BlueLinx Holdings Inc (BXC) Surpasses EPS Estimates in Q1 2024, Despite Revenue Decline

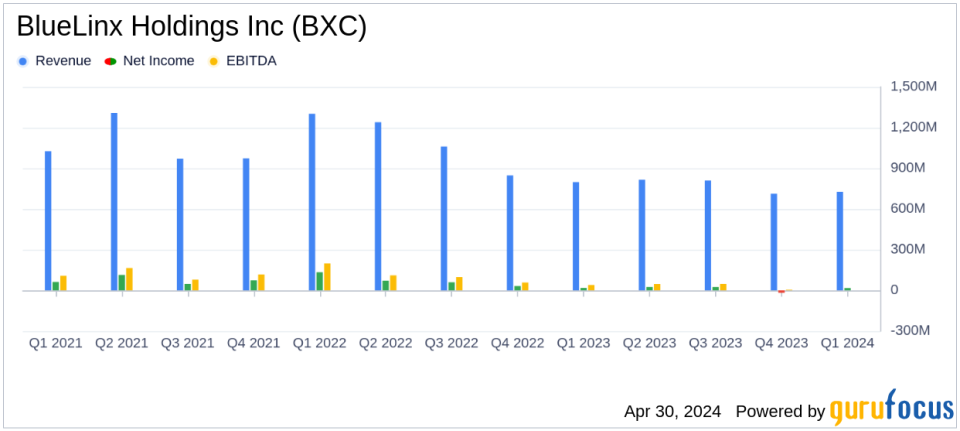

Net Sales: Reported $726 million, a decrease of 9% year-over-year, falling short of estimates of $701.67 million.

Net Income: Achieved $17 million, surpassing the estimated $12.07 million.

Earnings Per Share (EPS): Delivered $2.00 per diluted share, significantly exceeding the estimated $1.35.

Gross Margin: Improved to 17.6% from 16.7% year-over-year.

Adjusted EBITDA: Recorded at $39 million, representing 5.3% of net sales.

Free Cash Flow: Reported a negative $37 million due to seasonal changes in working capital.

Liquidity and Debt: Maintained strong liquidity with $828 million available and a net leverage ratio of (0.8x).

On April 30, 2024, BlueLinx Holdings Inc (NYSE:BXC), a prominent player in the U.S. wholesale distribution of building products, disclosed its financial outcomes for the first quarter ended March 30, 2024, through its 8-K filing. The company reported a net income of $17 million, translating to $2.00 per diluted share, which notably surpassed the analyst's EPS estimate of $1.35. However, the revenue for the quarter stood at $726 million, below the estimated $701.67 million, reflecting a 9.0% decrease from the previous year.

Company Overview

BlueLinx Holdings Inc operates across the United States, specializing in the distribution of a wide range of residential and commercial building products. The company's offerings are categorized into structural products, including lumber and plywood, and specialty products such as engineered wood and siding. This diverse product mix supports a broad customer base from national home centers to local dealers.

Financial Highlights and Challenges

The first quarter saw BlueLinx achieving a gross profit of $128 million with a gross margin of 17.6%, an improvement from the previous year. The specialty products segment, despite a revenue decline due to deflationary pressures, experienced an increase in gross margin to 20.7%. Structural products witnessed a slight decrease in both sales and gross profit, attributed mainly to lower framing lumber volumes. The adjusted EBITDA was reported at $39 million, or 5.3% of net sales.

Management highlighted the adverse impact of deflationary pressures and unfavorable weather conditions on the company's specialty business segment. However, the recovery in volumes and sustained strong margins in both product categories were seen as positive indicators. The company's strategic focus remains on navigating market uncertainties and leveraging its robust liquidity position to drive growth and shareholder value.

Operational and Financial Position

BlueLinx's operational strategy includes capital investments aimed at enhancing distribution capabilities and fleet upgrades, with $5 million allocated in the first quarter. The company maintains a strong liquidity profile with $828 million available, including significant cash reserves. The net leverage ratio improved to (0.8x), underscoring a strong balance sheet and financial flexibility.

The company's SG&A expenses remained stable at $91 million, aligning with the previous year's figures. However, net cash used in operating activities was reported at $31 million, a shift from the $89 million of net cash provided in the prior year, primarily due to seasonal working capital changes.

Outlook and Strategic Moves

Looking ahead to the second quarter of 2024, BlueLinx anticipates continued variability in gross margins for both specialty and structural products. The company remains committed to its capital allocation strategy, which includes ongoing share repurchases under the existing authorization.

In conclusion, BlueLinx Holdings Inc's first-quarter results reflect a resilient operational performance amidst challenging market conditions. The company's strategic initiatives and strong financial positioning are expected to support its long-term growth trajectory, despite the near-term pressures on revenue and margins.

Investor and Analyst Perspectives

During the upcoming conference call scheduled for May 1, 2024, management will further discuss quarterly results and provide more insights into the company's strategic plans and market outlook. Investors and analysts are encouraged to participate to gain deeper understanding of BlueLinx's operations and financial strategies.

Explore the complete 8-K earnings release (here) from BlueLinx Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance