Bridgewater Bancshares Inc (BWB) Q1 Earnings: Aligns with Analyst EPS Projections Amidst ...

Net Income: Reported $7.8 million for Q1 2024, falling short of the estimated $6.94 million.

Earnings Per Share (EPS): Achieved $0.24 diluted EPS, slightly below the estimated $0.25.

Revenue: Details on total revenue not provided in the text, hence comparison with the estimated $27.03 million cannot be made.

Net Interest Margin: Declined to 2.24% in Q1 2024 from 2.27% in the previous quarter and down from 2.72% year-over-year.

Loan Portfolio: Grew to $3.78 billion, marking a 6.5% annualized increase from the end of the previous quarter.

Deposits: Increased to $3.81 billion, up by 10.5% annualized from $3.71 billion at the end of the previous quarter.

Asset Quality: Remains high with nonperforming assets to total assets at a minimal 0.01%.

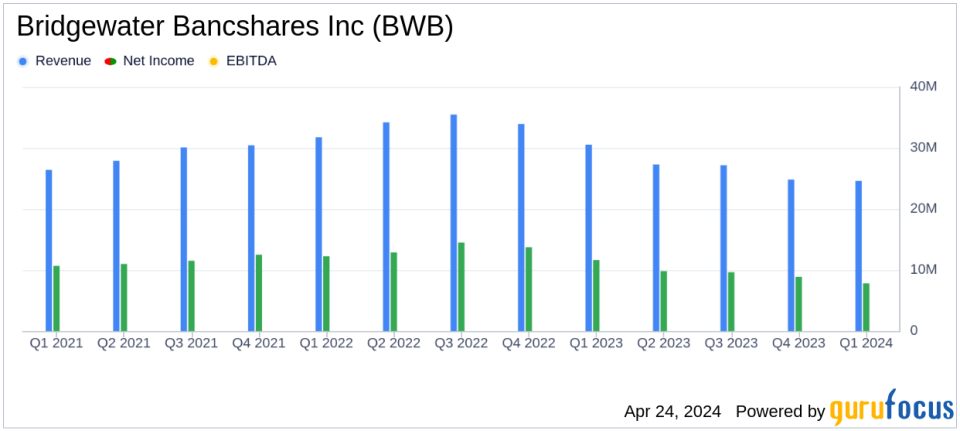

Bridgewater Bancshares Inc (NASDAQ:BWB) disclosed its financial results for the first quarter of 2024 on April 24, revealing a net income of $7.8 million and diluted earnings per share (EPS) of $0.24. These figures align closely with analyst expectations of $0.25 EPS and showcase a slight underperformance in net income against the forecast of $6.94 million. The detailed financial outcomes are available in the company's 8-K filing.

About Bridgewater Bancshares Inc

Bridgewater Bancshares Inc, operating primarily in the Minneapolis-St. Paul-Bloomington, MN-WI Metropolitan Statistical Area, offers a broad spectrum of retail and commercial loan and deposit services. The companys financial solutions range from commercial deposits to remote deposit services, catering to a diverse clientele including commercial real estate investors and business entities.

Financial Highlights and Challenges

The first quarter of 2024 saw Bridgewater Bancshares experiencing a net income of $7.8 million, a decrease from $8.9 million in Q4 2023 and a more significant drop from $11.6 million in Q1 2023. The EPS also declined to $0.24 from $0.28 in the previous quarter and $0.37 year-over-year. This reduction can be attributed to ongoing net interest margin compression, which has slowed but continues to impact earnings. Despite these challenges, the company benefited from a robust increase in loan demand and a rebound in deposit balances, improving the loan-to-deposit ratio to below 100% for the first time since early 2022.

Key Financial Metrics

Bridgewater reported a net interest income of $24.6 million for Q1 2024, down from $25.3 million in the preceding quarter and $28.6 million in the same quarter last year. The bank's total assets amounted to $4.72 billion, with gross loans at $3.78 billion and total deposits at $3.81 billion. The bank's asset quality remained strong, with nonperforming assets to total assets at a minimal 0.01%. The return on average assets was 0.69%, and the return on average equity stood at 7.35%.

Strategic Financial Management

Bridgewater's management has been proactive in navigating the challenging economic environment. The bank's strategic focus on expanding its loan portfolio and enhancing core deposits has paid dividends in stabilizing its financial metrics. Furthermore, the bank's efficiency ratio of 58.2% reflects well-controlled expenses, contributing to its financial health.

Outlook and Forward Movements

Looking ahead, Bridgewater Bancshares remains optimistic about its future performance. With a continuing focus on its proven business model and differentiated service level, the bank is well-positioned to manage external economic pressures. Moreover, the recent declaration of a quarterly cash dividend on its Series A Preferred Stock underscores the bank's commitment to delivering shareholder value.

In conclusion, while Bridgewater Bancshares Inc faces ongoing challenges such as interest rate fluctuations and economic uncertainties, its strategic initiatives and strong fundamental operations provide a stable foundation for future growth. Investors and stakeholders are likely to watch closely how the bank maneuvers through the evolving financial landscape in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Bridgewater Bancshares Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance