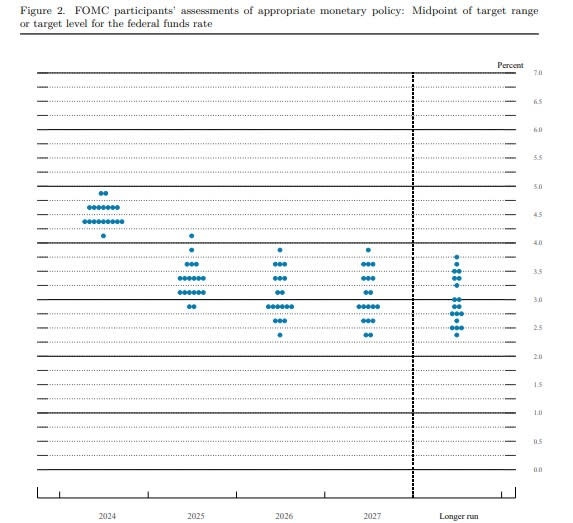

Yesterday, the central bank also signaled two more cuts this year to support the economy. The Fed officials indicated four more interest rate cuts in 2025 and two in 2026.

Fed’s Dot Plot

Image Source: Federal Reserve

This marks the end of the aggressive monetary policy adopted by the Fed to control decades-high inflation numbers. With the inflation significantly cooling down and resulting in a slowdown in the labor market, the central bank took this step.

The interest rate cut is a positive development for banks, including BNY Mellon, STT and NTRS. These custodian banks have been reeling under increasing funding cost pressure. While higher rates have led to a significant jump in banks’ net interest revenues (NIR), the same led to increased funding costs, which squeezed margins.

BK’s NIR has seen a five-year (2018-2023) compound annual growth rate of 3.8%. The company’s NIR declined in the first half of 2024 due to higher funding costs.

So now that the Fed has cut the rates, funding costs are expected to gradually stabilize/come down, supporting BNY Mellon’s NIR and margins over time. During the second-quarter earnings conference call in July, management reiterated its guidance of a 10% NIR decline this year.

Nonetheless, with rate cuts already started and more to come this year, the company might come out with better NIR guidance for 2024 after the third-quarter results on Oct. 11.

Other Factors Supporting BNY Mellon’s Performance

BNY Mellon’s growth initiatives are impressive. The company has been launching several new services and products, digitizing operations and making strategic acquisitions.

On Monday, BNY Mellon announced plans to launch Alts Bridge, an extensive data, software and services solution, by fall. It will cater to rising demand from wealth intermediaries seeking simplified access to alternative and private market investment products. The platform has been designed to integrate seamlessly into intermediaries' existing desktops, starting with BNY Pershing X’s Wove advisory platform and NetX360+, incorporating cutting-edge artificial intelligence and analytics tools.

Earlier this month, BK signed an agreement to acquire Berwyn, PA-based Archer Holdco, LLC, a leading technology-enabled service provider of managed account solutions to the asset and wealth management industry. This will bolster the company’s retail wealth presence.

BNY Mellon has a solid balance sheet. As of June 30, 2024, the company had a total debt of $50.3 billion, and cash and due from banks and interest-bearing deposits of $121.5 billion. It maintains investment-grade long-term senior debt ratings of A1, A and AA- from Moody’s, S&P Ratings and Fitch Ratings, respectively, which render it favorable access to the debt markets.

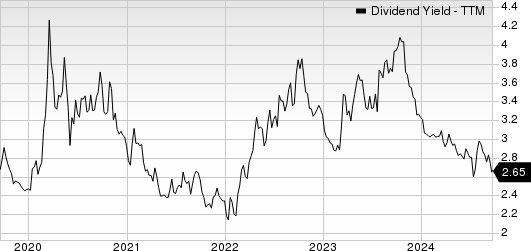

BNY Mellon is expected to keep enhancing shareholder value through efficient capital distributions. After the clearance of the 2024 stress test, the company hiked its quarterly cash dividend by 12% to 47 cents per share. In the last five years, the company increased its dividend four times. It has an annualized dividend growth rate of 7.84%, with a payout ratio of 31%.

Dividend Yield (TTM)

The Bank of New York Mellon Corporation dividend-yield-ttm | The Bank of New York Mellon Corporation Quote

Similar to BK, State Street hiked quarterly dividends by 10.7% as it cleared this year’s stress test. On the other hand, NTRS has kept its dividend payouts steady at 75 cents per share since July 2022.

Further, in April 2024, BK announced a new share repurchase program worth $6 billion. It will be effective once the prior buyback plan, which had approximately $0.81 billion authorization remaining as of June 30, 2024, is fully utilized. The company expects to return 100% or more of its earnings to shareholders in 2024 after having returned 123% last year.

Is This the Right Time to Buy BK Stock?

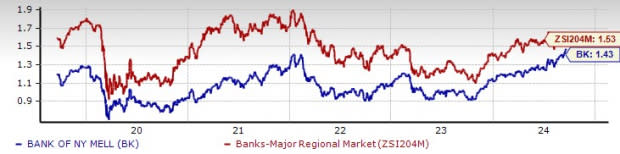

Despite the rally in BK shares, it appears inexpensive relative to the industry. The company is currently trading at the price-to-book (P/TBV) of 1.43X, below the industry’s 1.53X.

Price/Book

Image Source: Zacks Investment Research

Hence, from a valuation perspective, BNY Mellon’s shares present an attractive buying opportunity. The stock is still undervalued as the market has yet to fully recognize or price the company’s growth prospects.

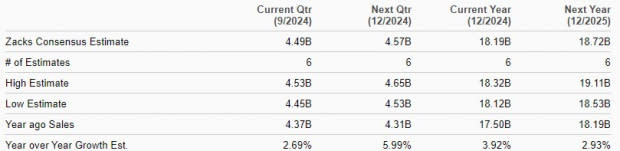

Further, BK is expected to deliver solid results in 2024 and 2025.

Sales Estimates

Image Source: Zacks Investment Research

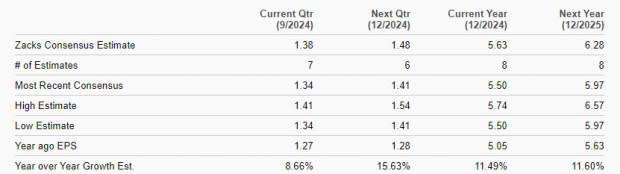

Earnings Estimates

Image Source: Zacks Investment Research

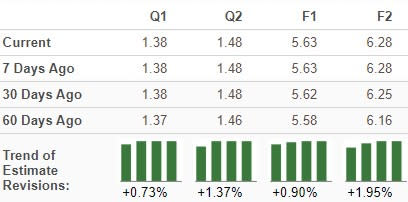

BNY Mellon is also witnessing northbound estimate revisions for the current and the next year.

Estimate Revision Trend

Image Source: Zacks Investment Research

BNY Mellon has demonstrated remarkable growth and resilience, significantly outperforming industry benchmarks and key peers. The company's efforts to expand its product suite to cater to client needs are expected to translate into substantial financial gains.

Also, cheap valuation, a healthy growth trajectory and positive estimate revisions make BK stock an attractive pick.

BNY Mellon currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance