Bruker (BRKR) Q3 Earnings Surpass Estimates, Guidance Up

Bruker Corporation BRKR reported adjusted earnings per share (EPS) of 37 cents in the third quarter of 2018, up 27.6% from the year-ago figure. Adjusted EPS also exceeded the Zacks Consensus Estimate by 23.3%.

On a reported basis, earnings came in at 28 cents a share, a 21.7% surge on a year-over-year basis.

Revenues in Detail

Bruker registered revenues of $466.6 million in the third quarter, up 7.1% year over year. Moreover, the top line surpassed the Zacks Consensus Estimate of $452.5 million.

Excluding 1.5% positive effect from acquisitions and a 1.4% favorable impact from changes in foreign currency rates, Bruker generated higher organic revenues of 7% year over year.

The company’s organic revenue growth is driven by the strength in Bruker Scientific Instruments (BSI) and BEST segments.

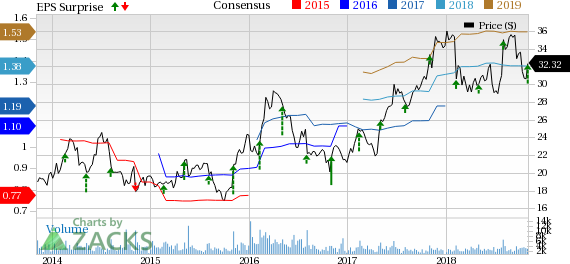

Bruker Corporation Price, Consensus and EPS Surprise

Bruker Corporation Price, Consensus and EPS Surprise | Bruker Corporation Quote

Geographically, European revenues declined 5.4% year over year in the reported quarter while North America revenues were up 20.6%. In Asia Pacific (APAC), revenue uptick was 14.7%.

Bruker’s BioSpin Group revenues inched up 0.5% above the year-ago quarter’s level.

Revenues in the NANO group increased 13.9%, fueled by a strong uptrend in academic research and industrial research markets. CALID revenues were up 6.6% year over year.

Margin Trend

Gross margin in the quarter under review expanded 205 basis points (bps) to 47.7%. While selling, general & administrative expenses climbed 3.7% to $106.5 million. Research and development expenses rose 2.9% year over year to $41.8 million. Overall, adjusted operating margin improved 316 bps to 15.9%.

Financial Position

Bruker exited third-quarter 2018 with cash and cash equivalents plus short-term investments of $270.1 million, up from $258.7 million at the end of the second quarter. Year to date, operating cash inflow was $107.4 million in comparison to $50.7 million in the year-ago period.

2018 Guidance

Bruker updated its expectations for 2018. For the full year, the company projects revenue growth of approximately 6.5-7% including nearly 3.5-4% of organic revenue rise. The figure compares favorably with the earlier prediction of 6.5% revenue growth comprising 3.5% organic increase. The company projects a year-over-year expansion of 80 bps in adjusted operating margin including an estimated 70 bps headwind from foreign currency translation.

For 2018, Bruker raised its adjusted EPS view to a range of $1.36-$1.40, up 12-16% from the previous year’s rally (earlier projection was 1.34-$1.38, an estimated 11-14% rise from the year-ago period). The Zacks Consensus Estimate of $1.38 remains under the company’s current forecast.

Our Take

Bruker exited the third quarter on a solid note with a strong year-over-year increase in revenues as well as earnings. Additionally, the improvement in gross and operating margins buoys optimism. The company’s strategic acquisition activity has also been encouraging. Further, we are upbeat about the company’s current focus on product development through higher R&D investment.

On the flip side, a competitive landscape and macroeconomic woes persistently pose challenges to the company.

Zacks Rank & Key Picks

Bruker carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader medical space, which reported solid earnings so far this season, are Intuitive Surgical ISRG, Stryker Corp. SYK and Merit Medical Systems, Inc. MMSI. All stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical reported third-quarter 2018 adjusted EPS of $2.83, which beat the Zacks Consensus Estimate of $2.65. Revenues totaled $920.9 million, also surpassing the consensus estimate of $918.6 million.

Stryker posted third-quarter 2018 adjusted EPS of $1.69, steering past the Zacks Consensus Estimate of $1.68. Operating margin was 17.8%, up 30 bps.

Merit Medical reported third-quarter 2018 adjusted EPS of 47 cents, which trumped the Zacks Consensus Estimate of 42 cents. Revenues of $221.6 million edged past the consensus estimate of $218 million.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bruker Corporation (BRKR) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance