Bonterra Intersects 6.4 g/t Au over 1.5 m, Including 18.9 g/t Au over 0.5 m at Moss

Val-d'Or, Quebec--(Newsfile Corp. - January 5, 2022) - Bonterra Resources Inc. (TSXV: BTR) (OTCQX: BONXF) (FSE: 9BR2) ("Bonterra" or the "Company") is pleased to provide new exploration results from the regional drilling campaign on the Moss property. The recent drilling results at Moss confirm the existence of high-grade gold mineralized veining in hole UB-21-15, which returned 6.4 g/t Au over 1.5 metres ("m"), including 18.9 g/t Au over 0.5 m.

Highlights:

6.4 g/t Au over 1.5 m, including 18.9 g/t Au over 0.9 m in hole UB-21-15

6.5 g/t Au over 1.5 m in hole UB-21-16

Pascal Hamelin, CEO commented: "These new high-grade exploration drilling results at Moss are very encouraging. Moss is an important regional target that was first drill tested by the Company in 2016. The discovery hole BE-16-09 returned 9.2 g/t Au over 2.2 m and 70.9 g/t Au over 2.6 m (see press release by a predecessor Company {Metanor Resources Inc.} dated October 31, 2016). Importantly, Moss is open along strike and at depth and situated between the Company's Barry deposit and the neighboring Windfall deposit. We currently plan to continue drill testing the Moss target area in the coming year."

The recent exploration drilling targeted the expansion of existing gold mineralization interpreted to trend northeast from some key historic high grade intersections in the Moss Center and Moss East areas. Moss historic values include 15.2 g/t Au over 1.3 m, 70.9 g/t Au over 2.6 m, and 102.2 g/t Au over 0.2 m (see SIGEOM document GM 70866 - MNRQ). Mineralization at Moss consists of a system sub-parallel mineralized veins trending northeast identified along a span of approximately three kilometres ("km") and remains open along strike and at depth.

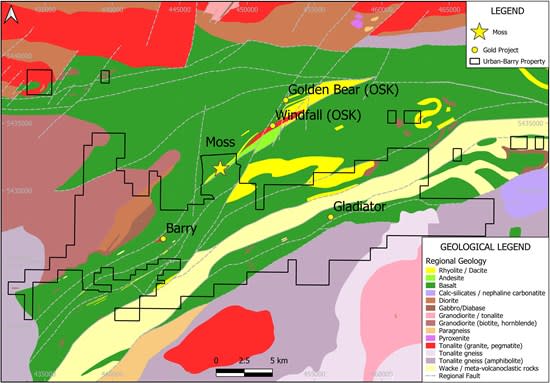

Bonterra has drilled sixteen holes representing a total of 6,990 m at the Moss since September 2021. Partial results from twelve drill holes have been received thus far. Results from the remaining four holes are pending (See Figures 1, 2, 3, 4, 5 & 6 and Table 1).

Figure 1 - Urban-Barry Regional Geology

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1528/109124_cbc8d2c5145d9a72_001full.jpg

Figure 2 - Moss Drill Hole Location Map

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1528/109124_cbc8d2c5145d9a72_002full.jpg

Moss is centered on the northeast trending Mazeres fault along which several gold deposits and gold showings are spatially associated including the Barry and Windfall deposits. The Moss property is dominated by massive to pillowed basaltic to andesitic rocks with minor felsic volcanic rocks and tuffaceous horizons across the central and southeastern property area with local gabbroic to dioritic and felsic intrusions. Mineralization at Moss consists of a system of sub-parallel, shear hosted quartz-carbonate-chlorite veining and stockworks with minor sulfides which include pyrite, pyrrhotite, sphalerite and gold trending northeast and identified along a span of approximately three kms.

The Moss mineralized trend is subdivided into three areas: Moss West, Moss Center and Moss East. (See Figure 2)

Figure 3 - Moss East Cross-Section UB-21-15

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1528/109124_cbc8d2c5145d9a72_003full.jpg

Figure 4 - Moss East Cross-Section UB-21-17

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1528/109124_cbc8d2c5145d9a72_004full.jpg

Figure 5 - Moss Cross-Section UB-21-16

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1528/109124_cbc8d2c5145d9a72_005full.jpg

Figure 6 - Moss Cross-Section UB-21-10

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/1528/109124_cbc8d2c5145d9a72_006full.jpg

Table 1: Significant mineralized intersections from drilling on the Moss Property

Hole ID | From (m) | To (m) | Length (m) | Grade (g/t Au) | Target | |

UB-20-09 | Anomalous values | |||||

UB-21-10 | 217.5 | 218.6 | 1.1 | 0.7 | Moss center | |

325.9 | 326.5 | 0.6 | 1.3 | Moss center | ||

464.0 | 465.0 | 1.0 | 2.8 | Moss center | ||

UB-21-11 | 496.3 | 497.5 | 1.2 | 1.0 | Moss center | |

UB-21-12 | Anomalous values | |||||

UB-21-13 | Anomalous values | |||||

UB-21-14 | 285.0 | 285.7 | 0.7 | 0.5 | Moss center | |

UB-21-15 | 482.0 | 484.0 | 2.0 | 0.6 | Moss center | |

487.5 | 488.8 | 1.3 | 0.6 | Moss center | ||

492.5 | 494.0 | 1.5 | 6.4 | Moss center | ||

including | 492.5 | 493.0 | 0.5 | 18.9 | Moss center | |

505.1 | 505.6 | 0.5 | 0.7 | Moss center | ||

510.0 | 510.5 | 0.5 | 0.7 | Moss center | ||

UB-21-16 | 196.5 | 198.0 | 1.5 | 6.5 | Moss center | |

486.5 | 487.5 | 1.0 | 1.8 | Moss center | ||

491.7 | 492.2 | 0.5 | 0.8 | Moss center | ||

544.6 | 545.6 | 1.0 | 0.7 | Moss center | ||

551.0 | 551.5 | 0.5 | 0.8 | Moss center | ||

565.3 | 565.8 | 0.5 | 0.8 | Moss center | ||

587.5 | 591.5 | 4.0 | 0.5 | Moss center | ||

598.0 | 598.5 | 0.5 | 0.5 | Moss center | ||

619.5 | 620.0 | 0.5 | 0.6 | Moss center | ||

UB-21-17 | 19.6 | 20.6 | 1.0 | 0.6 | Moss east | |

99.0 | 101.1 | 2.1 | 1.2 | Moss east | ||

including | 99.0 | 99.5 | 0.5 | 4.0 | Moss east | |

158.0 | 159 | 1.0 | 0.5 | Moss east | ||

204.3 | 205.0 | 0.7 | 2.0 | Moss east | ||

249.5 | 250.0 | 0.5 | 0.5 | Moss east | ||

256.0 | 257.0 | 1.0 | 0.7 | Moss east | ||

269.0 | 271.5 | 2.5 | 2.8 | Moss east | ||

including | 270.3 | 271.5 | 1.2 | 5.6 | Moss east | |

UB-21-18 | Anomalous values | |||||

UB-21-19 | Results pending | |||||

UB-21-20 | Results pending | |||||

UB-21-21 | Results pending | |||||

UB-21-22 | Results pending | |||||

UB-21-23 | No significant values | |||||

UB-21-23A | No significant values | |||||

Notes:

1) The meterage represents the length of the drilled lengths.

2) True widths are estimated to be greater than 75% of the drill intersection length.

3) The mineralized intervals shown above use a 0.5 g/t Au cut-off grade.

4) Gold results obtained between 0.1 and 0.5 g/t Au are represented as anomalous values.

5) Gold results obtained below <0.1 g/t Au are represented as no significant values.

Quality Control and Reporting Protocols

The Moss drill core gold analyses are performed at the Company's Bachelor Mine analytical laboratory (the "Laboratory") and at Activation Laboratories Ltd. ("Actlabs"). The Company employs a rigorous QA-QC analysis program that meets industry standards. The analyses are carried out by fire assay (A.A.) with atomic absorption finish. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor the Laboratory's performance. The Company's QA-QC program requires that at least 10% of samples be analyzed by an independent laboratory. These verification samples are sent to ALS Minerals laboratory facility located in Val-d'Or, Quebec. The verifications show a high degree of correlation with the Laboratory's results.

Qualified Person

Boris Artinian, P.Geo., Chief Geologist of the Company oversees all exploration activities on the Moss property. Mr. Artinian is a qualified person as defined by National Instrument 43-101 ("NI-43-101"). Marc Ducharme, P.Geo. and Bonterra's Exploration Manager, has compiled and approved the information contained in this press release. Mr. Ducharme is a Qualified Person as defined by NI 43-101.

About Bonterra Resources Inc.

Bonterra is a Canadian gold exploration company with a large portfolio of advanced exploration assets anchored by a central milling facility in Quebec, Canada. The Company has four main assets, Gladiator, Barry, Moroy, and Bachelor that collectively have a total of 1.24 million ounces in Measured and Indicated categories, and 1.78 million ounces in Inferred category. Importantly, the Company owns the only permitted and operational gold mill in the region that is currently estimated at 75% through the permitting process to expand from 800 to 2,400 tonnes-per-day. Bonterra is focused on graduating from advanced exploration to a development company over the next 18-24 months to deliver shareholder value.

FOR ADDITIONAL INFORMATION

Pascal Hamelin, President & CEO

ir@btrgold.com

2872 Sullivan Road, Suite 2, Val d'Or, Quebec J9P 0B9

819-825-8678 | Website: www.btrgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that implies predictions, expectations, interpretations, opinions, plans, projections, objectives, assumptions, future events or performance (often using words such as "expects" or "does not expect", "is expected", "interpreted", "in management's opinion", "anticipates", or "plans", "budget", "schedule", "forecasts", statements that certain actions, events or results "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved) is not a statement of historical fact and may constitute forward-looking information and is intended to identify forward-looking information. This news release may contain forward-looking information relating to, among other things, the outlook for the Gladiator, Barry, and Moroy projects; updated mineral resources; the deposit remaining open laterally and at depth; and future drilling. These factors include, but are not limited to, risks associated with the ability of exploration activities (including drilling results) to accurately predict mineralization; the Company's ability to obtain required approvals; the results of exploration activities; risks associated with mining operations; global economic conditions; metal prices; dilution; environmental risks; and community and non-governmental actions. Although the forward-looking information contained in this news release is based on assumptions that management believes are reasonable at the time of release, Bonterra cannot assure shareholders and prospective purchasers of the Company's securities that actual results will be consistent with the forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither Bonterra nor any other person assumes responsibility for the accuracy or completeness of forward-looking information. All statements made, other than statements of historical fact, that address the Company's intentions and the events and developments that the Company anticipates, are considered forward-looking statements. Although the Company believes that the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ from those in the forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/109124

Yahoo Finance

Yahoo Finance