Burkhalter Holding And Two More Top Swiss Dividend Stocks

Despite a day of fluctuating fortunes where the Swiss market largely hovered in positive territory, it ultimately closed with a slight decline. In such an environment, discerning investors might look towards stable dividend stocks like Burkhalter Holding as potentially resilient options amidst market inconsistencies.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.50% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.10% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.38% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.32% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.92% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.09% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.12% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

EFG International (SWX:EFGN) | 4.09% | ★★★★☆☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

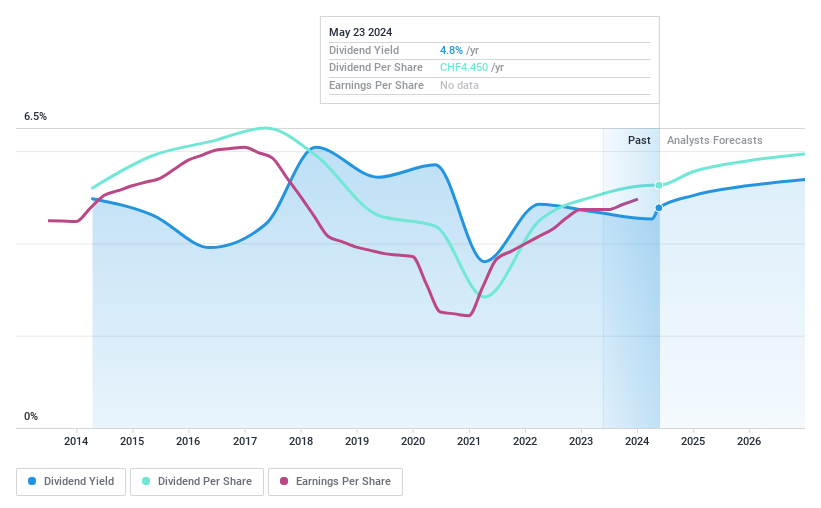

Burkhalter Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burkhalter Holding AG specializes in providing electrical engineering services to the construction sector throughout Switzerland, with a market capitalization of CHF 955.33 million.

Operations: Burkhalter Holding AG generates CHF 1.16 billion primarily from its electrical engineering services.

Dividend Yield: 4.9%

Burkhalter Holding is trading at 23.1% below its estimated fair value, suggesting potential undervaluation. Despite a volatile dividend history with significant annual fluctuations over the past decade, its current dividend yield of 4.94% ranks in the top 25% of Swiss dividend payers. The dividends are well-supported, covered by both earnings and cash flows with payout ratios of 89.9% and 87.1%, respectively. Earnings have increased by 34.7% last year and are expected to grow by 6% annually.

Unlock comprehensive insights into our analysis of Burkhalter Holding stock in this dividend report.

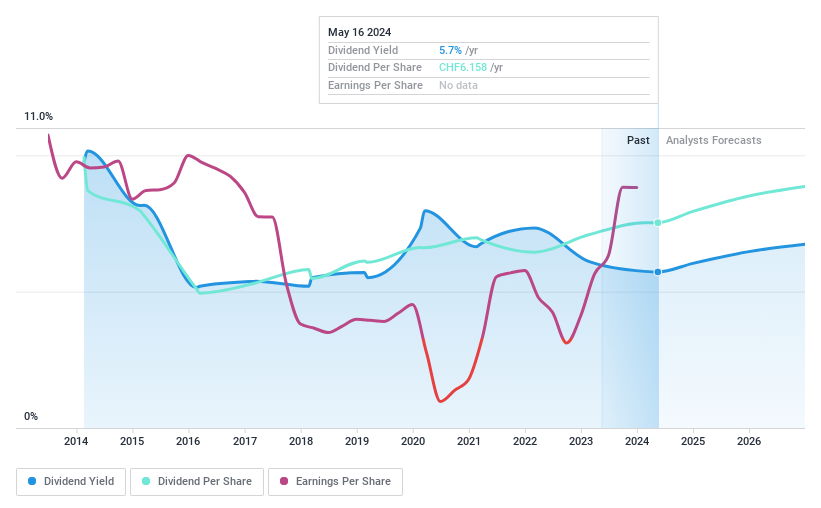

St. Galler Kantonalbank

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG, primarily serving the Cantons of St. Gallen, offers banking products and services to local residents and small to mid-sized businesses, with a market capitalization of CHF 2.59 billion.

Operations: St. Galler Kantonalbank AG generates its revenue by providing banking services to individuals and small to mid-sized enterprises in the St. Gallen region.

Dividend Yield: 4.4%

St. Galler Kantonalbank offers a solid dividend yield of 4.38%, ranking it well within the top 25% of Swiss dividend payers. The company's dividends have shown stability and growth over the last decade, supported by a consistent earnings increase of 5.2% annually over the past five years. With a payout ratio currently at 54.9% and projected to improve to 49.2% in three years, its dividends appear sustainable. Additionally, trading at a 25% discount to its fair value suggests potential undervaluation.

Swiss Re

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG operates globally, offering wholesale reinsurance, insurance, and other risk transfer services with a market capitalization of approximately CHF 32.05 billion.

Operations: Swiss Re AG's revenue is primarily derived from three segments: Corporate Solutions at $6.06 billion, Life & Health Reinsurance at $18.09 billion, and Property & Casualty Reinsurance at $23.74 billion.

Dividend Yield: 5.5%

Swiss Re presents a mixed dividend profile, offering a 5.53% yield, placing it in the top quartile of Swiss dividend stocks. Despite an unstable dividend history over the past decade, current dividends are well-supported with a payout ratio of 53.9% and cash flow coverage at 48.3%. Recent product launches and executive changes suggest operational enhancements but past volatility in dividends and a significant undervaluation (69% below fair value) indicate potential risks and opportunities for investors.

Click to explore a detailed breakdown of our findings in Swiss Re's dividend report.

Our valuation report here indicates Swiss Re may be undervalued.

Turning Ideas Into Actions

Get an in-depth perspective on all 26 Top Dividend Stocks by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BRKN SWX:SGKN and SWX:SREN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance