Bullish EUR/AUD on Strong EUR, Weak AUD Due To Iron Ore Oversupply

DailyFX.com -

Point to Establish Exposure: Long on Retracement above 1.47

Spot: 1.4914

Target: 1.5461, 61.8% retracement of 2015-2017 range

Invalidation Level: Close below 1.46635, May 12 low

Highlights:

-EUR builds on bullish momentum as Nov. high in EUR/AUD taken out

-Per CFTC, hedge funds continue to close out AUD long positions

-Commodity bear market in base metals likely preventing AUD appreciation

Find other trading opportunities like this by attending Tyler’s FX Closing Bell webinar at 3 pm ET

Fundamental & Technical Focus:

The EUR has found favor across the board in 2017 at an accelerating pace. Institutions are beginning to reverse their year-end calls on EUR/USD higher and the concern that the EUR as a single currency is a ‘lost cause’ continues to evaporate. Combine this with an improvement in Economic sentiment in Europe and ECB discussions of a monetary policy shift to a more hawkish stance, and you begin to get a sense for some of the factors that caused EUR to recently become one of the strongest G8 currency on a relative basis.

On the other side of the strong/weak spectrum is AUD. While not the weakest G8 currency at the time of this writing, thought it was a few weeks ago, AUD continues to remain weak. AUD/USD has moved toward January lows, and EUR/AUD recently traded above November highs. One reason that we’ve seen weakness in AUD is that institutional speculators seem to be giving up on their hope for reflation, which was played out in the FX market via being long commodity currencies like the AUD.

On Friday, the CFTC's Commitment of Traders report showed that leveraged funds cut their AUD net long positions down to 12,879 contracts in the week through May 9. This reduction marked the sixth straight reduction of longs and down from as high as 53,601 at the start of March when hope remained for reflation.

A key driver for AUD weakness has been iron ore prices, which has entered bear market territory. Iron ore is a key resource that the Australian economy is known for exporting to China. The drop in Iron Ore price has aligned with the rise in inventory in China. Per Bloomberg, Iron ore stockpiles at Chinese ports almost 2% (i.e., less demand than supply) to a record 134.25 million tons as of Friday, according to weekly data from Shanghai Steelhome E-Commerce Co.

These developments could continue to spell trouble for AUD longs, which is why I like EUR/AUD higher toward the 61.8% retracement of the 2015-17 range at 1.5461 with an invalidation of the long thesis on a break below the May 12 low at 1.4663.

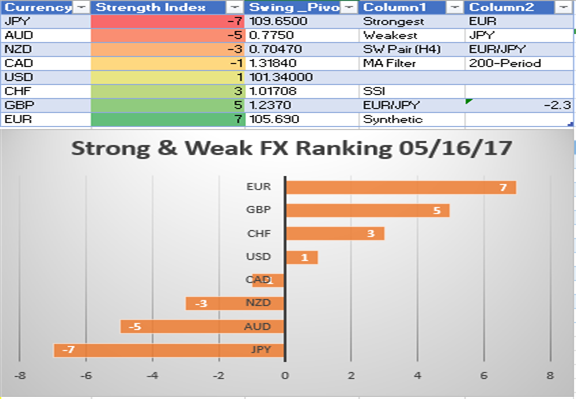

Favorable Strong/Weak Relationship:

Chart:

Created by Tyler Yell, CMT

Happy Trading!

-Tyler Yell, CMT

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance