Bullish Insiders Bought More Of These Stocks In June

Generally, insiders buying more shares in their own firm sends a bullish signal. A research published in The MIT Press (1998) concluded that stocks following insider buying outperformed the market by 4.5%. Though it is certainly not sufficient to base your investment decision merely on these signals alone, below I’ve put together three stocks you should examine further.

Range Resources Corporation (NYSE:RRC)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), and oil company. Established in 1975, and now led by CEO Jeffrey Ventura, the company now has 773 employees and with the company’s market capitalisation at USD $3.89B, we can put it in the mid-cap group.

Range Resources Corporation’s (NYSE:RRC) insiders have invested 959,033 shares in the large-cap stocks within the past three months. In total, individual insiders own over 1 million shares in the business, which makes up around 0.61% of total shares outstanding.

The entity that bought on the open market in the last three months was

SailingStone Capital Partners LLC. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

With a relatively flat forecasted top-line, but a robust earnings growth rate of 39.34% per year for the five years, insiders may have strong conviction in management’s cost initiatives moving forward. This underlying driver of growth could be one of the reasons why insiders have bought more shares over the past couple of months. More on Range Resources here.

Victory Capital Holdings, Inc. (NASDAQ:VCTR)

Victory Capital Holdings, Inc., together with its subsidiaries, operates as an independent investment management company in the United States. Founded in 2013, and headed by CEO David Brown, the company now has 267 employees and with the company’s market capitalisation at USD $708.05M, we can put it in the small-cap stocks category.

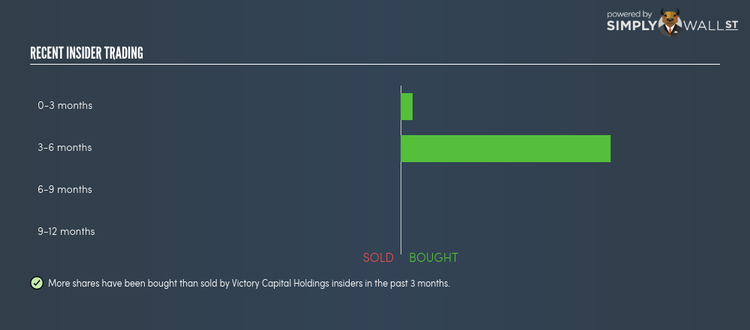

Victory Capital Holdings Inc (NASDAQ:VCTR) is one of United States’s small-cap stocks that saw some insider buying over the past three months, with insiders investing in 10,000 shares during this period. In total, individual insiders own over 78 million shares in the business, which makes up around 115.13% of total shares outstanding.

The insider that recently bought more shares is Alan Rappaport (board member) .

With a notable expected earnings growth rate of 142.31% in the upcoming year, the current bullish sentiment around the company’s outlook may be a key driver for insiders to rally behind their own stock if they believe this growth potential has not yet been properly factored into the share price. More detail on Victory Capital Holdings here.

Tonix Pharmaceuticals Holding Corp. (NASDAQ:TNXP)

Tonix Pharmaceuticals Holding Corp., a clinical-stage biopharmaceutical company, focuses on discovering and developing pharmaceutical products to treat serious neuropsychiatric conditions and to improve biodefense. Founded in 2007, and currently lead by Seth Lederman, the company provides employment to 14 people and with the company’s market cap sitting at USD $37.31M, it falls under the small-cap category.

Tonix Pharmaceuticals Holding Corp (NASDAQ:TNXP) is one of United States’s small-cap stocks that saw some insider buying over the past three months, with insiders investing in 25,100 shares during this period. In total, individual insiders own less than one million shares in the business, or around 2.23% of total shares outstanding.

Latest buying activities involved the following insiders: Bradley Saenger (management) . , Gregory Sullivan (board member) . , Jessica Morris (management) . , John Rhodes (management and board member) . and Seth Lederman (management) .

The entity that bought on the open market in the last three months was

Lederman & Co LLC. Although this is an institutional investor, rather than a company executive or board member, the insights gained from direct access to management as a large investor would make it more well-informed than the average retail investor. In this specific instance, I would classify this investor as a company insider.

More detail on Tonix Pharmaceuticals Holding here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance