Building Materials Stocks Q1 Teardown: UFP (NASDAQ:UFPI) Vs The Rest

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at UFP (NASDAQ:UFPI) and the best and worst performers in the building materials industry.

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

The 6 building materials stocks we track reported a decent Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and building materials stocks have held roughly steady amidst all this, with share prices up 1% on average since the previous earnings results.

Weakest Q1: UFP (NASDAQ:UFPI)

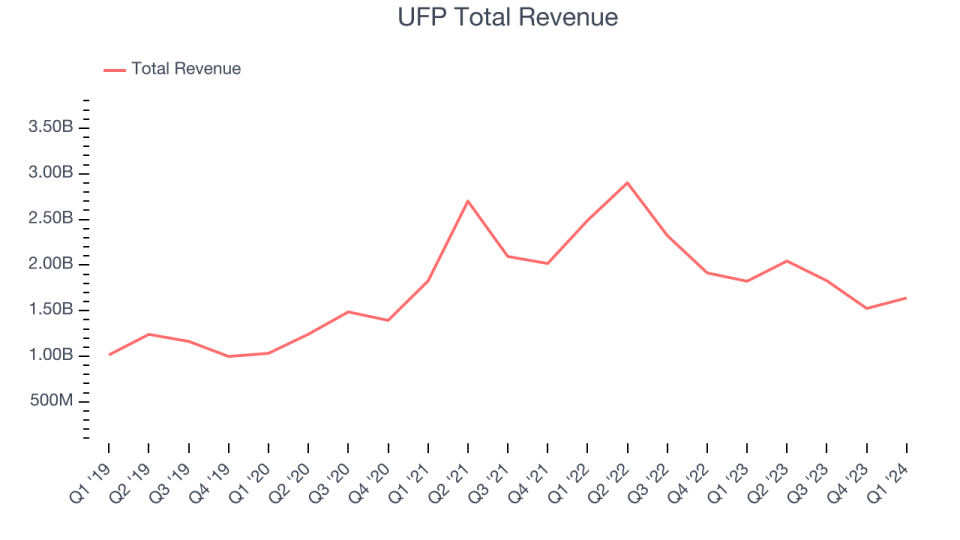

Beginning as a lumber supplier in the 1950s, UFP (NASDAQ:UFPI) makes a wide range of building materials for the construction, retail, and industrial sectors

UFP reported revenues of $1.64 billion, down 10.1% year on year, falling short of analysts' expectations by 4.7%. It was a weak quarter for the company, with a miss of analysts' volume estimates.

UFP delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 6.1% since the results and currently trades at $108.75.

Read our full report on UFP here, it's free.

Best Q1: Armstrong World (NYSE:AWI)

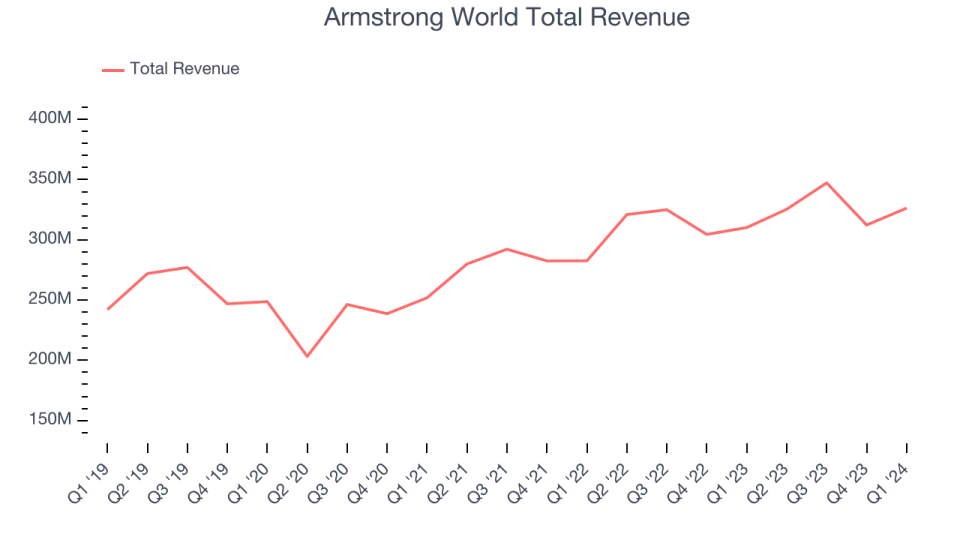

Started as a two-man shop dating back to the 1860s, Armstrong (NYSE:AWI) provides ceiling and wall products to commercial and residential spaces.

Armstrong World reported revenues of $326.3 million, up 5.2% year on year, outperforming analysts' expectations by 2.1%. It was an impressive quarter for the company, with full-year revenue guidance exceeding analysts' expectations and a solid beat of analysts' organic revenue estimates.

Armstrong World scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 5.1% since the results and currently trades at $112.81.

Is now the time to buy Armstrong World? Access our full analysis of the earnings results here, it's free.

Tecnoglass (NYSE:TGLS)

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE:TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

Tecnoglass reported revenues of $192.6 million, down 4.9% year on year, in line with analysts' expectations. It was a mixed quarter for the company. Tecnoglass beat analysts' revenue expectations this quarter. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates.

The stock is up 0.2% since the results and currently trades at $52.03.

Read our full analysis of Tecnoglass's results here.

AZEK (NYSE:AZEK)

With a significant portion of its products made from recycled materials, AZEK (NYSE:AZEK) designs and manufactures goods for outdoor living spaces.

AZEK reported revenues of $418.4 million, up 10.8% year on year, surpassing analysts' expectations by 1.5%. It was a good quarter for the company, with a decent beat of analysts' organic revenue estimates.

AZEK pulled off the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is down 8.7% since the results and currently trades at $41.01.

Read our full, actionable report on AZEK here, it's free.

Resideo (NYSE:REZI)

Holding around 3000 active and pending patents, Resideo (NYSE:REZI) provides home comfort, security, energy, and water management solutions.

Resideo reported revenues of $1.49 billion, down 4.1% year on year, in line with analysts' expectations. It was a solid quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 3.2% since the results and currently trades at $19.09.

Read our full, actionable report on Resideo here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance