Japan’s Megabanks Are Said to Seek Deep Cuts to BOJ Bond Buying

(Bloomberg) -- Japan’s largest banks called on the Bank of Japan to make deep cuts to its monthly bond purchases during hearings of market participants at the central bank, according to people who attended.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

Stocks Hold Near Peak as Powell Sticks to Script: Markets Wrap

Biden’s Biggest Donors Left Powerless to Sway Him to End Bid

One megabank said the BOJ should move early to make sharp cuts to its bond buying, while another major bank recommended an eventual reduction to monthly purchases of ¥1 trillion ($6.2 billion), the people said. A third megabank said the buying should be halved from the current monthly level to ¥3 trillion yen, the people added.

The views of regional banks on the scale of bond reductions were more cautious, the people said. Some brokerages called on the BOJ to trim its purchases to ¥3 trillion from August, while some other brokerages recommended that mark be reached after a year, the people added.

The central bank itself didn’t show a specific plan for reducing its bond purchases, they said.

Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. declined to comment on the news.

The comments come as the BOJ looks to finalize its plans for reducing its purchases of Japanese government debt as it normalizes policy after more than a decade of massive stimulus.

“The BOJ likely has some plans already,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co. “What it wants to show is a stance of proceeding cautiously by hosting the gatherings.”

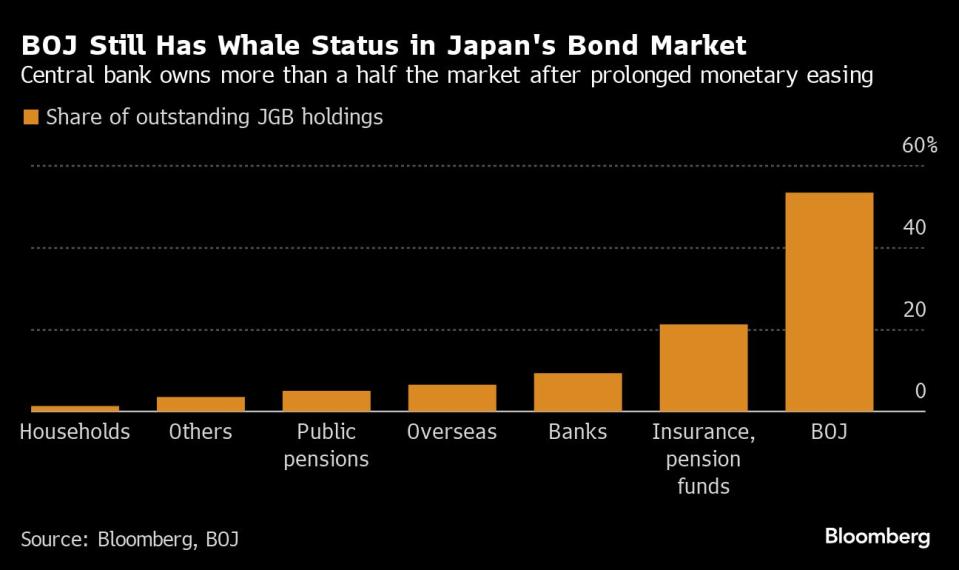

The BOJ has long been characterized as the whale in the pond of JGBs as it pushed other buyers out of the water during an aggressive quantitative easing program it ended in March. During that time the bank scooped up more than half of Japan’s outstanding government bonds, creating the potential for its quantitative tightening moves to have major ripples in the market.

The central bank is holding the meetings to give participants in the market a chance to convey their views as it assesses how quickly it can reduce its huge footprint in the bond market ahead of the unveiling of its plans for the next one to two years on July 31.

The bank’s ¥585 trillion stockpile of bonds is bigger than the size of the world’s fourth-largest economy and a key reason bond players must be on a high alert for the BOJ’s next move.

Representatives from banks, securities firms and those buying bonds for financial institutions already offered a wide range of suggestions for the targeted monthly purchases by the central bank in a survey conducted ahead of the hearings on Tuesday and Wednesday.

Among the answers received, respondees suggested cutting the BOJ’s monthly buying of Japanese government bonds to zero, to a range between ¥2 trillion and ¥3 trillion, and to ¥4 trillion, reference materials released by the central bank showed. The figures compare with the current monthly purchase pace of roughly ¥6 trillion.

These views along with the favored form of guidance on purchases and how to proceed for each maturity zone were among the themes discussed during the first hearing on Tuesday, according to a BOJ public relations official.

Governor Kazuo Ueda’s board decided to slow the pace of bond buying at a policy meeting last month. The BOJ chief said he wanted to construct the plan carefully and that it merited hearings with market players before it was finalized conclusion.

“These two days are going to be critical,” said Yuuki Fukumoto, senior financial researcher at NLI Research Institute. “For the BOJ, the key point is to hear and gather information on how much more bond-buying the market can take to assuage its concerns.”

According to a Bloomberg survey late last month, BOJ watchers predict the central bank will start by reducing its monthly purchases to around ¥5 trillion from the current ¥6 trillion. They expect that pace to slow to ¥3 trillion in two years.

Ueda said the size of the reduction would be “sizable” while declining to elaborate further at a post-meeting press conference on June 14. Takahide Kiuchi, a former BOJ board member, said Ueda’s comments implied the reduction would be bigger than the expected first cut.

“Ueda must have been aware that the ¥5 trillion figure has been doing the rounds for a while before he made that remark,” Kiuchi said. “So it could even be as low as ¥3 trillion.”

A larger cut than consensus may help ease pressure on the yen by crystalizing the BOJ’s aggressive stance on QT, according to some analysts. The yen weakened to a 38-year low this month, fueling views that the bank will want to avoid any further dovish signals.

The BOJ’s plans are highly significant for the finance ministry. The retreat of the BOJ as the main buyer in the market has implications for yields that could push up the servicing costs of Japan’s massive national debt. It will also likely require a rethink of its own bond issuance management.

At the same time, a half-hearted reduction could send the yen lower, forcing the ministry to intervene in markets again to prop up the currency.

“These are important talks so I’ll be carefully watching out for what is discussed,” Finance Minister Shunichi Suzuki said Tuesday morning. “I haven’t made any specific requests.”

While some economists surveyed expect the bank’s purchases to eventually fall to zero, Atsushi Miyanoya, a former BOJ executive director, said there is “absolutely no chance” of that happening. The bank already bought close to ¥2 trillion of bonds per month to stabilize the market before it kicked off a massive monetary easing program in 2013.

--With assistance from Erica Yokoyama, Sumio Ito and Takashi Umekawa.

(Adds comments from attendees of meeting)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

How Stocks Became the Game That Record Numbers of Americans Are Playing

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance