Burning Rock Biotech (NASDAQ:BNR) Shareholders Booked A 19% Gain In The Last Year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. For example, the Burning Rock Biotech Limited (NASDAQ:BNR), share price is up over the last year, but its gain of 19% trails the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Burning Rock Biotech

Burning Rock Biotech wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Burning Rock Biotech saw its revenue grow by 36%. We respect that sort of growth, no doubt. The share price gain of 19% seems pretty muted, considering the growth. Its possible that shareholders had expected higher growth. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

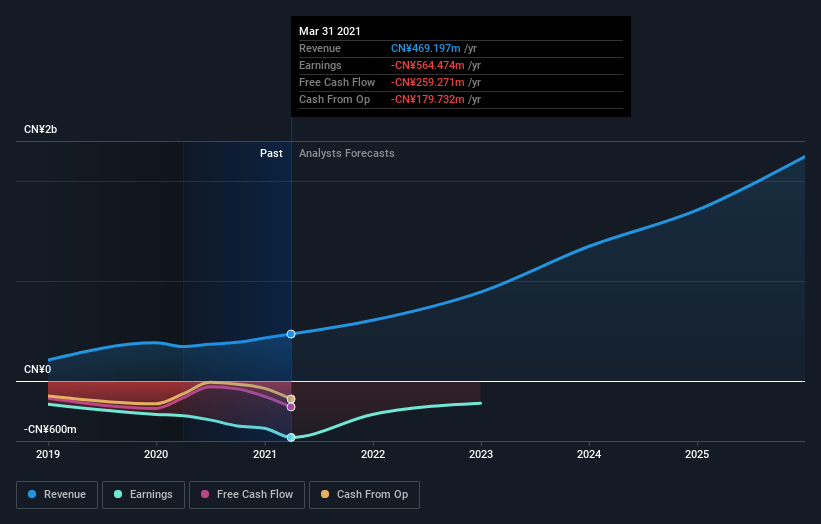

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Burning Rock Biotech stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're happy to report that Burning Rock Biotech are up 19% over the year. The bad news is that's no better than the average market return, which was roughly 48%. It's always interesting to track share price performance over the longer term. But to understand Burning Rock Biotech better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Burning Rock Biotech , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance