Brookdale (BKD) February 2024 Weighted Average Occupancy Rises

Brookdale Senior Living Inc. BKD announced that its February weighted average occupancy climbed 160 basis points (bps) from the year-ago level to 76.3%. However, this indicates a 10-bps decline from the January level.

In the fourth quarter of 2023, BKD observed a weighted average occupancy of 78.4%, up from 77.1% a year ago. For the third quarter, the metric rose to 77.6% from 76.4% a year ago. At the fourth-quarter end, it had the capacity to serve around 59,000 residents in 41 states.

BKD has experienced 28 straight months of year-over-year growth in weighted average occupancy, showcasing a consistent upward trend in occupancy levels. This positive trajectory is anticipated to contribute in increasing resident fee revenues. In 2023, resident fee revenues saw a noteworthy 10.5% year-over-year rise. The momentum is expected to persist, providing further support to the company's overall results.

For the first quarter of 2024, it projects revenue per available unit (RevPAR) growth to fall in the range of 6.25-6.75%. The company experienced year-over-year RevPAR growth of 10% during the fourth quarter of 2023, contributing positively to its overall revenues. Additionally, it expects adjusted EBITDA in the range of $90 -$95 million in the first quarter of 2024.

The Zacks Consensus Estimate for first-quarter 2024 is pegged at a loss of 17 cents per share, which remained stable over the past few weeks. The estimate for full-year 2024 indicates an improvement of 21.4% from the year-ago loss of 84 cents per share.

The company is poised for a substantial revenue growth opportunity. BKD’s weighted average occupancy improved nearly 900 bps as of 2023-end compared with the start of pandemic recovery. Its objective is to restore occupancy and return to its pre-pandemic levels (84.5% observed in the fourth quarter of 2019). Management projects to yield at least $250 million in incremental revenues to achieve this target.

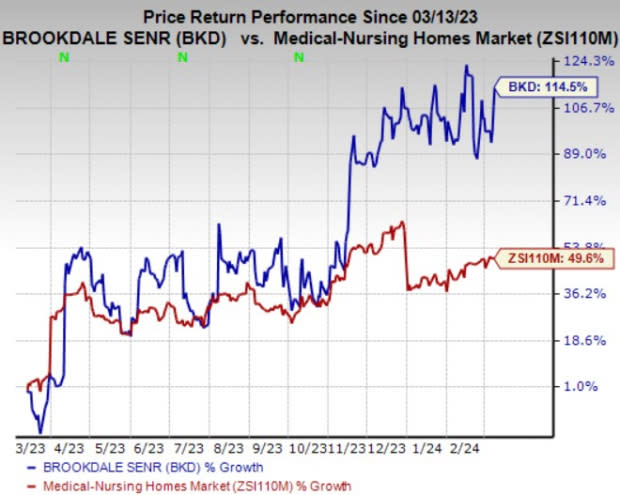

Price Performance

Brookdale shares have surged 114.5% in the past year compared with the industry’s growth of 49.6%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

BKD currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the Medical space are HCA Healthcare, Inc. HCA, Medpace Holdings, Inc. MEDP and Universal Health Services, Inc. UHS. HCA Healthcare and Medpace sport a Zacks Rank #1 (Strong Buy) each, and Universal Health Services carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

HCA Healthcare’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters, missing once, the average beat being 9.8%. The Zacks Consensus Estimate for HCA’s 2024 earnings and revenues suggests an improvement of 7.8% and 6.2% from the respective year-ago reported figures.

The consensus estimate for HCA’s 2024 earnings has moved 0.9% north in the past 30 days. Shares of HCA have gained 31.7% in the past year.

Medpace’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.4%. The Zacks Consensus Estimate for MEDP’s 2024earnings and revenues suggests an improvement of 19.1% and 15.9% from the respective year-ago reported figures.

The consensus estimate for Medpace’s 2024 earnings has moved 5.3% north in the past 30 days. Shares of MEDP have soared 132.7% in the past year.

Universal Health Services’ earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 5.9%. The consensus estimate for UHS’ 2024 earnings and revenues suggests an improvement of 19.9% and 8.4% from the respective year-ago reported figures.

The consensus estimate for UHS’ 2024 earnings has moved 5.2% north in the past 30 days. Shares of UHS have rallied 50.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance