Will You Boost Your Income With Big Dividend Energy Stocks?

With oil prices trading near their two-year lows, it’s a good idea for adventurous investors to look for oil and gas producers for a trade. Also, you can boost your income while holding these stocks. Let’s see which is a better buy.

First up is Surge Energy (TSX:SGY).

Why Surge Energy has been a dud lately

Surge Energy is an oil-focused producer with about 84% of oil and liquids production and 16% of natural gas production this year. It has a light/medium gravity crude oil asset base, which is preferred over heavy crude oil.

Surge Energy has increased its production by more than 80% since Q2 2016. The reason why its stock has gone down 47% since then is partly due to that on a per-share basis, its production has actually declined by about 5%, which indicates that its acquisitions weren’t accretive (at least in the near term).

At $1.35 per share as of writing, Surge Energy offers a 7.41% yield. Management believes the annual dividend of $0.10 per share is sustainable. In the last four reported quarters, Surge Energy generated operating cash flow of more than $123 million.

After subtracting capital spending, it had more than $14 million of free cash flow. This year, it’s estimated to pay out about $32 million in dividends. I can’t say its dividend is 100% secure. However, management seems committed to the dividend and can sustain the dividend by tweaking its capital spending if needed.

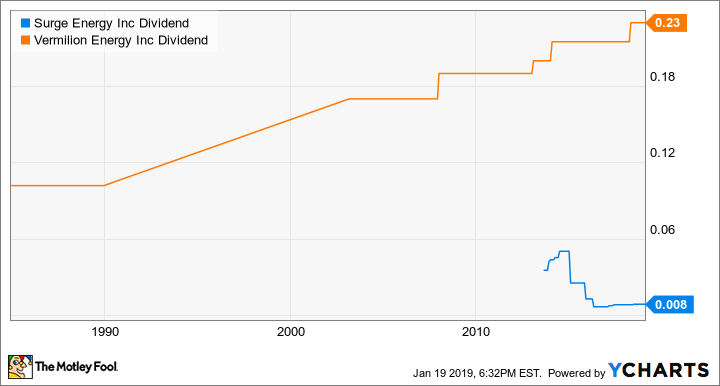

SGY Dividend data by YCharts. The dividend history of Surge Energy and Vermilion Energy.

Vermilion Energy has a better track record

Vermilion Energy (TSX:VET)(NYSE:VET) is an international oil and gas production with about 53% of oil production and 47% of natural gas and natural gas liquids. For its production outside North America, it enjoys premium pricing for Brent oil and European gas, which are about 37% of its production this year.

Management’s top priority is Vermilion Energy’s balance sheet, but it’s also cognizant of the company’s production per share growth. Since 2013, there has been growth every year at a rate of about 16% per year on average, thanks partly to a big boost from last year’s Spartan Energy acquisition, which was accretive.

At $32.67 per share as of writing, Vermilion Energy offers an 8.45% yield. In the last four reported quarters, Vermilion Energy generated operating cash flow of more than $787 million.

After subtracting capital spending, it had more than $101 million of free cash flow. This year, it’s estimated to pay out about $419.5 million in dividends. Management seems committed to the dividend, as it has maintained or increased the dividend since 2003.

Investor takeaway

After reviewing the two companies, I prefer Vermilion Energy over Surge Energy because of its better track record in production per-share growth and dividend sustainability.

In terms of price appreciation, Thomson Reuters analysts currently have a mean 12-month target of $45.30 per share for Vermilion Energy and $2.34 for Surge Energy, representing near-term upside of 38% and 73%, respectively.

More reading

Tax-Free Fortune: 2 Stocks to Pay You $5,000 a Year With a $50,000 TFSA

Will Aurora Cannabis Inc. (TSX:ACB) Stock Hit Double Digits This Winter?

Fool contributor Kay Ng owns shares of VERMILION ENERGY INC.

Yahoo Finance

Yahoo Finance