Britain snubs GSK in favour of US pharma giant for RSV vaccine

The NHS has turned to US drugs giant Pfizer over its British rival GSK for vaccines against Respiratory Syncytial Virus (RSV), the winter infection known as the “silent killer” of the elderly.

Officials have signed a two-year supply agreement with Pfizer for more than 3.5 million doses of its RSV vaccine for older people and more than 1.4 million doses of the jab for pregnant mothers.

It comes after the vaccine, which is among the first to treat the deadly virus, got the green light from UK regulators last year. RSV causes around 33,000 NHS hospitalisations of under-fives annually and kills between 20 and 30 youngsters a year. It kills an estimated 8,000 elderly people every year in the UK.

Government advisors said last year that the UK should start a national rollout of an RSV vaccination programme.

However, the deal to strike the deal with Pfizer comes as a blow to GSK, which also got approval for an RSV vaccine in the UK last year.

The British company has been enjoying huge success in the US with its RSV vaccine Arexvy.

Figures from January suggested that more than two thirds of the RSV vaccines given in the country were GSK’s jab.

A spokesman for GSK said it was “disappointed not to have been selected to supply our RSV vaccine for the UK eligible population”.

However, they added: “We are very confident in the value it delivers, with data that demonstrates sustained efficacy against lower respiratory tract disease caused by RSV in adults aged 60 and over.”

A Pfizer spokesman said it won the contract after a “competitive tender process”, adding: “This new vaccination programme will help protect infants, through maternal vaccination, and older adults from RSV.”

The latest decision follows post-pandemic tensions between the Government and British pharmaceutical companies after industry chiefs last year warned that ministers were squandering a lead in life sciences.

AstraZeneca at the time claimed the UK’s tax policies were to blame for it choosing Ireland over Macclesfield for a new £320m drug factory.

GSK had said the country was at a “tipping point” for its life sciences sector.

More recently, however, there have been signs of easing frustrations, with both GSK and AstraZeneca plotting significant factory investments.

Read the latest updates below.

06:02 PM BST

Signing off...

Thanks for joining us on the Markets blog today. We will be back in the morning to cover the latest from the stock market and beyond, but I shall leave you this evening with Melissa Lawford’s report on this election’s “conspiracy of silence” over tax:

Perhaps the most notable part of the Labour manifesto was what it did not say.

Sir Keir Starmer has ruled out rises in income tax, National Insurance, VAT and the headline corporation tax rate. He and Rishi Sunak, the Prime Minister, have been in a “tax lock arms race”, according to Institute for Fiscal Studies director Paul Johnson.

What Johnson wants to know more about, however, is what taxes Starmer does intend to raise.

The IFS chief has accused both parties of a “conspiracy of silence” over the true scale of the economic and fiscal challenge facing the next administration.

05:58 PM BST

Boeing should face criminal charges over 737 Max crashes, say US prosecutors

Boeing should face criminal charges after violating a settlement over two fatal crashes involving its 737 Max aircraft, US prosecutors have said. Matthew Field reports:

The aerospace giant has been accused of breaching a settlement related to the crashes, which took place in 2018 and 2019.

The two crashes in Indonesia and Ethiopia killed 346 people, resulting in the longest grounding of a commercial jet in US history for the 737 Max.

US prosecutors have said that Boeing violated the terms of its settlement and have recommended that the Department of Justice bring criminal charges, according to Reuters.

Under the 2021 deal Boeing agreed to pay $2.5bn (£2bn) in fines and compensation to customers and families involved in the crashes and to overhaul its compliance practices. The settlement gave Boeing protection from claims that it deceived regulators into approving the 737 Max aircraft.

05:38 PM BST

Dow jumps amid broader market rally in countdown to inflation data

The blue-chip Dow Jones Industrial Average hit a one-month high in a broad-based rally on Monday, as investors rotated out of AI-linked stocks, while focus turned to a key inflation print later in the week to sharpen bets around interest rate cuts this year.

Nvidia dropped more than 4pc, sliding for the third day, with market participants citing profit taking in the semiconductor bellwether and other AI stocks, following Nvidia’s meteoric rise to the world’s most valuable company last week.

Other chip stocks including US shares of Taiwan Semiconductor Manufacturing, Broadcom, Marvell Technology and Qualcomm dropped 2pc-5pc, dragging the chip stocks index down 1.7pc.

Phil Blancato, chief executive of Ladenburg Thalmann Asset Management, said:

The AI craze’s starting to cool off a bit and surprisingly with the potential for rates to go lower, you would think it would be an additional boost and we’re not seeing that. From evaluation standpoint, they got extremely expensive.

If inflation comes in softer, the market could broaden out quite significantly ... The breadth will get wider and everything beyond the AI stocks.

Technology was the only laggard among the 11 S&P 500 sector indexes, hitting a near two-week low.

05:35 PM BST

EU adopts new sanctions against Russia, including on liquefied natural gas

European Union countries have adopted a 14th package of sanctions on Russia that aims to close some loopholes and hits Russia’s gas exports for the first time, EU foreign ministers said today.

Western powers imposed sweeping sanctions on Moscow after Russia launched a full-scale invasion of Ukraine in February 2022, which have been progressively ramped up since.

The new restrictions on gas aim to reduce Russia’s revenues from liquefied natural gas (LNG) exports by banning trans-shipments - transferring cargoes from one ship to another - off EU ports and a clause allowing Sweden and Finland to cancel some LNG contracts.

The measures stop short of an EU ban on LNG imports, which have risen since the start of the war.

The sanctions will take effect after a nine-month transition period. The package also prohibits new investments and services to complete LNG projects under construction in Russia.

Gas market experts say the measure will likely have little impact as Europe still buys Russian gas itself and trans-shipments via EU ports to Asia represent only around 10pc of total Russian LNG exports.

An EU official said the estimated hit on Russia would be in the millions of euros rather than billions.

Some central European countries still receive pipeline gas from Russia via Ukraine. The EU banned Russian oil imports in 2022 with some limited exemptions.

05:19 PM BST

UN chief tells consumer tech firms: own the harm your products cause

The secretary general of the United Nations, Antonio Guterres, has demanded that big consumer technology firms take responsibility and “acknowledge the damage your products are inflicting on people and communities”.

Taking aim at the companies, which he did not name, and their social media platforms, he said: “You have the power to mitigate harm to people and societies around the world. You have the power to change business models that profit from disinformation and hate”.

He warned that “opaque algorithms push people into information bubbles and reinforce prejudices including racism, misogyny and discrimination of all kinds” with common targets being women, refugees, migrants, and minorities.

Guterres was speaking at a press conference to launch a set of UN global principles for information integrity, which he called a starting point to combat misinformation, disinformation and hate speech.

05:15 PM BST

Prudential drives FTSE 100 higher despute market caution

London stocks kicked off the week on a positive note, driven by gains from life insurer Prudential, although caution lingered ahead of inflation data from the United States that could set the outlook for global interest rates.

The blue-chip FTSE 100 closed 0.5pc higher, touching a three-week high and hitting the psychological 8,300 mark during the day.

Prudential also boosted the life insurance sector to a two-week high, with a 7.3pc jump after it announced a $2bn (£1.6bn) buyback plan.

This week, the UK will release its gross domestic product (GDP) numbers that will provide more insight into the state of the British economy. Strong retail sales data on Friday tempered some of the optimism that followed comments from the Bank of England.

The bank kept interest rates unchanged on Thursday, and dovish comments from policymakers raised expectations of an August cut.

A domestic inflation report last week showed that headline inflation in the economy had fallen to 2pc - the BoE’s target.

The looming British parliamentary election, which is less than two weeks away, added to market caution.

05:11 PM BST

European stock markets rebounded despite French election worries

European stock markets rebounded today despite jitters over the first round of French elections taking place this weekend.

Joshua Mahony, an analyst at Shore Markets, said:

European markets are in recovery mode, with widespread gains taking shape.

Despite ongoing concerns around this weekend’s French parliamentary election, French stocks are on the rise as investors buy the dip that saw the Cac [the Paris stock index of 40 leading companies] lose almost 10 percent in a month...

The positive tone being taken by European markets could yet come into question as we get closer to this potential seismic shift in French politics

Meanwhile, investors seemingly set aside a key survey showing that German business sentiment unexpectedly fell in June, pouring cold water on hopes Europe’s biggest economy is on course for a strong rebound.

Mateusz Urban, analyst at Oxford Economics, said:

Today’s results add to the growing stream of indicators sending mixed signals on where the eurozone’s biggest economy is heading.

The German Dax index was up 1pc.

04:59 PM BST

Footsie closes up

The FTSE 100 closed up 0.5pc. The top riser was Prudential, the Asia and Africa-focused insurance and investment company, up 7.3pc. It was followed by Frasers Group, in the news today for doing a deal with THG. It rose 3.9pc. The biggest faller was housebuilder Berkeley, down 2pc, followed by Sage, down 1.3pc.

Meanwhile, the FTSE 250 fell 0.6pc. The top riser was takeover target Britvic, up 7pc, followed by polymer supplier Victrex, up 5.2pc. The biggest faller was investment business Foresight Group, down 6.2pc, followed by biotechnology company PureTech, down 5pc.

04:44 PM BST

Getir to be broken up amid Abu Dhabi cash injection

Rapid food delivery business Getir is to be broken in two as part of $250m capital injection led by Abu Dhabi wealth fund Mubadala Investment Company.

The Turkish-headquartered business will be split into a food delivery business in Turkey, controlled by Mubadala, and a separate company owning assets such its New York grocery delivery business FreshDirect, controlled by Nazim Salur and his co-founders.

04:30 PM BST

Visa seals deal with Lloyds to take millions of cards from MasterCard

Visa has beaten its biggest rival by clinching a new deal with Lloyds Banking Group that will see some 10m cards converted to the payments giant over the next two years.

Visa and Mastercard are the UK’s biggest payments firms, accounting for 95pc of transactions on UK cards.

Visa already provides payment cards for about 30m Lloyds accounts as part of a partnership first agreed 40 years ago.

But many Lloyds customers currently have debit and credit cards powered by Mastercard.

The new deal means that about 10m consumer and commercial credit cards will migrate to Visa by the end of 2026.

The UK payments watchdog last month said Visa and Mastercard do not face enough competition in the payments market, and it was considering placing new rules on the two major players.

But the Payment Systems Regulator rowed back on prior suggestions that it could introduce a price cap to protect UK businesses from certain fees that are set by the providers.

04:22 PM BST

Canada considers new tariffs on Chinese EVs

Canada is considering whether to impose import tariffs on Chinese-made electric vehicles and will seek the public’s opinion about the idea, the country’s deputy orime minister Chrystia Freeland said this afternoon.

Ms Freeland told reporters in Ontario that the government would open a 30-day consultation period.

04:13 PM BST

Tech boss ‘felt like he was bribed’ to move company from UK to China

The former boss of the British microchip company Imagination Technologies has claimed Chinese investors seemingly offered him what “felt like a bribe” to move the company to China. James Titcomb reports:

Ron Black told an employment tribunal case that he was told he would make “a lot of money” if he transferred Imagination’s technology and its employees out of the UK to China.

Mr Black resigned from Imagination in 2020 amid an attempt by China Reform, the state-owned investment company that is Imagination’s key financial backer, to take over the company’s board.

He is suing the company for $257m (£203m) for unfair dismissal, alleging he was forced out for blowing the whistle.

The company claims Mr Black was removed for orchestrating an executive coup over a disagreement about strategy.

Imagination, which designs processors for smartphones, cars and smart devices, was bought by Canyon Bridge, a private equity firm backed by state-owned China Reform, in 2018.

04:05 PM BST

American stocks rally - except big tech firms

On Wall Street, the Dow Jones Industrial Average of 30 leading companies is up 1pc, while the S&P 500 is up 0.3pc. But the Nasdaq Composite, which is heavily focused on tech firms, is down 0.2pc.

Chris Beauchamp, Chief Market Analyst at online trading platform IG, said:

Just as worries about poor market breadth hit the mainstream, breadth begins to recover.

Last week saw Nvidia soar and the Nasdaq 100 hit 20,000, but the new week has continued where Friday left off, with old economy stocks rallying and tech continuing to drop back.

This kind of rotation is very healthy for a continuation of the rally into July.

04:00 PM BST

Government snubs British drugmaker as it buys American blockbuster

The British Government has decided to buy Pifzer’s blockbuster respiratory syncytial virus (RSV) vaccine in a blow to Britain’s GSK.

The American drugmaker is to supply 4.9m doses of its Abrysvo vaccine, Bloomberg reported, which counters a virus that infects the lungs and respiratory tract.

It is understood that Pfizer won after a competitive tender process.

The American drug is approved for both the elderly and pregnant women - the two groups the Government wants to target.

The GSK rival, Arexvy, is just approved for older people.

According to the NHS: “RSV is very common and spreads easily in coughs and sneezes. Almost all children have had it by the time they’re two.”

However, among elderly people it can cause serious sickness or fatalities, and it is particularly problematic for premature babies and children with weakened immune systems.

GSK’s vaccine reportedly brought in over £1bn last year ($1.3bn), while Pfizer’s took in $890m.

GSK has been approached for comment.

03:39 PM BST

China’s ability to make original innovations is still weak, Xi says

China’s original innovation capacity is still relatively weak and some key core technologies are restricted by others, President Xi Jinping has said.

China will step up technological research and development efforts in response to “bottlenecks and constraints” such as integrated circuits, basic software and advanced materials, Mr Xi told state broadcaster CCTV.

The country will accelerate scientific and tech innovation in fields of new-generation information technology, artificial intelligence, quantum technology, biotechnology, new energy and others, Mr Xi added.

03:32 PM BST

Aldi risks fines of up to £600m in Australian crackdown on supermarkets

Aldi faces the threat of fines of up to £600m in Australia as the country’s Left-wing government mounts a clampdown on supermarkets. Daniel Woolfson reports:

Australian officials are pushing to introduce a mandatory code of conduct for supermarkets amid growing anger at rising prices. Companies risk being hit with stringent financial penalties if they violate the code, the government said.

The crackdown comes as Australia’s ruling Left-of-centre Labor party, led by prime minister Anthony Albanese, faces pressure to help ease the burden of inflation on households.

A recent review of the Australian supermarket sector found the current voluntary code meant to be followed by retailers was “failing to address the imbalance of bargaining power between supermarkets and their suppliers, including farmers”, Australian federal treasurer Jim Chalmers said.

Retailers that are found to have seriously violated the code could face fines ranging from A$10m (£5.3m) to as much as 10pc of their turnover in the latest year.

Read the full story...

03:31 PM BST

Bitcoin slumps amid doubts over interest rate cuts

Bitcoin dropped by as much as 5.1pc today to trade at its lowest level in a month amid doubts over how quickly the US Federal Reserve will cut interest rates.

The world’s largest cryptocurrency was trading as low as $60,656 after six days of sales from dedicated US funds tracking its price, known as ETFs.

Markus Thielen, founder of 10x Research, warned that bitcoin faces a “steeper correction” before the US election and inflation figures are expected to lead to gains in prices.

With that, I will head off for the day and leave you in the capable hands of Alex Singleton.

03:15 PM BST

Pound rises despite impending election

The pound has gained against the dollar as markets looked beyond the upcoming election.

Sterling was last up 0.4pc to under $1.27, having fallen on Friday to its lowest level since May 15.

The strengthening of the pound indicates markets are not concerned by polls indicating a huge Labour majority after the general election on July 4.

Simon Harvey, head of FX analysis at Monex, said:

Given the stability in the polls, a Labour victory looks like a foregone conclusion.

There’s not much room for fiscal manoeuvre whoever comes in so it doesn’t make the UK election a major market event.

The Bank of England last week held its main interest rate steady at a 16-year high of 5.25pc, but the prospect of a future rate cut moved closer as some policymakers said their thinking was now “finely balanced”.

Money markets imply around a more than 60pc chance of a quarter-point rate cut at the central bank’s August meeting.

The pound was down around 0.1pc to 84.6p per euro.

02:59 PM BST

Oil flat amid doubts over US inflation

Oil prices were subdued, much like global stocks, amid doubts over the next key inflation numbers from the US due at the end of the week.

Brent crude, the international benchmark, was up 0.1pc above $85 a barrel while US-produced West Texas Intermediate was up 0.2pc to nearly $81.

Oil has been muted as the dollar has strengthened ahead of the PCE inflation figures due on Friday.

Crude remains on track for a monthly gain, and there are signs of rising petrol demand in the US and healthy air travel volumes, which is aiding the outlook.

Warren Patterson, head of commodities strategy at ING, said:

We remain supportive toward the oil market with a deficit over the third quarter set to tighten the oil balance.

Speculators have also become more constructive toward oil as we move into summer.

02:38 PM BST

Wall Street subdued ahead of inflation numbers

The Nasdaq opened lower after Nvidia and some other chip stocks remained under selling pressure.

Investors are nervous ahead of a key inflation data later this week, which is expected to shape bets over the timing and level of interest rate cuts this year.

The Dow Jones Industrial Average rose 34.16 points, or 0.1pc, at the open to 39,184.49.

The S&P 500 opened lower by 5.04 points, or 0.1pc, at 5,459.58, while the Nasdaq Composite dropped 49.10 points, or 0.3pc, to 17,640.26 at the opening bell.

02:36 PM BST

Germany’s derided pink kit becomes best-selling away strip

Derided at its unveiling, Germany’s pink-and-purple away kit has become the breakout style star of Euro 2024, where it has added a splash of colour to the stands at the host’s fixtures.

The gaudy number has sold “almost as much” as Germany’s traditional white home strip, Adidas spokesman Stefan Pursche said.

Under normal circumstances, four out of every five shirts sold would be the home kit, but the pink change has had “exceptional” success, Mr Pursche said.

The huge demand has made it Germany’s “best-selling away kit in history”, ahead of previous iconic green or black jerseys.

Despite initial scepticism over the away shirt’s daring palette - and some homophobic or sexist commentary about the choice of colours - the kit has been embraced by fans.

“I think it is courageous to choose such a colour,” said fan Alex Mueller, 39, outside Germany’s game against Switzerland on Sunday, sporting a pink shirt received as a gift.

The shirt was out-of-stock on Adidas’s website this morning, with new supplies to be put online at 7.30am on Tuesday.

02:22 PM BST

Nestle to sell supplements that tackle ‘Ozempic face’

Nestlé is to target “Ozempic face” by selling dietary supplements to counteract the effects of weight-loss drugs.

Our retail editor Hannah Boland has the details:

Nestlé said it would roll out products that “complement” people’s weight-loss treatments, including hair growth supplements, electrolyte tablets and collagen peptides that improve skin elasticity.

The maker of KitKat and Smarties is braced for a dent in sales of ice cream and confectionery amid soaring demand for products such as Ozempic.

Anna Mohl, the chief executive of Nestlé’s health science division, told Bloomberg it would keep up with changing needs among customers, including “preserving lean muscle mass, managing digestive upset and assuring an adequate daily consumption of micronutrients”.

Read how the supplements are expected to help to tackle the rise of “Ozempic face”.

01:57 PM BST

Materials supplier SIG issues profit warning amid construction struggles

Building materials supplier SIG has warned over weak demand for construction work in Europe, leading it to downgrade its profit expectations for the year.

The London-listed company saw its share price tumble by more than 10pc following the downbeat update to investors.

Sales have been worse than expected in recent weeks, with a decline of about 7pc in May and June compared with the same time a year ago.

This performance, coupled with the expectation that conditions may not significantly improve over the second half of the year, means the business now expects to report an underlying annual profit of between £20m and £30m.

Analysts had been pencilling in yearly earnings of as much as £43m.

SIG is a Sheffield-based business which sells specialist building materials, like insulation, flooring, roofing, and tools, to international markets.

It said it had been impacted by a wider lull in demand for building and construction work, particularly in France and Germany.

01:39 PM BST

Labour frontbencher confirms meetings with Shein bosses

Shadow business secretary Jonathan Reynolds said he has met with Shein bosses, as the Chinese fashion giant seeks a listing in the UK.

He said that if a business wants to work in Britain then “we should seek to regulate them in the UK”.

He said that would ensure the UK could “enforce the highest standards”, adding that any company listed in Britain “has a pretty extensive set of compliance standards applied to them”.

Ms Badenoch said she had not met with Shein and had two concerns about a listing, namely its ability to sidestep customs duties and fears it is using slave labour in Xinxiang.

01:34 PM BST

Government should not have to bail out Thames Water, says Labour frontbencher

Shadow business secretary Jonathan Reynolds said he does not “want to see nationalisation” of Thames Water as the struggling utilities company battles its £18bn debt pile.

The Labour frontbencher said it was not the job of the state to “bail out bad investments”.

Business Secretary Kemi Badenoch said she did not want to talk about nationalisation but said that Britain needs a “regulatory regime that is working for our utilities”.

01:25 PM BST

We won’t allow ECJ oversight, says Badenoch

Business Secretary Kemi Badenoch has criticised Labour’s “astonishing” position on the European Courts of Justice as she said Britain “cannot allow any kind of oversight” on its trade.

Shadow business secretary Jonathan Reynolds dodged a question about whether a future Labour government “would accept a role for the European Court of Justice”, in a future deal with the European Union.

Taking questions during Bloomberg’s Business Debate, Mr Reynolds said:

We’re not going to give away our negotiating hand entirely but... the argument on food and agricultural products is this - do you want lower standards than the European Union?

If you don’t want lower standards, surely we remove pragmatically some of those checks and balances to make sure we can have as close a relationship as is possible, to remove some of those costs.

There will still be costs because we’re not going to talk about going back into a customs union.

Ms Badenoch described his response as “astonishing” and added: “What would they have to give up in order to get that? That is the question that they don’t want to answer, saying it’s part of their negotiating hand.”

She accused Labour of trying to take the country “back into the EU without saying so” and also said: “We cannot allow any kind of oversight from the ECJ - that’s not something that you should be keeping in your back pocket. That’s something that you need to be honest about with the British public.”

Mr Reynolds hit back: “This is a conversation on one side, on the Conservative side, which is all about to be frank the next leadership election in the Conservative Party and the red lines within there.”

01:06 PM BST

Business is terrified of what Labour is selling, says Badenoch

Business Secretary Kemi Badenoch has claimed voters should be “absolutely terrified” by Labour’s plans.

Shadow business secretary Jonathan Reynolds discussed Labour’s overhaul of workers’ rights, dubbed the New Deal for Working People, which includes curbs on zero-hours contracts, at a Bloomberg debate.

He said: “It’s been developed very closely with businesses to make sure those burdens are not too burdensome.”

Ms Badenoch said: “It is unbelievable that Jonathan would actually suggest that those employment regulations have been developed with business. Which business? Business is terrified of what Labour is selling.

She added: “You should be terrified about surrendering your business, the economy, tax to Labour, absolutely terrified.

“And the reason why I say that is because the problems in our economy are not to do with flexible working rights.”

12:49 PM BST

Labour shows ‘lack of understanding of reality’ over net zero, says Badenoch

Net zero is both an opportunity and a risk to be mitigated, the Business Secretary has said, as the she criticised Labour’s “wrong way” of looking at the transition to green energy.

Kemi Badenoch told a Bloomberg event that for the UK had to “adapt when circumstances changed” after the outbreak of the war in Ukraine and the pandemic.

She said: “To say that is dishonest shows a lack of understanding of the reality of governing”.

She was responding to shadow business secretary Jonathan Reynolds, who said the net zero transition is “an opportunity” and could “address some of the real, long, deep-seated problems within the economy”.

12:38 PM BST

Shein ‘files papers’ for London listing

China’s fast-fashion giant Shein has confidentially filed papers with regulators for a potential London listing, it has been reported.

The Chinese-founded company, which was valued at $66bn (£52bn) in a fundraising round last year, had started engaging with its financial and legal advisors to explore a listing on the London Stock Exchange early this year.

It is not immediately clear when Shein, known for its low-cost tops and dresses, plans to launch the initial public offering (IPO).

Shein filed the documents with the Financial Conduct Authority in early June, according to Reuters, pushing ahead with what would be one of the largest IPOs globally this year.

Shein and the Financial Conduct Authority have been contacted for comment.

12:17 PM BST

Adnoc and Covestro step up talks on £9.9bn takeover

German chemicals company Covestro is giving Abu-Dhabi’s Adnoc access to its books and stepping up talks after an improved €11.7bn euro (£9.9bn) takeover offer.

The maker of plastics and chemicals for construction and engineering said it believed the two sides could “generally reach a common understanding regarding core aspects of a possible transaction including support for Covestro’s further growth strategy”.

Discussions, which had previously been described as open-ended, will now be “concrete negotiations” after more than a year of courtship by the Emirates’ energy company.

Covestro will provide due diligence information, after Adnoc, short for Abu Dhabi National Oil Co, made a €62 per share offer.

Covestro shares were up 5.4pc in early trading.

11:52 AM BST

Raising capital gains ‘isn’t going to get you very much money’, warns IFS

At its manifesto analysis launch, our economics reporter Melissa Lawford asked the IFS whether a new Labour government would seek to address the problems with the public finances by raising capital gains tax or inheritance tax.

The IFS’s deputy director and head of tax Helen Miller said:

I’m not sure really. If people want something big and chunky, we have lower rates on capital gains than on other forms of income. People know about that now and don’t like it so in that sense it might be an obvious place to look.

But they wouldn’t be able to do anything easy there, I don’t think. Just pushing up rates a little bit isn’t going to get you very much money and could actually maybe lose you money, so I think if they wanted serious money - billions as opposed to just rounding errors - then you would to start looking at serious reform in the tax base. Then there is the question of whether they have the political appetite to actually do that.

So they could. It’s not technically difficult, but it would be politically difficult.

They could also do what other governments and done - and this is not a recommendation, they shouldn’t do this - and just fiddle around behind the sofa and say ‘lets just put up stamp duty a little bit, let’s put up a few taxes that nobody really notices, like insurance premium tax’.

The problem with that is it is not necessarily the best way to do it in terms of the least-damaging way to raise taxes.

Paul Johnson added: “If you look in history where big increases and really chunky amounts of money come from, most recently freezing income tax allowances and national insurance allowances thresholds has raised loads of money.”

11:31 AM BST

Sunak: North Sea industry isn’t safe with Labour

Prime Minister Rishi Sunak has promised to “stand full square behind Scotland’s North Sea oil and gas industry”.

Speaking in Edinburgh, the Prime Minister said only the Scottish Conservatives have the “courage to stand up to the nationalists” as he launched the Scottish Tory manifesto.

Mr Sunak said: “Our North Sea industry isn’t safe with Labour.”

He added:

The Conservative Government that I lead will always stand full square behind Scotland’s North Sea oil and gas industry.

We’re committed to new licences, more investment in infrastructure and skills and energy security for our country. We’ll deliver a secure future for the North Sea industry and for the workers that it employs, whereas Labour want to stop all new licences in the North Sea from day one of a Labour government.

Keir Starmer and Ed Miliband want to tax the UK’s oil and gas sector and the 100,000 Scottish jobs that it supports into oblivion.

To laughter, Mr Sunak said: “But Labour don’t want to ban all oil and gas it turns out - just British oil and gas. I mean, they would rather virtue signal to eco-zealots than protect jobs here at home.”

11:16 AM BST

Labour and Tory spending plans dwarfed by rival parties

Labour has a tighter borrowing target than the Conservatives, the IFS said, as it aims to have the current budget in balance.

However, both parties’ taxing and giveaway plans are dwarfed by the rival parties.

These are perhaps the slides of the day from the IFS, as it gives its manifesto analysis:

Here's how the Conservative and Labour offers compare to the other main parties.

This is taking the parties' costing as given (which in some cases are likely to be under/overestimates) but shows a big difference in scale between the parties.

Watch live: https://t.co/xEbsdKewrQ pic.twitter.com/nYckxGFGof— Institute for Fiscal Studies (@TheIFS) June 24, 2024

11:08 AM BST

Taxpayers ‘left guessing’ about plan to fix public services

British taxpayers have been “left guessing” about the difficult spending decisions on public services that the next government will have to make, the IFS has said.

Day-to-day public spending has fallen by 4.6pc per person since 2009-10, the think tank said.

However, Labour acknowledged there is a “major crisis” in higher education, for example, yet never mentions how this will be fixed.

The Tories do not mention the phrase “higher education” in their manifesto, although they do talk a bit about universities.

Labour stated that 'higher education is in crisis' in their manifesto. The Conservative manifesto doesn't mention higher education at all.

Neither offer a solution to the serious challenges for higher education financing.

We're left guessing, warns @ckfarquharson. pic.twitter.com/TNWNVsXYBK— Institute for Fiscal Studies (@TheIFS) June 24, 2024

10:50 AM BST

Labour and Tories face several ‘very small’ options to raise taxes

Both Labour and the Conservatives have limited their options for tax increases by ruling out large potential sources of revenue, according to the IFS.

The IFS’s deputy director and head of tax Helen Miller warned that of the options left to raise taxes, “a lot of these are actually very small”.

A side point, she pointed out that the Government raises more from insurance premium tax than it does for inheritance tax:

Here are the tax options left that neither the Conservatives or Labour have ruled out in their manifestos.

But @HelenMiller_IFS warns that "a lot of these are actually very small", some are "politically unrealistic" and raising some would undesirable economically. pic.twitter.com/YMAF8YNA6w— Institute for Fiscal Studies (@TheIFS) June 24, 2024

10:38 AM BST

Next government faces ‘toxic mix’ for public finances, warns IFS boss

The next government faces a “pretty toxic mix for the public finances” after a series of shocks, according to Institute for Fiscal Studies (IFS) director Paul Johnson.

Addressing a manifesto analysis briefing in Westminster, Mr Johnson said taxes are at the “highest level ever” in the UK yet public services are struggling.

Mr Johnson said: “Despite the high tax levels, spending on many public services will - on current plans - likely need to be cut over the next five years unless taxes are raised further or government debt raises ever upwards.”

On how such a situation has emerged, Mr Johnson said:

The answer is in large part a £50 billion increase in debt interest spending relative to forecasts and a pretty big growth in the welfare budget over the last few years. We’ve also got rising health spending, a defence budget which for the first time in decades is going to grow not shrink, and the reality of demographic change and the need to transition to net zero.

Add in low growth and the after-effects of the pandemic and the energy price crisis and you’ve got a pretty toxic mix for the public finances. The two manifestos of the main parties essentially ignore these big challenges, these big facts that huge decisions over the size and shape of the state will need to be taken, that those decisions will, in all likelihood, mean higher taxes or worse public services.

You simply wouldn’t guess from looking at their prospectuses or listening to the promises. They failed to even acknowledge some of the most important issues and choices facing us for a very long time. As the population ages these choices are not going to get easier.

10:25 AM BST

We do not know which taxes will go up, warns IFS boss

Paul Johnson, the director of the Institute for Fiscal Studies (IFS), warned we do not know how a future government will respond if the economy worsens, as he held a press conference on his think tank’s manifesto analysis.

Speaking in London, he said:

We need more efficient and effective public services. We need a government laser-focused on improving our economic performance. It’s good to see those facts acknowledged. But on the big issues over which governments have direct control - on how they will change tax, welfare, public spending - the manifestos of the main parties provide thin gruel indeed. On 4 July we will be voting in a knowledge vacuum.

If - as is likely - growth forecasts are not revised up this autumn, we do not know whether the new government would stick roughly to the day-to-day and investment spending totals set out in the March Budget, or whether they would borrow more or tax more to top them up. If they were to stick to spending plans we do not know what would be cut. If taxes are to go up, we do not know which ones. We certainly don’t know how they would respond if things were to get worse.

The choices in front of us are hard. High taxes, high debt, struggling public services, make them so. Pressures from health, defence, welfare, ageing will not make them easier. That is not a reason to hide the choices or to duck them. Quite the reverse. Yet hidden and ducked they have been.

10:20 AM BST

Households ‘must brace for tax rises over next five years’

Households must brace for tax rises for the next five years amid uncertainty over how the next government will fund its spending plans, the Institute for Fiscal Studies (IFS) has warned.

Our deputy economics editor Tim Wallace - who has been very busy this morning - has the details here:

Both Labour and the Conservatives are engaged in a “conspiracy of silence” over the dire state of the public finances, said Paul Johnson, the think tank’s director.

The mounting cost of debt interest, healthcare and defence are all piling pressure on already-strained public finances, he said, yet there is little sign of how they will be paid for.

Mr Johnson said: “These raw facts are largely ignored by the two main parties in their manifestos. That huge decisions over the size and shape of the state will need to be taken, that those decisions will, in all likelihood, mean either higher taxes or worse public services, you would not guess from reading their prospectuses or listening to their promises.

“It will be a considerable surprise if no other taxes are increased over the next five years.”

Read how Britain will be faced with the highest tax burden since the 1940s.

10:08 AM BST

Protectionism holding back global growth, warns OECD

A boom in protectionism is holding back the global economy by bunging up international trade in services, the Organisation for Economic Cooperation and Development has warned.

Our deputy economics editor Tim Wallace has the latest:

The internet should be a boon for trade across borders, but analysts found a 25pc increase in barriers to online sales of services over the past decade, with countries piling up extra hurdles to communications infrastructure and data connectivity.

Freeing up trade in services could give the world economy a $1 trillion boost - the equivalent to 1pc of extra GDP - said the think tank.

Britain would be a big beneficiary, because of the country’s expertise in industries including business services, communications and finance.

The UK itself has relatively low barriers to trade, but other countries have been adding to red tape at their borders.

The OECD suggested finance trade could be boosted if countries made it easier for foreigners to work in their industries, to own financial businesses, and to transact in foreign currencies.

It comes amid a growing divide between the US and China as the era of globalisation and freer trade between the world’s two largest economies comes to an end, potentially dividing much of the globe into rival trading blocs.

10:04 AM BST

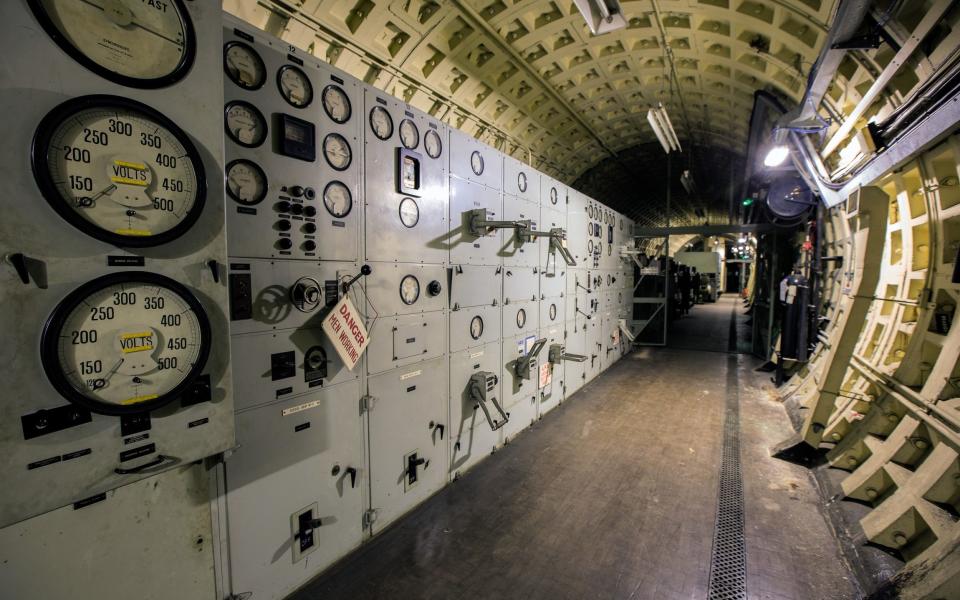

London Tunnels company to list in Amsterdam in latest blow for the City

A company aiming to turn a network of Second World War tunnels in London into a tourist attraction has opted to list in Amsterdam rather than its namesake in the latest blow for the City.

London Tunnels has applied for a listing on the Euronext exchange in the Netherlands, where it hopes to raise about £30m and secure a valuation of about £130m.

The company aims to develop a series of visitor attractions in the Kingsway Exchange Tunnels, which were originally built in the early 1940s as a deep level shelter for 8,000 people underneath Chancery Lane tube station.

They were home to the Combined Operations and the Inter Services Research Bureau from January 1944 to May 1945, and they are thought to have provided the inspiration for “Q Branch” in Ian Fleming’s James Bond books and films.

The decision to list in Europe is another blow for the City, which comes on the day Tui will formally delist from London in favour of a soul primary listing in Frankfurt.

09:42 AM BST

EU and China hold talks over electric vehicle tariffs

China and the European Union are open to holding talks on the EU’s recent decision to sharply raise tariffs on imports of Chinese-made electric vehicles, officials from both sides say.

China’s Commerce Ministry and Germany’s economy minister said over the weekend that each side was willing to hold talks on the issue.

Meanwhile, Chinese state media said today that Beijing is pushing for the EU to give up plans to sharply raise tariffs on imports of Chinese-made electric vehicles by July 4.

The EU plans to impose provisional tariffs of up to 38.1pc on EVs from China for four months starting on July 4.

That is on top of the 10pc duties for all imported EVs. They would apply to vehicles exported to Europe by both Chinese and foreign brands, including Tesla.

The European Commission, the EU’s executive arm, said preliminary results from an investigation into Chinese EV subsidies showed the country’s battery electric vehicle “value chain” benefits from “unfair subsidisation” that hurts EU rivals.

09:21 AM BST

German economy suffers latest setback as business confidence sinks

Germany’s business outlook has declined for the first time in five months in a blow to the recovery of Europe’s largest economy.

The Ifo business climate indicator declined from 89.3 in May to a three-month low of 88.6 in June.

Ifo president Clemens Fuest said: “The German economy is having difficulty overcoming stagnation.”

He pointed to Germany’s dominant manufacturing sector, where bosses “were again more sceptical for the months ahead”.

“They were particularly [disappointed] by the declining order backlog, but were somewhat more satisfied with current business,” he added.

The data was “a setback,” he told Bloomberg Radio, adding that it was driven by a “grimmer outlook for the industrial sector”.

Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics, said he felt the Ifo indicators have been “overstating the weakness in the economy for some time”.

He said: “Looking ahead, we expect the economy to continue growing at a slow pace. We forecast GDP to rise by 0.2pc in 2024 as a whole.”

Germany Business Confidencehttps://t.co/VNYiJDLvbS pic.twitter.com/uhhB2HL2cg

— TRADING ECONOMICS (@tEconomics) June 24, 2024

09:06 AM BST

Apple faces multi-billion euro fine under Brussels monopoly crackdown

Brussels has accused Apple of breaking Big Tech monopoly laws in a move that could lead to a multi-billion euro fine.

The European Commission said it believed Apple’s App Store was in breach of its new Digital Markets Act (DMA), a sweeping set of laws designed to rein in the world’s biggest tech companies.

It said Apple’s business terms unfairly block app developers from steering customers to alternative payment methods that may be cheaper.

If the Commission finds against Apple it can face a fine of up to 10pc of its worldwide revenue, which was $316bn (£171bn) in its last financial year.

Thierry Breton, the European Commissioner for Internal Market, said: “‘Act different’ should be their new slogan. For too long Apple has been squeezing out innovative companies - denying consumers new opportunities & choices.”

Apple said it would engage with the EU.

A spokesman said: “Throughout the past several months, Apple has made a number of changes to comply with the DMA in response to feedback from developers and the European Commission. We are confident our plan complies with the law, and estimate more than 99pc of developers would pay the same or less in fees to Apple under the new business terms we created.

“All developers doing business in the EU on the App Store have the opportunity to utilise the capabilities that we have introduced, including the ability to direct app users to the web to complete purchases at a very competitive rate. As we have done routinely, we will continue to listen and engage with the European Commission.”

Apple’s requirements being investigated by the commission include a 50 cent per download fee paid by developers who offer their apps outside the App Store, and restrictions on providing information about cheaper purchases on other app stores.

The EU said it would make a decision within 12 months.

08:40 AM BST

FTSE slumps ahead of US inflation data

The FTSE 100 edged lower as investors turned cautious ahead of key inflation data in the United States.

The blue-chip index was down 0.1pc after touching a two-week high on Friday, while the mid-cap FTSE 250 was down 0.4pc.

The energy sector fell 0.3pc, in tandem with oil prices, as concerns that US interest rates could stay higher for longer strengthened the dollar.

Industrial miners slipped 0.9pc amid concerns of muted Chinese demand, which also pulled down copper prices.

In the US, the personal consumption expenditure numbers (PCE) are due on Friday. Investors are banking on the data to show a renewed moderation in inflation.

Among individual stocks, Prudential gained 5.6pc to be the biggest gainer on the FTSE 100 after the insurance group said it planned a $2bn share buyback programme, to be completed by mid-2026.

Shares of THG Group gained as much as 5.5pc but quickly fell back to gains of just 0.2pc after the ecommerce company agreed to sell its portfolio of luxury goods website to Fraser’s Group for an undisclosed sum. Fraser’s Group was up 0.9pc.

Britvic shares were up as much as 10.3pc to lead the FTSE 250 after Pepsi effectively gave its blessing to a potential takeover by Carlsberg.

08:19 AM BST

Gas prices edge lower despite unplanned outages

Natural gas prices have hovered between small gains and losses as the market absorbed the impact of unplanned disruption to supplies.

Dutch front-month futures, the European benchmark, fell as much as 0.9pc after earlier gains following the latest outage at the Hammerfest plant in Norway.

In Australia, production resumed at the Wheatstone plant after some disruption.

08:06 AM BST

UK markets fall at the open

Stock markets in London have dropped at the start the final full week of general election campaigning amid uncertainty also caused by the parliamentary poll in France.

The FTSE 100 has moved 0.1pc lower to 8,227.61 while the midcap FTSE 250 fell 0.2pc to 20,408.55.

07:59 AM BST

Frasers to buy THG’s luxury websites as it builds premium offer

Mike Ashley’s Frasers Group has announced its deal with THG will also include the takeover of a series of its luxury brand website.

The House of Fraser and Sports Direct owner have agreed on a partnership across several areas, which will include Frasers launching its consumer credit and loyalty feature, Frasers Plus, across THG’s tech platform Ingenuity.

It will also be acquiring THG’s luxury brand portfolio including Coggles, strengthening its premium portfolio which already includes the suit retailer Flannels.

Frasers’ chief executive Michael Murray said it marked an “exciting step” in its plan to launch the feature across more third-party platforms.

07:46 AM BST

Pepsi gives its blessing to Carlsberg’s takeover bid for Britvic

PepsiCo has effectively given its blessing to Carlsberg’s efforts to secure a takeover of Robinsons squash maker Britvic after it rejected a £3.1bn takeover approach from the Danish beer maker.

The soft drinks maker said it has agreed to waive the change of control clause in its bottling arrangements it has with Britvic, removing a potential barrier to the deal going ahead.

Carlsberg is considering its position after the British drinks giant confirmed on Friday that it had rejected two offers, which it claimed had “significantly undervalued” the business.

Britvic’s share price surged 16pc in response to the announcement.

It comes as London’s beleaguered stock market grapples with a wave of foreign takeovers, as international buyers take advantage of undervalued British stocks.

07:27 AM BST

THG announces Frasers deal ahead of shareholder meeting

British tech champion THG has announced a partnership with Mike Ashley’s Frasers as it seeks to shore up support ahead of its annual general meeting.

The online retailer behind brands including Lookfantastic and Glossybox said it would work with Frasers on a number of projects, including courtier management services and revamping its Australian warehouse and logistics operations.

It will also integrate the Frasers Plus loyalty programme into its Ingenuity checkout software.

THG, which also owns brands such as Cult Beauty and LookFantastic, has struggled to shrug off pressure from shareholders.

Last month, activist investor Kelso said it was planning to vote against THG’s chairman at its annual meeting.

Meanwhile, THG has become embroiled in a bitter High Court legal dispute with a former Australian business partner over claims of unpaid bills.

THG said today that it was leaving its revenue guidance unchanged.

07:13 AM BST

Salaries fall for first time in six months in boost to hopes for interest rate cuts

Salaries have fallen for the first time in six months, boosting hopes of a Bank of England rate cut later this summer.

Average salaries slipped 0.1pc to £38,765 from April to May, the first decline since last October, according to Adzuna’s closely-watched jobs report.

Although the decline is small, slowing wage growth could ease fears about a future uptick in inflation and bolster the chance of a rate cut by the Bank later this year.

The Bank held rates at 5.25pc again last week but economic indicators suggest a cut to borrowing costs is in the offing.

Inflation fell back to the Bank’s 2pc target for the first time in three years last week, paving the way for a rate cut as soon as August.

Adzuna’s monthly jobs report gives a snapshot of UK job vacancies. The company supplies its real time data to the Cabinet Office and Office for National Statistics labour market indices.

Job vacancies were broadly flat from April to May, rising by just 77 vacancies to 854,248.

The figure was 18.7pc below May last year, signalling fewer job openings and more normal pay growth, which will ease concerns among the Bank’s policymakers that the labour market is running too hot still.

Adzuna co-founder Andrew Hunter said the salary fall was “pointing to a slightly less tight labour market”.

Jobs in the legal and travel sectors were the worst hit, with salaries declining 1.5pc and 1.2pc respectively.

Mr Hunter said the Conservatives and Labour Party had both focused on the need for more jobs in healthcare and manufacturing, and these industries had seen vacancies drop by more than 20pc over the past year.

He said: “The UK job market has been met with resistance in the past few months but the upcoming general election may have the potential to salvage the situation.

“Any outcome is likely to move the needle on the sluggish job market, with both the Conservative and Labour parties pledging to create more jobs.”

Unemployment recently reached 4.4pc, its highest level in two and a half years.

06:51 AM BST

Good morning

Thanks for joining me. We begin the week with labour market figures which could boost hopes for interest rate cuts from the Bank of England.

Monthly average salaries have fallen for the first time since last October, according to Adzuna’s closely-watched jobs report.

Although the decline is small, slowing wage growth could ease fears about a future uptick in inflation and bolster the chance of a rate cut by the Bank later this year.

5 things to start your day

1) Post Office suffers leadership crisis amid Horizon investigation – Fresh expertise parachuted in ‘to change company culture and rebuild trust’

2) Rishi Sunak’s startup fund pulls the plug on dozens of companies – Scheme set up to support new businesses through Covid is seeking to recover £5m

3) Former M&S chief’s motor leasing giant faces debt crunch – Slump in second-hand electric car prices has spooked car fleet’s investors

4) China agrees to electric car tariff talks as EU fights to avoid trade war – Automotive industry fears crackdown on Chinese EVs would spark tit-for-tat tariff rises

5) Britain’s ‘queen of pottery’ slumps to £1.4m loss – Sharp rise in production and staffing costs push homewares brand into the red

What happened overnight

Asian shares were mostly lower after US stocks coasted to the close of their latest winning week on Friday, even as Nvidia’s stock slowed further from its startling run.

In Tokyo, the Nikkei 225 index rose 0.7pc to 38,869.94, making it the sole major benchmark in Asia to post gains on Monday.

The yen weakened to 159.93 per dollar during morning trading.

Minutes of the Japanese central bank’s last policy meeting released Monday put the yen under renewed pressure as it indicated that “any change in the policy interest rate should be considered only after economic indicators confirm that, for example, the CPI inflation rate has clearly started to rebound and medium-to long-term inflation expectations have risen.”

Elsewhere, Hong Kong’s Hang Seng dropped 1.2pc to 17,815.42, while the Shanghai Composite lost 1pc to 2,969.59.

Australia’s S&P/ASX 200 dipped 0.7pc to 7,740.80. South Korea’s Kospi was down 0.7pc to 2,763.95.

On Friday, the S&P 500 slipped 0.2pc to 5,464.62, but it remained close to its all-time high set on Tuesday and capped its eighth winning week in the last nine. The Dow Jones Industrial Average edged up less than 0.1pc to 39,150.33, while the Nasdaq Composite dropped 0.2pc to 17,689.36.

Yahoo Finance

Yahoo Finance