Bull of the Day: Phillips 66 (PSX)

Phillips 66 PSX is an oil and gas firm that topped our quarterly estimates in early November and boosted its guidance once again for 2022, and more importantly, for fiscal 2023.

Phillips 66 shares have soared in 2022, yet its improved earnings outlook has kept its valuation levels very appealing. Plus, its strong dividend yield is much-needed as investors attempt to find ways to keep pace with inflation. And it said earlier this month that it will return an additional $10 billion to $12 billion to shareholders between mid-year 2022 and the end of 2024.

Phillips 66 Basics

Phillips 66’s diversified energy portfolio includes midstream operations, which generally features the transport and storage of crude oil before it is refined and processed. The company also runs a refining segment that turns crude into everything from fuels for transpiration to lubricants and specialty products such as petroleum coke, solvents, and other products.

On top of its chemicals, refining, and specialties segment, Phillips 66 runs a successful marketing segment. The company operates Phillips 66 branded gas stations and service stations around the U.S. and beyond. Phillips 66 is also making sure it’s prepared for the expansion and likely transition to alternative fuels and energy in the coming decades and beyond.

Phillips 66’s emerging energy efforts include renewable fuels, batteries, carbon capture, and hydrogen. For instance, the company said recently that it’s converting its San Francisco refinery in Rodeo, California into “one of the world’s largest renewable fuels facilities,” with the project set to begin commercial operations in Q1 of 2024.

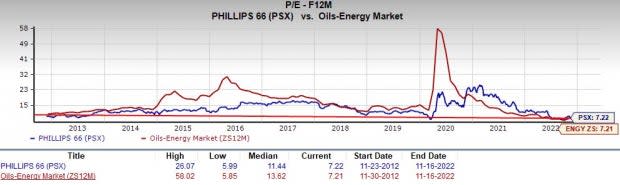

Image Source: Zacks Investment Research

Recent Growth and Outlook

Phillips 66 and others benefitted immensely from rising oil and energy prices amid the huge rebound in demand as the U.S. and economies around the globe soared back to life after the covid crash. Travel, including air, has already mounted a serious comeback and broader energy demand is returning to pre-covid levels. Plus, the ongoing Russian invasion of Ukraine continues to negatively impact oil and gas supplies.

Even though oil prices have come back down from their peaks of over $100 a barrel, they have hovered between roughly $80 and $90 a barrel for the last few months. Phillips 66’s revenue skyrocketed 74% last year, with its adjusted earnings up from a loss of -$0.89 per share to +$5.70 a share.

Phillips 66 has topped our quarterly estimates by an average of 28% in the trailing four quarters, including a 30% third quarter beat on November 1. Management was able to raise their guidance once again for FY22 and fiscal 2023, which is no easy task amid the current environment that’s seen the wider S&P 500 earnings picture fade.

PSX’s four quarter and first quarter FY23 consensus estimates are now up 41% and 49%, respectively over the past 60 days. Phillips 66’s FY22 and FY23 EPS estimates have climbed by 28% and 30%, respectively during this same stretch. Zacks estimates call for its 2022 revenue to soar 47% to $169.32 billion to help boost its adjusted earnings by roughly 270% from under $6 a share all the way to $21.00 per share.

Phillips 66 is currently projected to see its revenue and earnings decline on a YoY basis in 2023 as they come up against nearly impossible to compete against periods. But there is no guarantee that those estimates don’t continue to improve as they have over the last several months.

Other Fundamentals

The so-called lost decade for oil and gas companies forced everyone in the industry to reevaluate every aspect of their business, slimming down operations to run more efficiently than ever. The cost-cutting measures are now paying off in a huge way amid rebounding oil and energy prices. The trimmed down operations will also help Phillips 66 and others keep margins relatively high going forward.

Phillips 66 generated $3.1 billion in cash from operations in the third quarter. This helped the company return $1.2 billion to shareholders through dividends and share repurchases last quarter. Better yet, PSX announced during its investor day on November 9 that it plans to return an additional $10 billion to $12 billion to shareholders between mid-year 2022 and the end of 2024 via buybacks and dividends.

Additionally, Phillips 66 said it will start to roll out sustainable cost reductions of $1 billion through business transformations. With this in mind, Phillips 66’s 3.6% dividend yield blows away its industry’s 2% average, as well as oil and energy titan Exxon Mobil’s XOM 3.2%. The company also has a very sustainable 22% dividend payout ratio.

Image Source: Zacks Investment Research

Price and Valuation

PSX shares have climbed 77% in the past two years to lag behind its highly-ranked industry’s 95% but blow away the S&P 500’s 10% gain. More recently, Phillips 66 shares are up 10% in the last six months to hit new 52-week highs on November 14. And its current Zacks consensus price target offers 12% upside to the roughly $108 a share it trades at right now.

On the valuation front, PSX trades at 7.2X forward 12-month earnings. This represents a 30% discount to its own 12-month median. Looking back further, the nearby chart showcases that Phillips 66 trades at a 35% discount to its own decade-long median and roughly in line with the Zacks Oil and Energy sector. And PSX trades not too far above its lows of 5.9X during this stretch.

Bottom Line

Phillips 66’s Oil and Gas - Refining and Marketing industry ranks in the top 7% of over 250 Zacks industries. PSX also sports “A” grades for Value, Growth and Momentum in our Style Scores system. Its commitment to boosting its dividend should help investors as they try to fight back against ongoing inflation. And investors looking for value during the current market and economic conditions would do well to consider Phillips 66 or other oil stocks.

Phillips 66’s positive upward earnings revisions help it grab a Zacks Rank #1 (Strong Buy) right now. Plus, the broader oil and gas sector will likely remain a major backbone of economies around the world for decades to come. And let’s remember that Phillips 66 is already preparing for an alternative fuel and energy future.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance