Bristol-Myers Squibb Co (BMY) Q1 2024 Earnings Report: A Detailed Overview

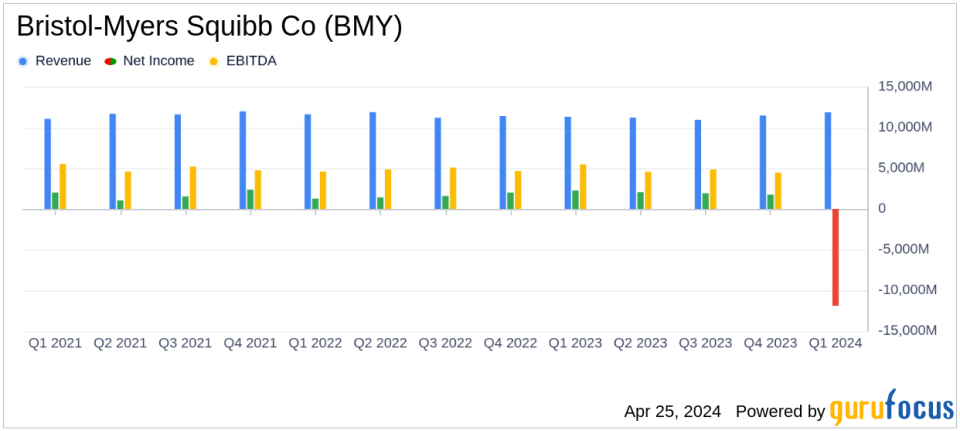

Revenue: Reported at $11.9 billion, up 5% year-over-year, exceeding the estimate of $11.457 billion.

Net Loss: Reported a GAAP net loss of $11.9 billion, significantly below the estimated net loss of $8.923 billion.

Earnings Per Share (EPS): GAAP loss per share was $(5.89), and Non-GAAP loss per share was $(4.40), both below the estimated EPS of $(4.44).

Gross Margin: On a GAAP basis, decreased to 75.3% from 77.4% a year ago; Non-GAAP gross margin also decreased to 75.5% from 77.8%.

Research and Development Expenses: On a GAAP basis, increased by 16% to $2.7 billion, driven by recent acquisitions and portfolio support costs.

Strategic Acquisitions: Completed significant transactions including Karuna Therapeutics, RayzeBio, Mirati Therapeutics, and SystImmune, aiming to strengthen long-term growth.

Productivity Initiatives: Executing strategic productivity efforts projected to save approximately $1.5 billion by the end of 2025, with the majority reinvested in innovation and growth.

Bristol-Myers Squibb Co (NYSE:BMY) released its 8-K filing on April 25, 2024, revealing a complex first quarter marked by strategic acquisitions and a significant non-GAAP loss per share of $4.40, closely aligning with analyst expectations of a $4.44 loss per share. Despite these challenges, the company reported a revenue increase to $11.9 billion, surpassing the estimated $11.46 billion.

Bristol-Myers Squibb, a global biopharmaceutical company, is known for its significant contributions to various therapeutic areas, including cardiovascular, cancer, and immune disorders. With a strategic focus on immuno-oncology, the company continues to lead in drug development, deriving approximately 70% of its total sales from the U.S. market.

Financial Performance and Strategic Developments

The first quarter of 2024 was notable not only for its revenue growth but also for several strategic moves aimed at bolstering the company's long-term growth. These included the completion of acquisitions such as Karuna Therapeutics and Mirati Therapeutics, enhancing Bristol-Myers Squibb's capabilities in neuroscience and oncology, respectively.

Despite these positive developments, the company faced a substantial GAAP net loss of $11.9 billion, primarily due to a $12.1 billion non-tax-deductible charge related to the acquisition of Karuna Therapeutics. This resulted in a GAAP loss per share of $5.89. The non-GAAP figures, which exclude certain specified items, presented a net loss of $8.9 billion, or $4.40 per share, reflecting the significant financial impact of these strategic initiatives.

Revenue Highlights and Operational Challenges

Revenue growth was driven by strong performances from key products such as Eliquis and Opdualag, although offset by declines in other areas like Revlimid and Opdivo. U.S. revenues increased by 7%, while international revenues remained flat, affected by lower average net selling prices and negative foreign exchange impacts.

Operational expenses on a GAAP basis saw substantial increases, with marketing, selling, and administrative expenses rising by 34% to $2.4 billion, and research and development expenses up by 16% to $2.7 billion. These increases were largely due to the costs associated with recent acquisitions and the ongoing support of the company's extensive product portfolio.

Strategic Productivity Initiatives

In response to these challenges, Bristol-Myers Squibb is implementing a strategic productivity initiative aimed at achieving approximately $1.5 billion in cost savings by the end of 2025. The savings are intended to be reinvested into innovation and growth-driving opportunities, reflecting the company's commitment to maintaining its competitive edge and delivering value to shareholders.

Outlook and Forward-Looking Statements

Looking ahead, Bristol-Myers Squibb has updated its 2024 non-GAAP EPS guidance to reflect the impacts of its recent transactions. The company remains focused on leveraging its enhanced portfolio and operational efficiencies to navigate the current challenges and capitalize on future growth opportunities.

For more detailed information and to stay updated on Bristol-Myers Squibb's progress, stakeholders are encouraged to refer to the full earnings report and subsequent investor communications.

For further inquiries, please contact Bristol-Myers Squibb's media relations at media@bms.com or investor relations at investor.relations@bms.com.

Explore the complete 8-K earnings release (here) from Bristol-Myers Squibb Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance