Brazil Central Bank in No Rush to Cut Again Amid Fiscal Woes

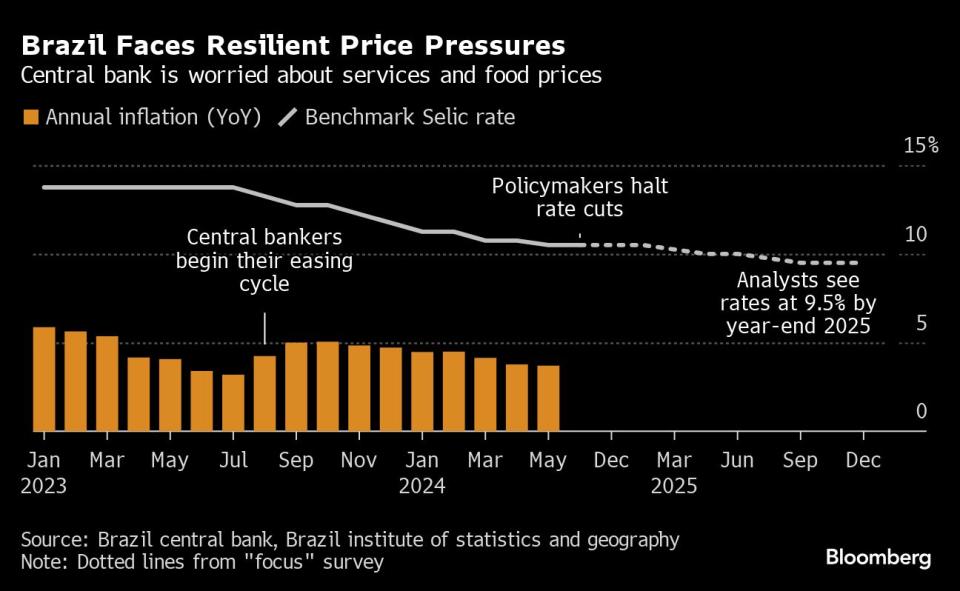

(Bloomberg) -- Brazil central bank signaled it’s not considering resuming its monetary easing cycle any time soon as the economy grows faster than it anticipated and inflation expectations rise amid persistent fiscal concerns.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

Nvidia Rout Takes Breather as Traders Scour Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

In minutes to their June 18-19 meeting, central bankers also said the economy now requires higher real interest rates to keep growing without inflationary pressures. They increased the so-called neutral interest rate to 4.75% from 4.5 previously, also considering scenarios with a neutral rate of as much as 5% — closer to levels seen by most economists.

Overall, the minutes dispelled concerns that the bank could lower borrowing costs prematurely, and suggested the benchmark Selic will remain at the current level of 10.5% for an extended period. Central bankers also gave no indication they debated future rate hikes, but vowed to stay “vigilant” in their inflation battle.

The committee “reinforced its view that the lack of commitment to structural reforms and fiscal discipline, the increase of earmarked credit granting, and the uncertainties about the stabilization of the public debt have the potential to raise the neutral interest rate of the economy,” they wrote.

Finance Minister Fernando Haddad, speaking after the document was released, said the minutes convey the idea that the monetary easing cycle is at a pause to give policymakers time to assess domestic and external scenarios and to allow the bank to make decisions based on fresh data.

“It’s important to underline that the board talks about an interruption of the cycle, and that seems to be a key difference that needs to be highlighted,” he told reporters.

What Bloomberg Economics Says

The minutes of the Brazilian central bank’s June policy meeting revealed three key details: policymakers marginally increased their estimate of the neutral rate, some of them viewed upside risks to inflation and the board was united on reanchoring inflation expectations. There was no reference to a possible hike, but the overall tone of the minutes was somewhat more hawkish than the post-meeting statement, in our view.

— Adriana Dupita, Brazil & Argentina economist

Click here to read the full report.

In the minutes, policymakers led by Roberto Campos Neto wrote they “unanimously decided to interrupt” the easing cycle after lowering borrowing costs by 3.25 percentage points over almost a year. The consensual vote was aimed to calm investors who remain skeptical over the bank’s commitment to lower inflation to the 3% goal once President Luiz Inacio Lula da Silva names a new governor and two directors later this year, effectively having majority on the board.

Concerns of a more lenient bank spiked last month after all four board members appointed by Lula favored a bigger cut. In the end, a majority led by Campos Neto decided for the smaller rate reduction. Traders who priced in rate hikes as early as September are now cutting back on those trades.

Also easing such concerns were remarks by Monetary Policy Director Gabriel Galipolo, one of the board members appointed by Lula and a potential replacement for Campos Neto. After dissenting from the majority in May, he said the latest minutes “fully represent” his thinking, adding that he sees value in reaching consensus in monetary policy decisions.

Rising inflation expectations are a big concern for policymakers, but not the only reason why they decided to halt the easing campaign, Galipolo said.

“We had steep changes in the currency outlook, implicit inflation, long-term interest rates,” he said. “That’s a sign of resilient dynamism in the economy.”

He added that central bankers remain data dependent and will refrain from proving forward guidance on rate moves.

Swap rates briefly fell following Galipolo’s comments as traders welcomed efforts to reduce noise in the bank’s communication.

Faster Inflation

Policymakers are battling a recent rise of inflation estimates, with most analysts forecasting consumer price increases at least half-point above goal through 2027. Last week policymakers introduced an alternative scenario where they are able to deliver on their 3% goal by holding rates steady through 2025.

Current inflation is complicating matters further for the bank, after a spike in May cut short seven straight months of improving annual prints. Central bankers debate focused on current inflation, with some members more concerned about food prices. Services costs “continued to be a subject of much scrutiny,” according to the minutes, adding it plays a major role in a slower disinflation process.

“The Committee will not shy away from its commitment of reaching the inflation target and understands the fundamental role of expectations in the inflation dynamics,” they wrote.

Helena Veronese, chief economist at asset manager B-side Investimentos, said in a written note that policymakers kept their cautious tone while reinforcing the unanimity of their decision. “It seems clear that there’s no more room for rate cuts this year,” she added.

And Stronger Economy

The economy is also giving signs of stronger-than-expected performance, likely fueling price pressures. Policymakers see stronger than expected activity, and now estimate the economic slack is neutral.

With Brazil’s nominal rates among the highest in Latin America, the bank’s decision to hold them steady for longer is fueling a political tension. Lula recently escalated his criticism of monetary policy, saying the bank acts against the country’s growth, and singled out governor Campos Neto as a “political adversary.” His future pick to lead the board, he added, will stay focused on both inflation and growth, while remaining “immune” to market jitters.

Investors remain concerned about Brazil’s fiscal outlook, after Haddad’s latest proposal to increase revenue and shore up public finances was rejected by Congress. His economic team is expected to present plans to cut expenses, something Lula said he wouldn’t oppose as long as they’re proven necessary.

It all comes after the government weakened its fiscal goal for next year, aiming for a balanced budget instead of a primary surplus, excluding interest payments. Central bankers reinforced they are “closely monitoring” developments on the fiscal front, saying a “credible” goal helps lower inflation estimates.

“Synchronous and countercyclical monetary and fiscal policies help ensure price stability,” they wrote.

--With assistance from Bruna Lessa.

(Updates with comments from monetary policy director, economist and details of minutes starting in ninth paragraph .)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance