Should You Buy AutoZone (AZO) After Its Recent Buyback Boost?

U.S.-based auto parts retailer AutoZone AZO has announced an additional stock repurchase authorization of $1.5 billion. Since the inception of the stock buyback program and including the latest authorization, the company has authorized $39.2 billion in share repurchases. In the last reported quarter, AutoZone repurchased shares worth $735 million. At the end of the quarter, it had over $1.4 billion remaining under share repurchase authorization.

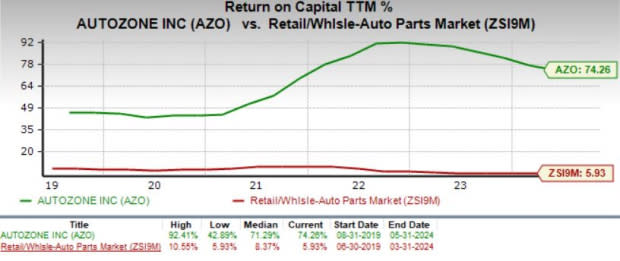

Investment-grade ratings from major rating agencies and strong cash flow generation are allowing AZO to remain committed to returning value to shareholders. The company's annualized cash flow growth rate has been 11.8% over the past 3-5 years versus the industry average of 2.7%. Investors should note that AutoZone has a 5-year average return on capital of 71%, which is spectacular both in absolute and relative terms, depicting its financial efficiency.

Image Source: Zacks Investment Research

Historically, the stock price movement of the company has been remarkable. Shares have gained roughly 450% and 3,600% over the last 10 and 20 years, respectively. Over the past year, shares of AZO have gained 21%, outperforming the industry.

Image Source: Zacks Investment Research

The stock hit an all-time high of $3,256/share on Mar 22, 2024. It is now trading at roughly 9% discount to its record high. Is this the right time to buy AutoZone shares for potential upside? Let’s take a closer look at the stock’s fundamentals and what’s driving this growth.

AZO’s Prospects Remain Healthy

One secular tailwind for AutoZone is the rising average age of U.S. vehicles. The average age of U.S. vehicles hit a new record of 12.6 years in 2024, up two months from 2023, marking the seventh consecutive year of increase. This will serve as a key catalyst for automotive aftermarket firms like AutoZone, as aging vehicles will drive the demand for repairs and maintenance. Per an S&P Global Mobility report, more vehicles are entering the prime range for aftermarket service, typically between 6 and 14 years old. Over 110 million vehicles fall into this category, representing nearly 38% of the fleet. This is expected to grow to 40% by 2028.

Additionally, high interest rates might deter consumers from purchasing new cars but affordability concerns are not likely to hit AutoZone hard as it operates in the aftermarket space.

Besides, AutoZone's strategy to improve inventory distribution by bringing the stock closer to customers will enhance efficiency and drive growth. The company is expanding its footprint both domestically and internationally, operating 6,364 stores in the United States, 763 in Mexico, and 109 in Brazil as of May 4. With 92% of stores incorporating a commercial program, AutoZone leverages its infrastructure to capture more market share. Initiatives like better inventory availability and the strength of the Duralast brand are boosting its commercial segment. Thanks to these strategic initiatives, AZO is able to generate handsome profits and reward investors generously.

It Still Isn’t an Opportune Time to Buy AZO Stock

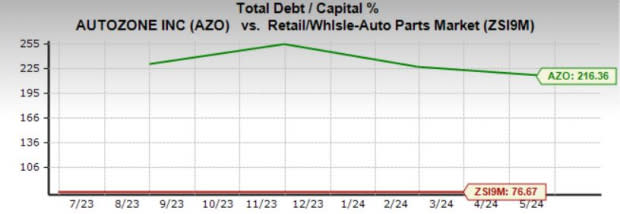

Despite the above-mentioned tailwinds, there are a couple of factors that keep us cautiously optimistic. Even though AutoZone carries investment-grade ratings, given its strong cash flows, operational efficiency and strategic growth initiatives, we are concerned about its high debt levels. The total debt amounted to $8.50 billion as of May 4, 2024, marking an increase from $7.67 billion on Aug 26, 2023, and $7.34 billion on May 6, 2023.

Image Source: Zacks Investment Research

Secondly, AutoZone’s valuation appears a bit pricey. Going by the price/earnings ratio, AZO shares currently trade at 18.39X forward earnings, higher than its five-year median.

Image Source: Zacks Investment Research

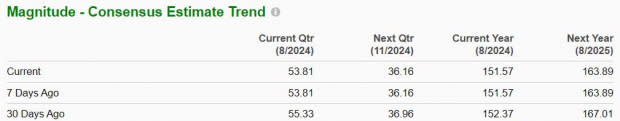

While AZO’s business is less cyclical as a vehicle manufacturer, it still faces some pressure from prolonged inflation and high interest rates. A premium valuation may not be justified unless consumer health improves, especially as EPS estimates have been revised downward over the past 30 days.

Image Source: Zacks Investment Research

The stock seems to have gotten a little too far ahead of itself. A slight price correction could offer a better entry point for potential investors. For those who already own the stock, stay invested for solid long-term prospects.

For fiscal 2024, the Zacks Consensus Estimate for AZO’s sales and EPS implies 6% and 14.5% growth, respectively, on a year-over-year basis. The consensus mark for fiscal 2025 sales and earnings indicates another 3% and 8% year-over-year growth, respectively.

AutoZone currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance