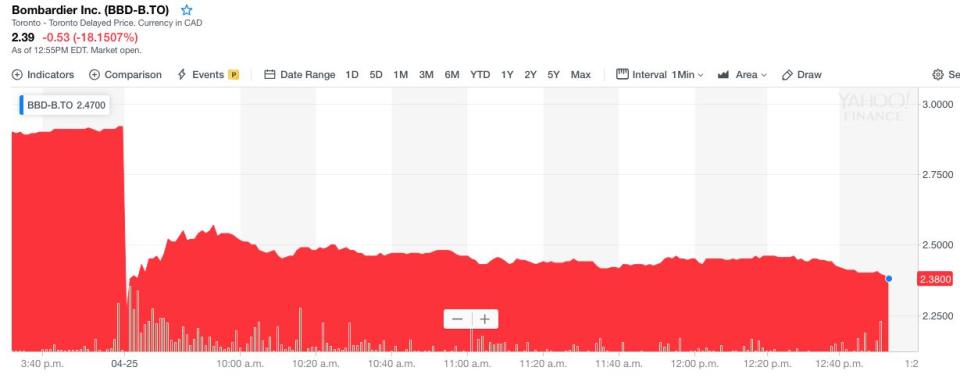

'This amplifies the uncertainty': Bombardier stock sinks after revenue forecast cut

Bombardier Inc.’s stock dropped as much as 25 per cent on Thursday after the company cut its full-year revenue forecast due largely to slower production at its transportation division.

The plane and train maker, which reports its earnings in U.S. dollars, said in a statement that its full-year 2019 revenues are now expected to be $1 billion less than originally forecast at $17 billion. The change in guidance was “mainly due to (a) revised transportation outlook”, the company said in a statement.

“We had a soft first quarter driven by the timing of aircraft deliveries, foreign exchange headwind, and a slower production ramp-up at Transportation,” Bombardier’s chief executive officer Alain Bellemare said in a news release.

Bombardier said that it expects revenues in its transportation division – its most profitable business which produces trains – to be $750 million lower than originally expected at $8.75 billion.

The company said the lower revenues “reflect a slower production ramp-up on certain large projects as the company better synchronizes its production output to customer requirements and delivery schedules.”

Bombardier’s stock was down 18 per cent as of 12:55 p.m. ET.

RBC Capital Markets analyst Walter Spracklin said in a note to clients Thursday that it was surprising that the company would issue a warning about the year so early after providing its 2019 guidance.

“(We) believe this amplifies the uncertainty and predictability around the company’s operations,” Spracklin wrote.

Bombardier is nearing the end of a five-year turnaround plan launched by Bellemare in 2015, shortly after he stepped into the role of chief executive. The strategy includes several ambitious financial targets: free cash flow of $750 million and overall revenues of $20 billion by 2020. The target for revenues in the transportation division is $10 billion by 2020.

But that strategy has stumbled in the last year.

“The company had worked hard to rebuild credibility since 2014 when the new management team embarked on its five-year plan – and up until the third quarter last year, was making good traction,” Spracklin noted.

“Now with this warning, we believe (progress) will take another step back.”

The transportation division has been facing challenges with some contracts as of late. Bombardier also announced in February that transportation president Laurent Troger – who had been with the company since 2004 – would be stepping down and replaced by Danny Di Parna.

National Bank analyst Cameron Doerksen pointed to several rail projects in Europe that have hit snags as the source of slowing ramp-up in deliveries.

The Crossrail contract in the United Kingdom has been reportedly delayed until 2021 due to signalling issues, which also delayed Bombardier’s train delivery schedule. Swiss Federal Railways also stopped taking deliveries from Bombardier until it fixed issues with 12 of its trains that were already in service, according to Reuters. That contract for 59 trains was initially awarded in 2010, but the first delivery was not made until 2018.

“The challenges Bombardier has faced with these contracts have clearly been greater than expected, but we continue to believe that cash flows will be recovered (the contracts are not cancelled) and margins for (Bombardier Transportation) will improve as these contracts deliver,” Doerksen wrote.

Despite the lowered guidance, Doerksen did not change his “outperform” rating of Bombardier.

“The reduction in full-year guidance and lingering issues on several contracts at Transportation are clearly disappointing, but we continue to believe that these challenges will largely be resolved this year and remain confident in 2020 margin and free cash flow improvement,” he said.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance