Broadridge (BR) Q2 Earnings Match, Revenues Beat Estimates

Broadridge Financial Solutions, Inc. BR reported second-quarter fiscal 2021 adjusted earnings of 73 cents per share that improved 38% year over year. Total revenues of $1.06 billion beat the consensus mark by 2.8% and were up 9% year over year. The company generated closed sales of $46 million in the quarter, up 2% year over year.

Revenues by Segment

Revenues in the Investor Communication Solutions segment increased 10% from the year-ago quarter's level to $784 million.

The segment’s recurring fee revenues were up 7% to $394 million. Event-driven fee revenues increased 46% to $45.2 million. Distribution revenues increased 9% to $345 million.

Global Technology and Operations segment's recurring fee revenues came in at $302 million, up 8% year over year. This improvement was driven by acquisitions and organic growth. Higher equity trading volumes benefited the segment’s internal growth.

Operating Results

Adjusted operating income of $119 million improved 26% year over year. Adjusted operating income margin increased to 11.2% from 9.7% in the prior-year quarter.

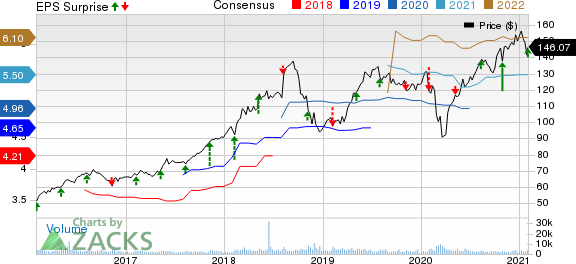

Broadridge Financial Solutions, Inc. Price, Consensus and EPS Surprise

Broadridge Financial Solutions, Inc. price-consensus-eps-surprise-chart | Broadridge Financial Solutions, Inc. Quote

Balance Sheet and Cash Flow

Broadridge exited the quarter with cash and cash equivalents of $365.6 million compared with the $356.6 million witnessed at the end of the prior quarter. Long-term debt was $1.8 billion, flat with the previous quarter's figure.

The company generated $127.5 million of cash in operating activities and capex was $15.8 million in the quarter. Broadridge paid out $66.3 million in dividends in the reported quarter.

Fiscal 2021 Guidance

Broadridge expects total revenue growth in the range of 1-4% and recurring revenue growth of 3-6%. Adjusted EPS growth is expected to be 6% to 10%. Adjusted operating income margin is estimated to be up by around 18%. Closed sales are anticipated to be between $190 million and $235 million

Broadridge currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Business Services Companies

Rollins’ ROL fourth-quarter 2020 adjusted earnings of 13 cents per share came ahead of the consensus estimate as well as the year-ago figure by 18.2%. Revenues of $536.3 million beat the consensus mark by 1.7% and improved 6% year-over-year.

IHS Markit’s INFO fourth-quarter fiscal 2020 adjusted earnings per share of 72 cents beat the Zacks Consensus Esimate by 7.5% and increased 11% on a year-over-year basis. Total revenues came in at $1.11 billion, marginally missing the consensus mark and declining 1% from the year-ago quarter on a reported basis.

Automatic Data Processing’s ADP second-quarter fiscal 2021 adjusted earnings per share of $1.52 beat the consensus mark by 17.8% and were flat year over year. Total revenues of $3.69 billion beat the consensus mark by 3.2% and improved 0.7% year over year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research SherazMian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

IHS Markit Ltd. (INFO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance