Is Bragg Gaming Group (CVE:BRAG) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Bragg Gaming Group Inc. (CVE:BRAG) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Bragg Gaming Group

What Is Bragg Gaming Group's Debt?

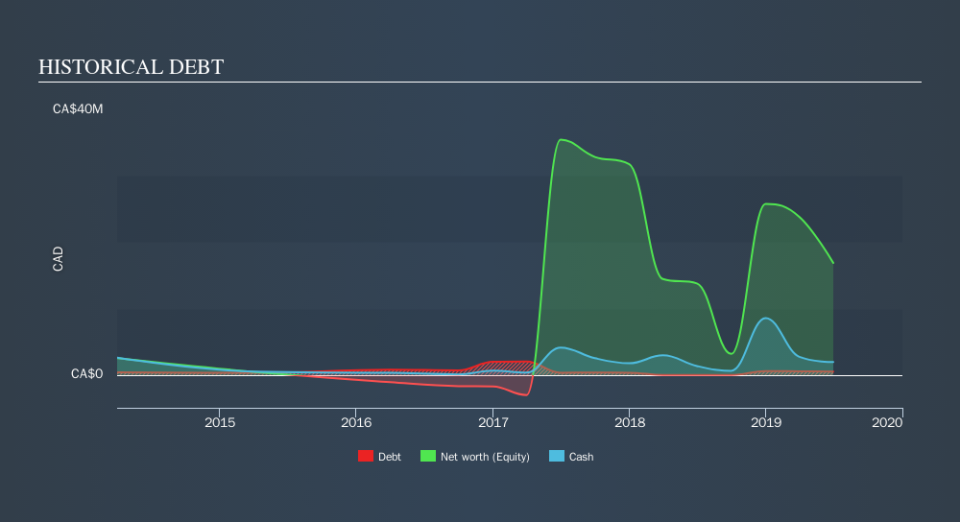

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Bragg Gaming Group had CA$514.3k of debt, an increase on none, over one year. But it also has CA$1.94m in cash to offset that, meaning it has CA$1.42m net cash.

How Healthy Is Bragg Gaming Group's Balance Sheet?

The latest balance sheet data shows that Bragg Gaming Group had liabilities of CA$27.2m due within a year, and liabilities of CA$20.8m falling due after that. Offsetting these obligations, it had cash of CA$1.94m as well as receivables valued at CA$6.08m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$39.9m.

The deficiency here weighs heavily on the CA$16.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, Bragg Gaming Group would likely require a major re-capitalisation if it had to pay its creditors today. Given that Bragg Gaming Group has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Bragg Gaming Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Bragg Gaming Group reported revenue of CA$30m, which is a gain of 137%, although it did not report any earnings before interest and tax. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Bragg Gaming Group?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Bragg Gaming Group lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CA$3.8m of cash and made a loss of CA$36m. Given it only has net cash of CA$1.42m, the company may need to raise more capital if it doesn't reach break-even soon. Importantly, Bragg Gaming Group's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Bragg Gaming Group's profit, revenue, and operating cashflow have changed over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance