BTC Tumbles Below $42K, Coinbase and Miners Plunge as Bitcoin ETF Mania Becomes 'Sell the News' Rout

Bitcoin tumbled below $42,000 in a Friday sell-off with cryptocurrency-focused stocks plummeting as Thursday's bitcoin ETF euphoria turned into a market rout.

The $42,000 level is a significant support where prices may bounce from with potential buyers stepping in, crypto research firm Swissblock said.

Bitcoin [BTC] dropped below $42,000 on Friday, plunging almost 10%, as the euphoria over the bitcoin ETFs approved this week gave way to a massive rout.

Bitcoin had been as high as $46,000 earlier Friday and surged to a two-year high of $49,000 on Thursday, when bitcoin ETFs began trading in the U.S. But the heady prices didn't last long.

Shares of Coinbase (COIN), the crypto exchange that provides vital custody services to most of the ETF issuers, lost 7.4% on Friday. Bitcoin miners Marathon Digital (MARA), Hut 8 (HUT) and Riot Platforms (RIOT) all sank at least 10%; Marathon fared worst, slumping 15%.

Read more: Grayscale, BlackRock Top Bitcoin ETF Volume Ranking as Products Debut

The declines happened a day after spot bitcoin exchange-traded funds (ETFs) began trading, marking a significant milestone for the industry. Bitcoin ETFs are traditional financial vehicles that may give retail and institutional investors alike easier exposure to bitcoin's price.

Friday's price declines may not be a surprise; research firm CryptoQuant predicted last month that bitcoin would fall to as low as $32,000 in the next month after an ETF approval, being a "sell the news" event.

Notably, previous landmark events such as Coinbase's stock market listing in April 2021 and ProShares' futures-based bitcoin ETF (BITO) debut in October 2021 happened near a significant peak in crypto prices, possibly foreshadowing cooling prices ahead.

Read more: Bitwise, Fidelity, BlackRock See Biggest Bitcoin ETF Inflow in Preliminary Tally

What's next for bitcoin price

Bitcoin posted a massive 80% rally since early October without significant pullbacks to a hit a two-year high as anticipation increased to a fever pitch into Thursday's spot bitcoin ETF launch, a significant milestone for the digital asset industry that expands investor access to the largest crypto asset.

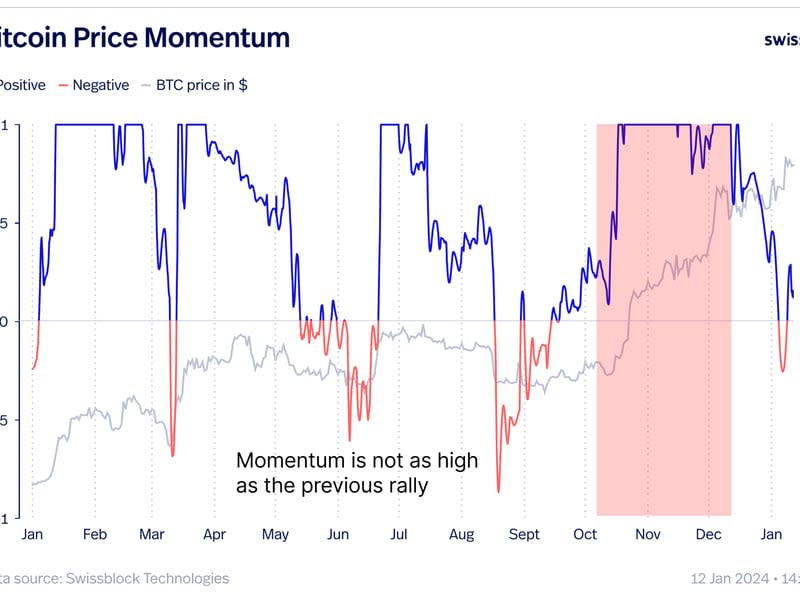

Crypto research firm Swissblock noted in a Friday market report that the last leg of the bitcoin rally to $49,000 into Thursday's bitcoin ETF launch showed signs of running out of fuel, with sellers stepping in above the $47,500 price level.

"The recent dynamics in bitcoin have not lived up to the expectations set by many bitcoin maximalists, with the asset failing to break the $50k mark, and the hype surrounding ETFs showing signs of cooling down," Swissblock analysts wrote. "The critical question now is whether the market can sustain upward momentum."

The $42,000 price level forms a significant liquidity zone where bitcoin may bounce from as buyers might enter the market, the report explained. If this support level falters, the next key zone to watch is the "CME gap" at $40,000, it added.

UPDATE (Jan. 13, 12:56 UTC): Adds analyst comment about price action.

Yahoo Finance

Yahoo Finance