BOE Losses on QE Over Three Times Greater Than Fed, Analyst Says

(Bloomberg) -- The Bank of England is losing over three times more on its quantitative-easing program than the US Federal Reserve, according to new research that threatens to reignite the political debate over the cost of more than a decade of BOE stimulus.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Stocks Struggle to Make Headway on Economic Signs: Markets Wrap

Citi Pitches Money-Moving ‘Crown Jewel’ as Central to Revamp

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

These Are the World’s Most Expensive Cities for Expats in 2024

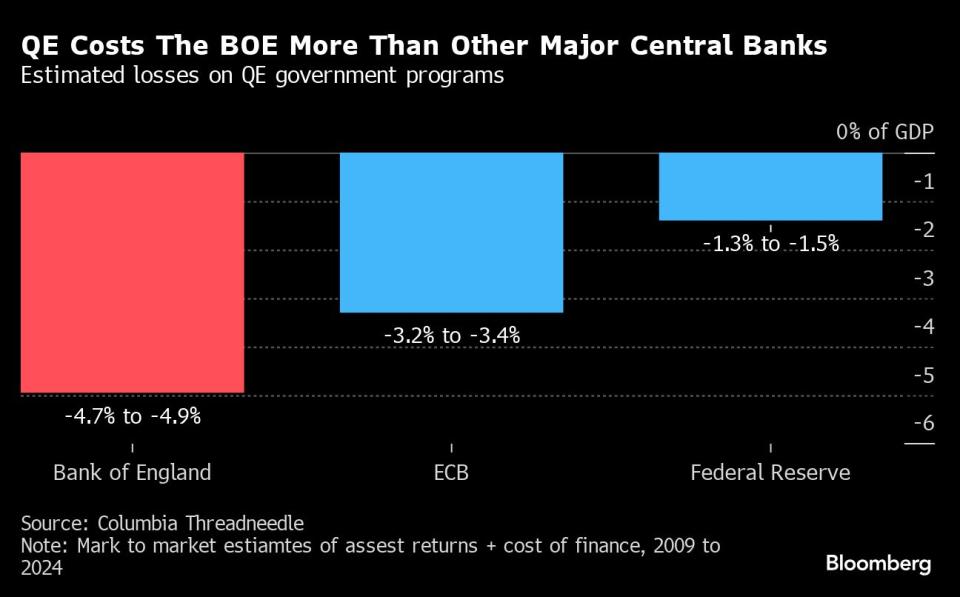

Christopher Mahon, head of dynamic real return at asset manager Columbia Threadneedle, said losses on the portfolio of government bonds the BOE bought between 2009 and 2021 amount to 4.7% to 4.9% of gross domestic product. That compares with 1.3% to 1.5% at the Fed and 3.2% to 3.4% at the European Central Bank.

In Britain, the deficit is equivalent to about £130 billion ($165 billion), all of which must be covered by taxpayers under a guarantee struck in 2009.

The scale of the cost, which starves the government of funds for public services or tax cuts, has dragged the BOE into politics with just weeks to go before the July 4 election. Reform UK, the right-wing challenger to the ruling Conservatives, has pledged to intervene at the BOE to stop the losses and save the state £35 billion a year.

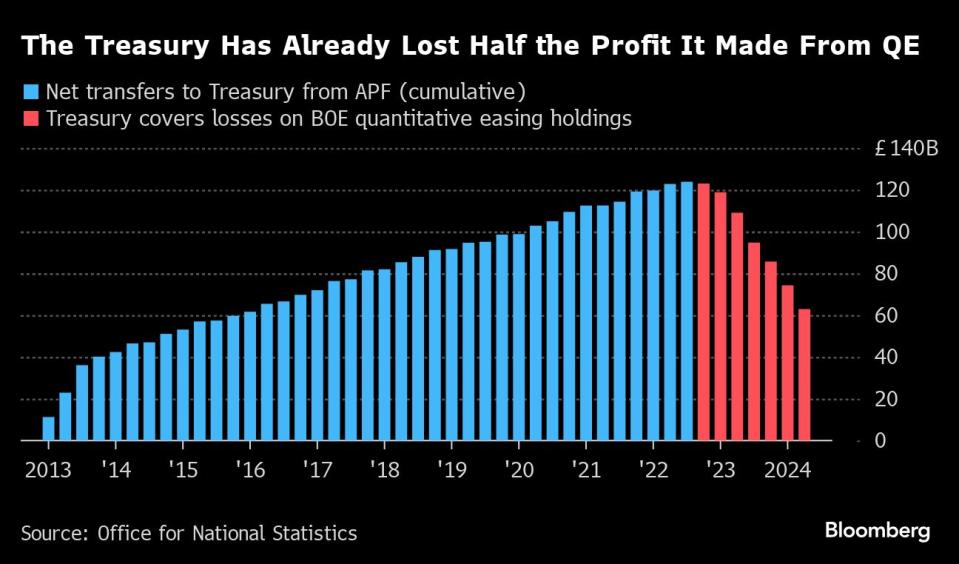

At their peak, bonds held by the BOE totaled £895 billion, the result of efforts to protect the economy from the global financial crisis and pandemic. QE made a profit for the Treasury £124 billion. However, the Treasury spent the money, and now it is losing billions as the BOE seeks to unwind the portfolio.

The losses are being incurred because the interest rate the government pays out on reserves created to buy the bonds — Bank Rate — is higher than the coupon income it earns on the securities held in the BOE’s Asset Purchase Facility. The central bank is also selling debt at lower prices than it paid for it.

Reform’s approach is considered extreme but Mahon said a new government, which is expected to be Labour as the party leads in the polls by over 20 points, “could reenergise the Treasury” and lead to “a different approach” on QE than the current status quo.

“The obvious solution is to adopt central bank norms,” he said. The BOE is the only major central bank actively selling bonds, which crystallises losses up front. The Fed and the ECB are instead allowing bonds to mature. Last month, the Fed slowed the pace of maturities to ensure it does not cause market stress.

Mahon expects the BOE to fall into line with ECB and the Fed by ending active sales in September, when it is due to review the program. He estimates that active sales will cost the government between £5 billion and £7 billion this year alone.

He expects the bank to argue that doing so is consistent with the start of a rate cutting cycle. The BOE is expected to start reducing rates in the autumn. Active sales are a form of policy tightening, the opposite of rate cuts.

Mahon calculated the valuations by using market values for the bonds at May 31 2024 and adjusting for gains made in the early years of QE. He had to use a consistent method because the US, eurozone and the UK have different ways of accounting for the losses caused by QE. Britain’s is the most transparent.

The deficit is bigger in the UK because the BOE bought both longer-dated bonds, which have lost more of their value, and a greater share of government debt at the peak of the program, Mahon said.

Responding to the assessment, the BOE pointed to recent comments by Governor Andrew Bailey that “different unwind strategies might affect the timing of the cashflows, but they will not necessarily change the lifetime amount accumulated in the APF.”

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance