bluebird (BLUE) Up as FDA Nod Likely for Thalassemia Therapy

bluebird bio BLUE announced that the FDA hasissued briefing documents on BLUE’s lentiviral gene-therapies for the upcoming Cellular, Tissue and Gene Therapies Advisory Committee (Committee) meeting on Jun 9-10.

The FDA Committee is set to give a recommendation on BLUE’s regulatory filings. BLUE had filed two separate regulatory applications, seeking approval for its lentiviral gene-therapies betibeglogene autotemcel (beti-cel) and elivaldogene autotemcel (eli-cel) for the treatment of β-thalassemia and cerebral adrenoleukodystrophy (CALD), respectively.

The FDA briefing document on beti-cel acknowledges that the treatment using the gene-therapy showed clinically meaningful benefit for patients with β-thalassemia who require regular red blood cell (RBC) transfusions. Based on late-stage clinical studies conducted by bluebird bio on beti-cel, 89% of evaluable patients achieved transfusion independence, which is defined as no longer needing RBC transfusions for at least 12 months while maintaining an average hemoglobin (hb) of at least 9g/dL.

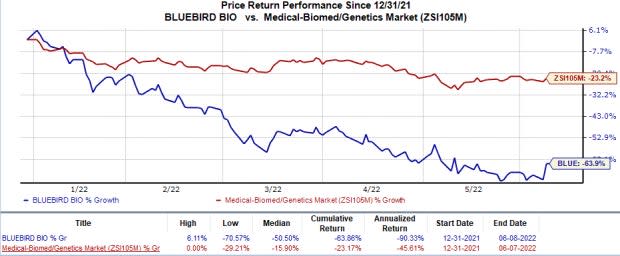

Shares of bluebird bio were up 21% on Jun 7 as based on the above observation, investors expect a positive recommendation from the FDA Committee on beti-cel. However, the stock has plunged 63.9% in the year so far compared with the industry’s 23.2% decline.

Image Source: Zacks Investment Research

Another briefing document issued by the FDA Committee on eli-cel reports the development of myelodysplastic syndrome (MDS), a life-threatening malignancy, which was found in three study participants. Based on this development, the FDA document warns that an administration of eli-cel may have a causal relationship with MDS. However, the FDA document does not confirm the existence of this relationship.

We note that the FDA already placed a full clinical hold on the clinical studies evaluating eli-cel after the discovery of MDS in participants. Management is in active discussion with the FDA authorities to respond to the regulatory body’s queries on the removal of the hold.

Both the BLAs filed by bluebird bio were accepted for a priority review by the FDA. While the regulatory agency set a target action date of Aug 19, 2022, for beti-cel, a decision on the regulatory filing for eli-cel is expected by Sep 16, 2022.

Currently, BLUE has no approved/marketed drug in its portfolio. A tentative approval to either beti-cel or eli-cel will provide bluebird bio with its first FDA-approved drug.

bluebird bio is currently facing the risk of a severe cash crunch. In February 2022, alongside the fourth-quarter 2021 result announcement, management expressed concerns over BLUE’s capacity to continue as a going concern due to the pressure on its existing cash balance, which is expected to dry up in the near future.

An approval to either or both beti-cel and eli-cel will also make bluebird bio eligible for priority review vouchers (PRVs) from the FDA. BLUE anticipates selling these vouchers to boost its cash resources.

To control its cash burn, BLUE announced that management implemented a comprehensive restructuring in April 2022 to save up to $160 million, thus allowing it to extend its cash runway to first-half 2023. To achieve this target, BLUE intends to trim its workforce nearly 30%, which in turn, is expected to save 35-40% of the estimated operating costs. This reduction should be reflected in bluebird bio’s operating budget for 2023.

These restructuring initiatives are intended to advance the near-term opportunities, including the pending FDA decision on eli-cel and beti-cel as well as a potential submission in first-quarter 2023 for the third gene-therapy candidate lovotibeglogene autotemcel (lovo-cel) to treat sickle cell disease (SCD).

bluebird bio, Inc. Price

bluebird bio, Inc. price | bluebird bio, Inc. Quote

Zacks Rank & Key Picks

bluebird bio carries a Zacks Rank #3 (Hold) at present. Some better-ranked stocks in the overall healthcare sector are Abeona Therapeutics ABEO, Alkermes ALKS and Sesen Bio SESN. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, both Abeona Therapeutics and Sesen Bio carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 60 days. Shares of ALKS have risen 24.5% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, ALKS delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 31 cents in the past 30 days. The same for 2023 has narrowed from 15 cents to 13 cents in the same time frame. Shares of ABEO have plunged 53.5% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, ABEO missed on earnings by 25%.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 60 days. Shares of SESN have declined 16.5% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

Abeona Therapeutics Inc. (ABEO) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance