Boston Beer (SAM) Beats on Q2 Earnings & Revenues, Ups View

The Boston Beer Company, Inc. SAM reported impressive second-quarter 2019 results, wherein earnings and revenues outpaced the Zacks Consensus Estimate. This marked the company’s fourth straight earnings beat, with positive sales surprise in three of the last four quarters.

Quarterly results were fueled by higher revenues owing to solid shipment and depletions growth. Notably, robust shipment growth due to the company’s efforts to ensure that distributors’ inventory levels were appropriate to cater to increased customer demand. Further, strong depletions growth was supported by continued strength in Truly Hard Seltzer and Twisted Tea brands.

Driven by these positive trends, management raised its 2019 guidance for earnings, shipments and depletions.

Q2 Highlights

Boston Beer’s second-quarter adjusted earnings of $2.34 per share surpassed the Zacks Consensus Estimate of $1.83. The bottom line also rose 18.2% from $1.98 earned in the year-ago period backed by robust revenue growth. This upside was partly negated by higher advertising, promotional and selling costs and lower gross margin. Including tax benefits, earnings per share were $2.36.

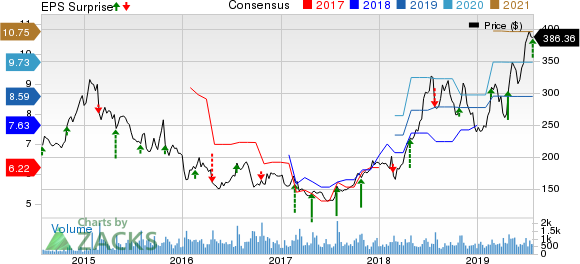

The Boston Beer Company, Inc. Price, Consensus and EPS Surprise

The Boston Beer Company, Inc. price-consensus-eps-surprise-chart | The Boston Beer Company, Inc. Quote

Net revenues advanced 16.6% year over year to $318.4 million and outshined the Zacks Consensus Estimate of $309 million. Including excise taxes, the top line rose 16.9% year over year to $338.6 million.

Robust top-line performance can primarily be attributed to a 17% improvement in shipments to nearly 1.4 million barrels. Increased shipments led to materially higher distributor inventory in the first half of 2019 compared with the year-ago period. In fact, distributor inventory as of June 29, 2019, averaged roughly 3-weeks on hand. Management projects wholesaler inventory levels between 2 and 4 weeks on hand for the balance of 2019. Notably, shipments in the first half of the current year grew at a higher rate than depletions.

In the quarter under review, depletions grew 17%, marking the fifth straight quarter of double-digit growth. Depletions growth can be attributed to major innovations, quality of products and strong brands alongside solid sales execution and support from distributors. Depletions growth was partly offset by fall in the Samuel Adams and Angry Orchard brands.

Depletions, excluding Dogfish Head Brewery depletions, for the year-to-date period through 28 weeks (ended Jul 13, 2019) are anticipated to have grown nearly 17% from the comparable year-ago period.

Costs & Margins

Gross profit improved about 12% year over year to $159 million. However, gross margin contracted 210 basis points to 49.9% due to elevated processing costs due to increased production at third-party breweries, and higher temporary labor at company-owned breweries. These factors were partly negated by higher prices and cost savings at company-owned breweries.

Furthermore, advertising, promotional and selling expenses increased nearly 8.7% to $94.1 million. Higher spending on media and production, marketing, increased salaries and benefits expense, and rise in freight to distributors on escalated volume were the primary reasons behind higher expenses.

General and administrative expenses totaled $26.7 million, up 12.1% from the year-ago quarter. This increase was driven by higher salaries and benefits expense as well as the Dogfish Head transaction-related fees.

Other Developments

On Jul 3, Boston Beer completed the merger with the Dogfish Head Brewery for $173 million in cash and 429,292 shares of restricted Class A Stock, including post-closing cash-related adjustment. Management expects to consolidate the Dogfish Head results into the company's financial results starting Jul 3, 2019.

In the second half of 2019, Dogfish Head is anticipated to contribute about 3-4% in annual shipments and depletions growth as well as about $50-$60 million in net revenues at a gross margin of roughly 50%. Moreover, operating expenses are expected to be $20-$25 million in the second half. These projections include transaction-related costs and other non-recurring expenses of about $8 million, of which $1.5 million were spent in the first half.

Excluding these costs, the Dogfish Head merger is likely to be neutral to slightly accretive to earnings per share in 2019.

Financials

As of Jun 29, 2019, Boston Beer had cash and cash equivalents of $3 million and total stockholders’ equity of $522.8 million. Moreover, it had about $37.5 million outstanding on its line of credit.

During the first six months, and the period between Jun 30, 2019, and Jul 19, 2019, Boston Beer did not repurchase shares . As a result, the company had nearly $90.3 million remaining under the $931-million share buyback authorization.

Outlook

Management updated its guidance for 2019 primarily due to the inclusion of the Dogfish Head business and robust trends witnessed for the Truly brand in the first half, which aided depletions growth. However, the company stated that increased volumes for the brands are resulting in higher costs due to the use of third-party breweries and a higher proportion of various packs in the company's overall mix. These are likely to hurt gross margin in 2019.

Boston Beer now estimates shipments and depletions growth of 17-22%, including Dogfish Head acquisition, up from 10-15% projected earlier. Excluding this, shipments and depletions growth are expected to be 13-18%. National price increases per barrel are still estimated between 1% and 3%.

Moreover, the company anticipates gross margin of 50-51% compared with the previously stated 50-52%. Investment in advertising, promotional and selling expenses is now envisioned to increase $35-$45 million, up from $20-$30 million projected earlier. This increase mainly stems from the addition of Dogfish Head Brewery expenses in the second half of 2019. Further, this excludes any changes in freight costs for the shipment of products to the company's distributors.

For 2019, the adjusted effective tax rate is estimated to be roughly 27%. The company now envisions adjusted earnings per share of $8.30-$9.30, up from $8.00-$9.00 projected earlier.

Furthermore, it expects capital spending of $120-$140 million compared with $100-$120 million anticipated earlier.

Price Performance

In the past three months, this Zacks Rank #3 (Hold) stock has rallied 27% against the industry’s 4.5% decline.

Want Better-Ranked Beverage Stocks? Check These

PepsiCo Inc. PEP, with a long-term earnings growth rate of 7%, currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Castle Brands Inc. ROX delivered an average positive earnings surprise of 66.7% in the trailing four quarters. The stock presently carries a Zacks Rank #2.

Craft Brew Alliance, Inc. BREW pulled off a positive earnings surprise of 20.8% in the last reported quarter. The company carries a Zacks Rank of 2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Craft Brew Alliance, Inc. (BREW) : Free Stock Analysis Report

Castle Brands, Inc. (ROX) : Free Stock Analysis Report

Pepsico, Inc. (PEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance