Bull Signal Flashing as Cannabis Stock Ignites

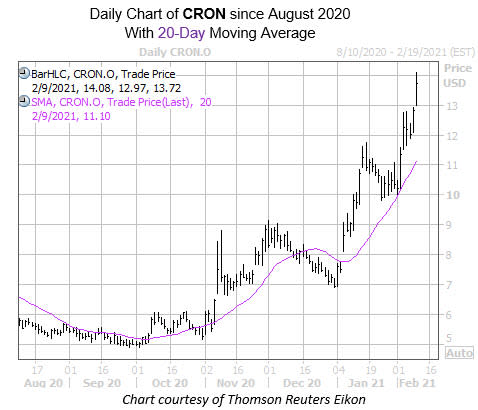

The shares of Canada-based cannabis company Cronos Group Inc (NASDAQ:CRON) are trading at new record highs today, up 7.2% at $13.74 at last check. With help from the 20-day moving average, Cronos stock has moved upward on the charts since the start of the year -- already posting a 98% year-to-date lead. Now, a bull signal could indicate even more upside for CRON.

Specifically, Cronos Group stock's peak comes amid historically low implied volatility (IV), which has been a bullish combination for the security in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, three similar signals have occurred in the past five years when CRON was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower -- as is the case with the security's current SVI of 89%, which sits in the 20th percentile of its 12-month range. White's data shows that a month after these signals, the security was higher two of those times, averaging a 20.3% return. From its current perch, a similar move would put the equity above $16.

Despite the stock's recent surge, there is still plenty of room for upgrades that could act as a tailwind as well. Of the 10 analysts in coverage, eight carry a lukewarm "hold" or worse rating on CRON. Plus, the 12-month consensus price target of $5.65 is a whopping 59.2% discount to current levels.

Meanwhile, short interest makes up 15.7% of Cronos Group stock's available float, or 4.5 days to cover at the stock's average pace of trading. An unwinding of this pent-up buying power could also push the equity higher.

Yahoo Finance

Yahoo Finance