Burberry Group Leads Three Key Dividend Stocks In The UK

As global markets exhibit mixed signals with the FTSE 100 showing a subdued performance ahead of key economic events, investors continue to navigate through a landscape marked by cautious optimism and regulatory scrutiny. In such an environment, dividend stocks like Burberry Group offer potential stability and income generation, qualities that are particularly appealing in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.61% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.88% | ★★★★★☆ |

Epwin Group (AIM:EPWN) | 5.65% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.86% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 6.93% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.32% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.77% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.52% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.57% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Burberry Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burberry Group plc operates in the luxury goods sector, manufacturing, retailing, and wholesaling products under the Burberry brand, with a market capitalization of approximately £3.20 billion.

Operations: Burberry Group's revenue is primarily generated from its Retail/Wholesale segment, which brought in £2.91 billion, complemented by a smaller Licensing segment that contributed £63 million.

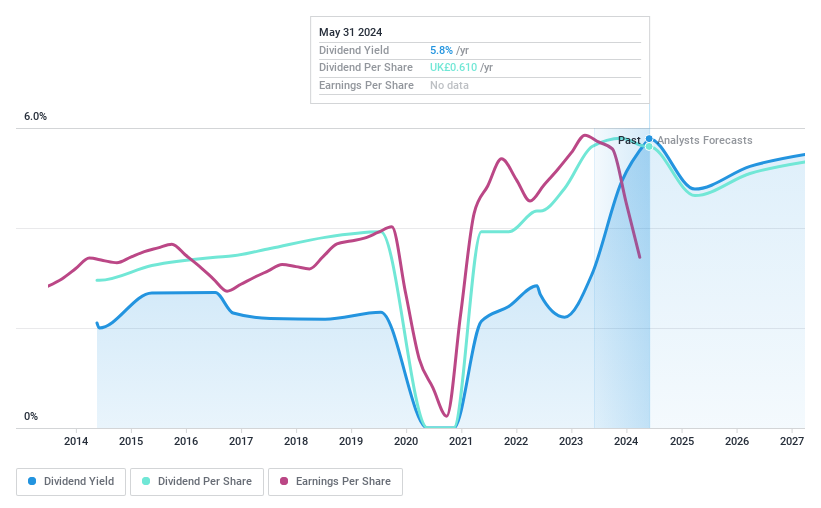

Dividend Yield: 6.8%

Burberry Group's dividends, with a 6.79% yield, rank in the top 25% of UK dividend payers. Despite a track record of volatile and unreliable dividends over the past decade, recent financials show both earnings and cash flows currently support its dividend payments with payout ratios at 82.5% and 73%, respectively. However, profit margins have declined from last year's 15.8% to 9.1%. The company recently proposed a reduced final dividend of £0.427 per share compared to £0.445 last year, reflecting some challenges in maintaining previous payout levels amidst fluctuating earnings, evidenced by a significant drop in net income from £490 million to £270 million year-over-year.

Morgan Sindall Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc is a UK-based construction and regeneration company with a market capitalization of approximately £1.24 billion.

Operations: Morgan Sindall Group plc generates revenue through diverse segments, including Fit Out (£1.11 billion), Construction (£966.60 million), Infrastructure (£886.70 million), Property Services (£185.20 million), Urban Regeneration (£185.30 million), and Partnership Housing (£837.50 million).

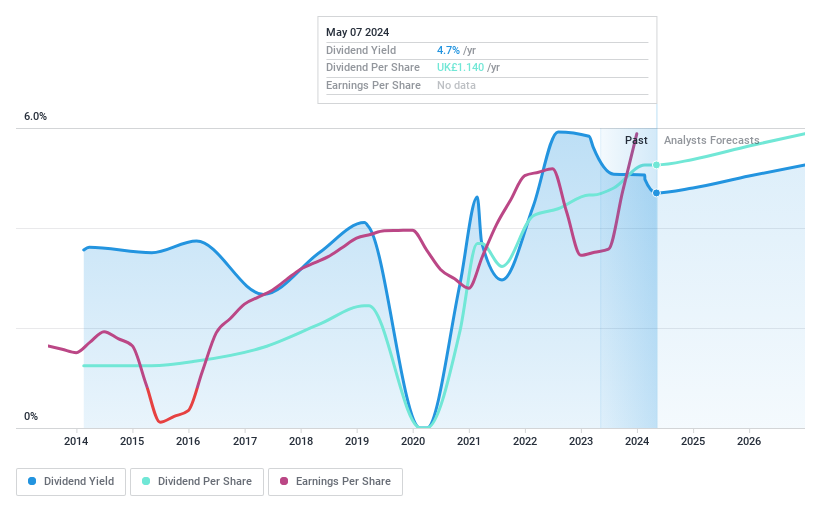

Dividend Yield: 4.3%

Morgan Sindall Group's recent dividend increase to 78 pence per share reflects a positive step, despite its historical volatility in dividend payments. The company's dividends are currently well-supported by both earnings and cash flows, with payout ratios of 44.8% and 29.1%, respectively, suggesting sustainability at present levels. However, the yield of 4.26% remains below the UK market's top quartile average of 5.52%. Recent executive changes could signal a strategic shift but their impact remains to be seen.

TBC Bank Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a financial entity offering banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.55 billion.

Operations: TBC Bank Group PLC generates its revenue primarily from banking, leasing, insurance, brokerage, and card processing activities in Georgia, Azerbaijan, and Uzbekistan.

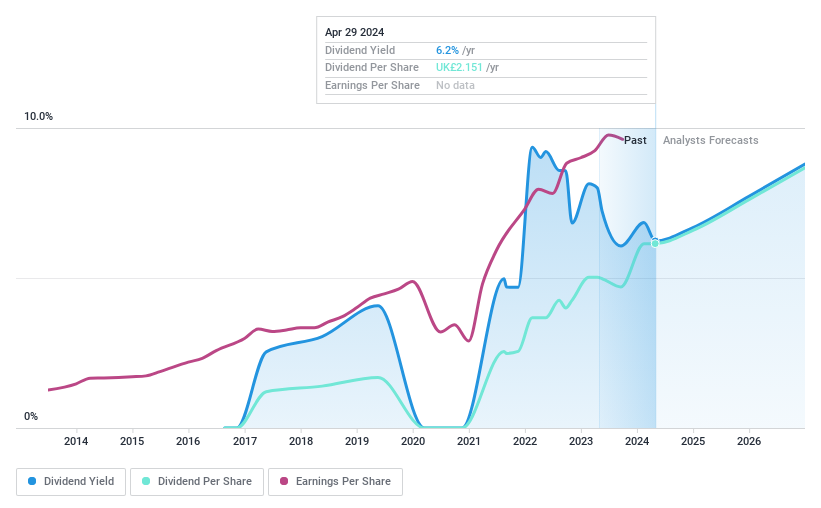

Dividend Yield: 7.1%

TBC Bank Group's dividend yield of 7.11% ranks in the UK market's top 25%, supported by a stable payout ratio of 33.5%. Despite a high bad loans ratio at 2.1% and inadequate allowance for bad loans at 74%, dividends are covered by earnings, with similar coverage expected in three years. Recent financials show robust growth, with net income up significantly to GEL 292.81 million from GEL 248.67 million last year, alongside a new share repurchase program aimed at reducing share capital.

Click here to discover the nuances of TBC Bank Group with our detailed analytical dividend report.

Upon reviewing our latest valuation report, TBC Bank Group's share price might be too pessimistic.

Summing It All Up

Get an in-depth perspective on all 55 Top Dividend Stocks by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BRBY LSE:MGNS and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance