Buy These 3 Retail Stocks Now and Hold Forever?

Today’s episode of Full Court Finance at Zacks digs into the rapid stock market rebound over the last two weeks and looks at the evolving earnings picture. The episode then explores three major retail stocks—Walmart (WMT), Target (TGT), and TJX (TJX)—that are all set to report quarterly earnings this week to see if investors might want to buy these stocks and make them a part of a long-term diversified portfolio.

The stock market ripped higher again on Friday after a much-needed respite on Thursday. The bulls prevented the S&P 500 and the Nasdaq from edging back down toward their 50-day moving averages, quickly stopping the bears from clawing back any of the ultra-fast recovery.

The S&P 500 found buyers near the end of October shortly after the benchmark dipped below its key 200-day and 50-week moving averages. The comeback coincided with sliding U.S. Treasury yields and signs that inflation and the economy are continuing to cool.

Image Source: Zacks Investment Research

The rebound could have real legs if yields keep slipping and the economy keeps slowing, without falling into a sizeable recession. Retail earnings reports this week will provide key insights into the health of the U.S. consumer and the economy.

Walmart (WMT) - Reports its Q3 Results on November 16

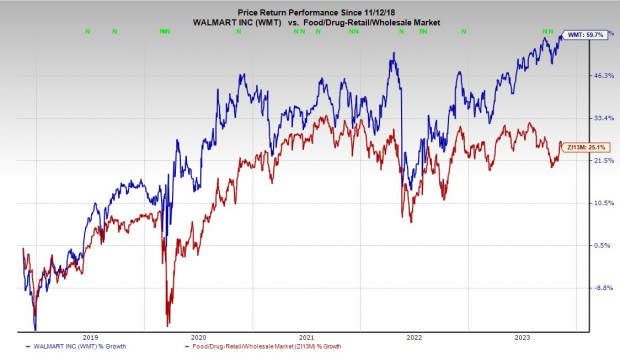

Walmart shares have surged 17% YTD to trade near fresh all-time highs, with shoppers clamoring for deals and Wall Street following in their footsteps. WMT’s push to compete against Amazon (AMZN) includes its own subscription service dubbed Walmart+.

Walmart is also expanding its own third-party marketplace and boosting its digital advertising segment, all while growing its reach as the one-stop shopping powerhouse that helps it generate more revenue than Amazon, Apple, and Exxon Mobil. Walmart is crucially continuing to innovate and push forward into new tech-focused and automation frontiers at its warehouses and stores.

Image Source: Zacks Investment Research

Walmart’s same-store sales growth has surged recently, alongside its e-commerce unit. Zacks estimates call for Walmart to post strong comps growth and revenue expansion this year and next while boosting its bottom line. WMT’s improving EPS outlook helps it grab a Zacks Rank #2 (Buy) right now and investors might want to consider Walmart for the long haul since it thrives during good economic times and bad.

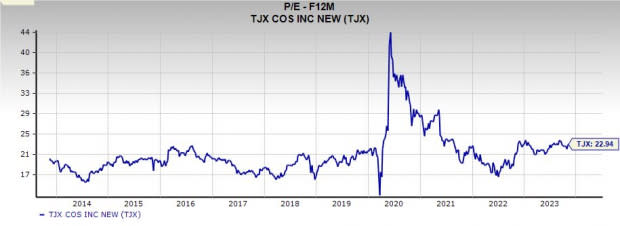

The TJX Companies, Inc. (TJX) – Reports its Q3 Results on November 15

TJX Companies, Inc. stock, like Walmart, has soared to fresh highs during 2023, with TJX currently trading just below its September peaks. TJX is an off-price apparel and home décor retailer that operates roughly 4,900 stores under multiple brands, including T.J. Maxx, Marshalls, HomeGoods, and others.

TJX has carved out a thriving retail niche by offering great deals on things people love to shop for in stores. The company has cultivated a loyal and growing customer base that keeps coming through thick and thin. TJX posted blowout second quarter FY24 results, with overall same-store sales up 6%, driven entirely by customer traffic.

Image Source: Zacks Investment Research

Zacks estimates call for 8% sales growth this year and 5% higher revenue next year, alongside 19% and 9%, respective earnings expansion. TJX stock is up 67% in the last five years and nearly 1,500% during the past 15 years. Despite the run, TJX trades around 50% below its highs in terms of forward earnings and near its 10-year median at 22.9X forward 12-month earnings.

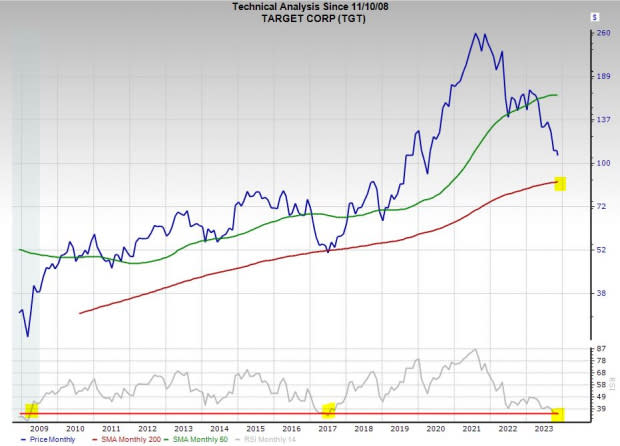

Target (TGT) – Reports its Q3 Results on November 15

Target is on the complete opposite end of the spectrum from Walmart and TJX, having been hammered over the last several years. In fact, TGT shares are now trading around 60% below their all-time highs as the company continues to lower its earnings outlook as shoppers focus on essentials and not the big-ticket items that drove Target’s Covid-19 boom.

Target shares have still climbed by 220% in the last 15 years vs. Walmart’s 195%. Yet its massive downturn has it trading around where it was in late 2019 and at a 20% discount to its 10-year median at 12.3X forward 12-month earnings. The fall helps TGT’s dividend yield 4.2% at the moment. Investors might want to put Target on their watchlists and look for it to possibly find support near its 200-week moving average, which is all the way down at $88 a share. Target is also trading at rather deeply oversold RSI levels.

Image Source: Zacks Investment Research

TGT stock was a pandemic and post-Covid superstar and it will likely bounce back once it finally normalizes its inventory and charts a more stable course going forward. Target’s negative earnings revisions help it land a Zacks Rank #4 (Sell) at the moment, which means investors likely want to stay away until at least after it reports its results and offers guidance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance