BP Delivers Its First Carbon Offset LNG Cargo to Mexico

BP plc BP entered an agreement with Sempra Energy SRE and Infraestructura Energetica Nova (or IEnova) to deliver its first carbon offset liquefied natural gas (“LNG”) cargo as part of efforts to achieve net-zero emissions.

Per the agreement, the shipment is expected to have been delivered at the Energía Costa Azul (“ECA”) terminal of Mexico on Jul 16, 2021. Notably, Energia Costa Azul is a joint venture between IEnova and Sempra LNG, a subsidiary of Sempra Energy. This is the first delivery under BP’s new offer and Sempra LNG’s first carbon offset LNG cargo import to Mexico.

The carbon dioxide (CO2) and methane emissions related to the cargo were estimated with the help of BP’s greenhouse gas (“GHG”) quantification methodology for LNG. Per the terms of the deal, the estimated emissions were neutralized by retiring an equivalent amount of carbon credits supplied from BP’s afforestation project in Mexico.

Natural gas and LNG play major roles in global transition as they emit less CO2 when combusted than fossil fuel. Energy companies have been seeking carbon-neutral or carbon offset LNG cargoes to reduce GHG emissions and prevent the consequences of climate change. In April 2021, Cheniere Energy Partners LP CQP delivered a carbon-neutral LNG cargo to Royal Dutch Shell plc (RDS.A) in Europe. Most recently, Shell entered a five-year agreement with PetroChina Company Limited for the supply of carbon-neutral LNG.

The agreement represents an important step for BP as it seeks to remain one of the leading and advanced LNG suppliers in the world. The development of carbon offset LNG is an important move to meet the rising energy demand globally, while reducing the carbon intensity of the energy products consumed.

Company Profile & Price Performance

Headquartered in London, UK, BP is a fully integrated energy company, with a strong focus on renewable energy.

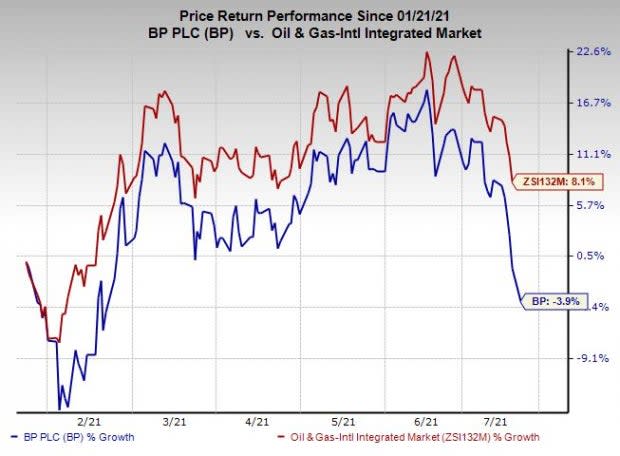

Shares of the company have underperformed the industry in the past six months. Its stock has declined 3.9% against the industry’s 8.1% growth.

Image Source: Zacks Investment Research

Zacks Rank

The company currently carries a Zack Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

Sempra Energy (SRE) : Free Stock Analysis Report

Cheniere Energy Partners, LP (CQP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance