Brazil Inflation Comes in Under Forecasts as Interest Rates Held High

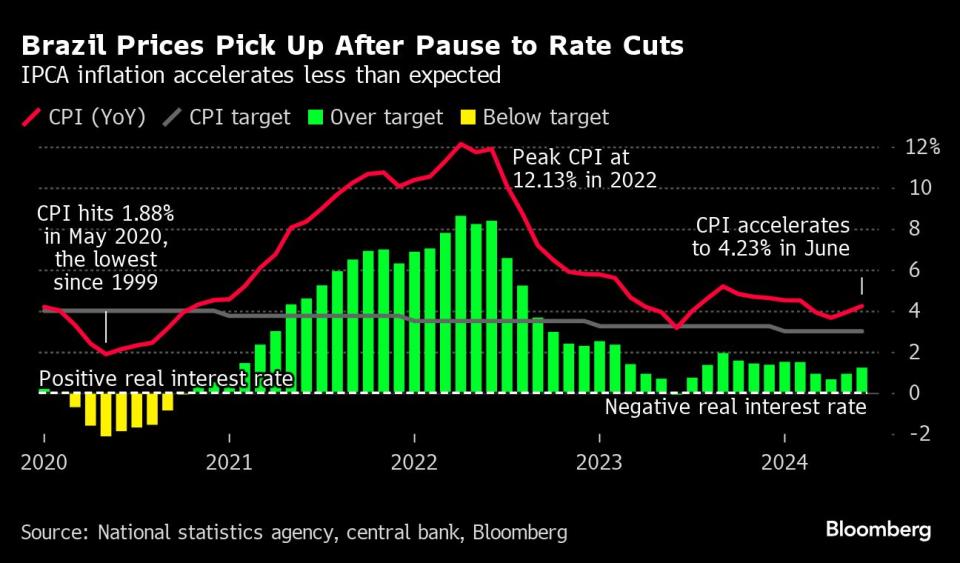

(Bloomberg) -- Brazil’s annual inflation rate rose less than expected in June, bolstering the central bank after it came under fire from critics for pausing its interest rate cuts to combat simmering price pressures.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

Official data released Wednesday showed prices increased 4.23% from a year earlier, below the 4.32% median estimate from analysts in a Bloomberg survey. On the month, inflation stood at 0.21%, under all forecasts.

Swap rates on the contract due in January 2026, which are a gauge of market sentiment toward monetary policy at the end of next year, fell 16 basis points in morning trading following the slower-than-expected inflation print.

“This was a rather important inflation report,” said Laiz Carvalho, a Brazil economist at BNP Paribas. “It brings some relief to the central bank.”

Policymakers broke a nearly yearlong streak of rate cuts last month as the economy outperforms expectations and investors fret over President Luiz Inacio Lula da Silva’s spending plans. The decision likely keeps the benchmark Selic in double-digits for the foreseeable future, a bid to tamp down fears that inflation will persist.

What Bloomberg Economics Says

“Brazilian inflation surprised to the downside in June, but we don’t expect the central to budge from its plan to keep the policy rate on hold at 10.5%. The print provides some relief ahead of a likely acceleration in coming months, and may help discourage bets on a rate hike.”

— Adriana Dupita, Brazil and Argentina economist

— Click here to read full report

Price rises are far their below their post-pandemic peak in 2022, but are now being pushed up by higher food costs and a slide in Brazil’s currency, the real. Economists have raised their inflation forecasts further above the 3% target.

Food and beverage prices that climbed 0.44% and a 0.54% jump in the cost of personal care products drove June’s inflation gain. Meanwhile, transportation costs fell 0.19% on a drop in airfares and cheaper prices of some fuels, the statistics agency said.

Going forward, there is plenty of reason for caution on inflation. While Brazil’s currency has recently pared losses, it’s still down nearly 10% year-to-date. Furthermore, state-controlled oil company Petroleo Brasileiro SA is raising gasoline prices for the first time in 11 months.

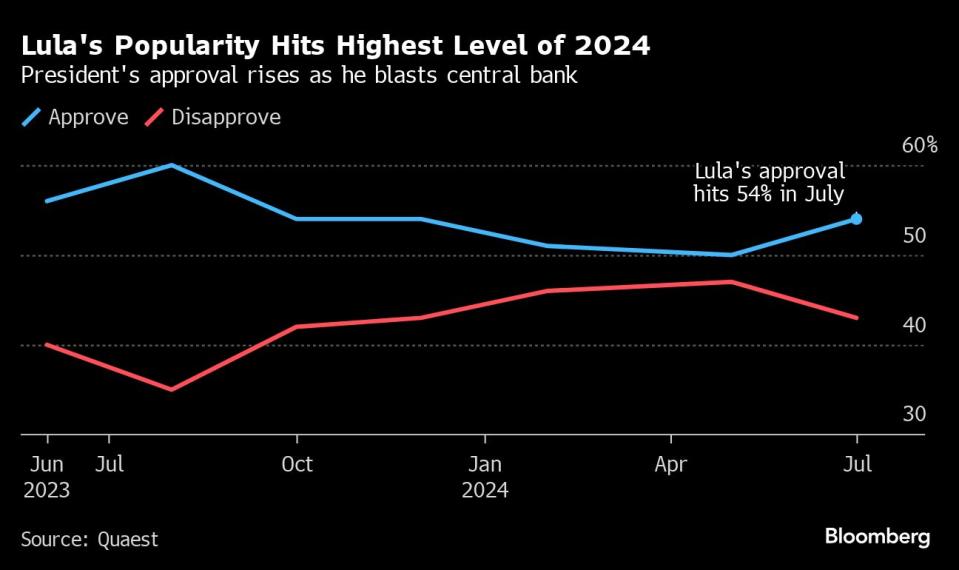

The central bank is autonomous from the government and its vigilant stance has enraged Lula. He says borrowing costs are choking off growth and that bank chief Roberto Campos Neto is inflicting too much economic pain in trying to reach the inflation goal.

That criticism appears to have resonated with regular Brazilians. In July, Lula’s approval rating reached the highest level of the year, at 54%, up from 50% in May, a survey from Quaest published on Wednesday showed. His disapproval rating fell to 43% from 47%.

The survey also found 87% of respondents concur with Lula that interest rates are very high, while two-thirds of respondents agreed with his criticism of the central bank. The poll interviewed 2,000 people around the country between July 5 and 8 and had a margin of error of plus or minus two percentage points.

The institutional clash has shaken local assets with markets betting the leftist president will try to exert more political pressure on the central bank once Campos Neto’s term ends later this year.

--With assistance from Giovanna Serafim, Beatriz Amat and Gabriel Diniz Tavares.

(Adds analysis, poll details on Lula’s popularity and central bank criticism beginning in 11th paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance