BP Rises 3.4% Since Q3 Earnings Beat, Increases Share Buybacks

BP plc BP shares have gained 3.4% since it reported strong third-quarter 2022 earnings on Nov 1. The outperformance can be attributed to its earnings beating the Zacks Consensus Estimate and an increase in share buybacks.

BP reported third-quarter adjusted earnings of $2.59 per American Depositary Share on a replacement-cost basis, excluding non-operating items. The bottom line beat the Zacks Consensus Estimate of earnings of $1.94 per share and rose from 99 cents reported a year ago.

Total quarterly revenues of $57,809 million surpassed the Zacks Consensus Estimate of $57,460 million. The top line increased from $37,867 million in the year-ago quarter.

Strong quarterly earnings were driven by higher production and realizations of commodity prices.

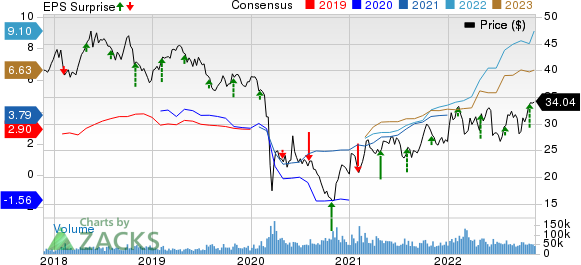

BP p.l.c. Price, Consensus and EPS Surprise

BP p.l.c. price-consensus-eps-surprise-chart | BP p.l.c. Quote

Share Repurchases

BP announced plans to execute a $2.5-billion share buyback program, which is expected to complete before its fourth-quarter results. BP anticipates buying back $1 billion worth of shares every quarter, considering Brent crude price of $60 per barrel.

Operational Performance

Oil Production & Operations:

For the third quarter, BP reported total production of 1,317 thousand barrels of oil equivalent per day (MBoe/d), marginally up from 1,313 MBoe/d in the year-ago quarter.

BP sold liquids at $93.14 a barrel in the third quarter compared with $65.53 in the prior-year period. It sold natural gas at $11.73 per thousand cubic feet compared with $5.61 in the year-ago quarter. Overall price realization rose to $86.21 per Boe from the year-ago level of $57.72.

After adjusting for non-operating items, underlying replacement cost earnings before interest and tax for the segment amounted to $5,211 million. The figure jumped from earnings of $2,461 million in the year-ago quarter. Higher commodity price realizations primarily caused the upside.

Gas & Low Carbon Energy:

Segmental profits totaled $6,240 million, improving from earnings of $1,807 million in the year-ago quarter, primarily led by increased oil-equivalent production and prices.

In the third quarter, the total production of 981 MBoe/d improved from 889 MBoe/d in the year-ago quarter. Key project start-ups primarily contributed to the production.

Customers & Products:

After adjusting for non-operating items, underlying replacement cost earnings before interest and tax for the segment amounted to $2,725 million, up significantly from $1,158 million in the year-ago quarter. A favorable refining business and an exceptional oil trading contribution aided the segment.

BP-operated refining availability at the September-end quarter was 94.3%, reflecting a decline from 95.6% in the year-ago quarter. Total refinery throughputs from the third quarter were 1,512 thousand barrels per day (MBbl/D), declining from 1,622 MBbl/D in the prior-year quarter.

Capex

Organic capital expenditure for the reported quarter was $3,191 million. The company reported total capital spending of $3,194 million for the quarter.

Financials

BP's net debt, including leases, was $29,919 million at the end of the third quarter versus $40,710 million in the prior-year quarter. Gearing was 29% compared with 31.3% in the prior-year quarter.

Outlook

BP expects upstream production to be slightly higher year over year in 2022. The company revealed its capital expenditure guidance of $15.5 billion for the year.

BP expects to receive more than $3 billion of divestment and other proceeds this year. Against a target of $25 billion of divestment and other proceeds between the second half of 2020 and 2025, the company has received $15.3 billion of proceeds so far.

The company anticipates oil and gas prices to remain high in the fourth quarter due to the recent supply cut amid ongoing uncertainty associated with Russia oil exports. Hence, it expects industry refining margins to remain elevated in the fourth quarter.

Zacks Rank & Other Key Picks

BP currently carries a Zacks Rank #2 (Buy). Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Marathon Petroleum Corporation MPC reported third-quarter 2022 adjusted earnings per share of $7.81, comfortably beating the Zacks Consensus Estimate of $6.80. The bottom line was favorably impacted by the stronger-than-expected performance of its Refining & Marketing segment.

In October, Marathon Petroleum completed its target to buy back $15 billion in common stock. MPC has a remaining authorization of $5 billion with no expiration date.

Patterson-UTI Energy PTEN reported a third-quarter 2022 adjusted net profit of 28 cents per share, beating the Zacks Consensus Estimate of a profit of 19 cents. The outperformance was driven by solid segmental performances.

Patterson-UTI doubled its quarterly cash dividend to 8 cents per share from the previous 4-cent payout. The dividend will be paid out on Dec 15, 2022, to shareholders of record as of Dec 1, 2022. PTEN also increased its share repurchase authorization to $300 million.

RPC Inc. RES reported adjusted earnings of 32 cents per share in the third quarter, beating the Zacks Consensus Estimate of 25 cents. The strong quarterly results were backed by higher activity levels in all the service lines and improved pricing.

With no debt load, RPC had cash and cash equivalents of $35.9 million at the third-quarter end. This reflects the company’s strong balance sheet, providing it with massive financial flexibility and allowing it to remain afloat during tough times.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

PattersonUTI Energy, Inc. (PTEN) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance