"Blockbuster Status": 3 Bios to Buy and Hold

Profitability in the Biotech Industry is Hard to Come By

The biotech sector is notorious for its sky-high research and development (R&D) costs, regulatory hurdles, and lengthy timelines to bring a drug or therapy to market. Many drugs fail clinical trials while biotech companies set others aside to focus on more encouraging opportunities. According to one study, for every 100 drugs that enter phase 1 trials, only 12 ultimately achieve phase lll (the final trial) approval. While the profitability of public biotech companies can vary significantly, most are unprofitable.

Unpredictability is a Challenge for Investors

For unsophisticated investors, investing in biotech stocks with little knowledge can be a quick way to lose money because:

· Binary Events: Bios often move 50% or more after an FDA decision. If an investor finds themselves on the wrong side of a decision, a massive gap down can devastate a portfolio.

· Volatility: Even when no FDA decisionlooms,biotech stocks can be volatile, illiquid, and challenging to trade.

· Lack of Profitability: Ultimately, stocks mirror their long-term fundamentals. Because most biotech stocks are unprofitable, they often underperform.

The Solution: Seek Biotech Firms Achieving “Blockbuster Status”

While many challenges exist for investors looking to profit off biotech stocks, they can be overcome. However, to do so, investors must identify biotech stocks that are profitable, liquid, and have achieved “blockbuster status.” Blockbuster status refers to the successful development and commercialization of a pharmaceutical product that generates annual sales exceeding $1 billion.

New blockbuster drugs offer investors something difficult to find in most biotech stocks: a long run way of profitability. Below are 3 examples:

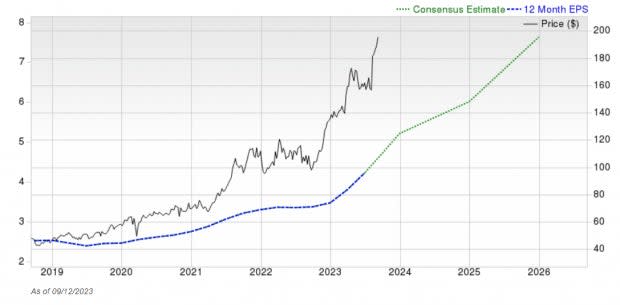

Novo Nordisk’s (NVO) Ozempic is a medication used to treat type 2 diabetes when diet and exercise alone are insufficient. In other words, it’s the first mainstream, effective fat-loss pill. Just how popular is Ozempic? Novo Nordisk’s market cap has soared than $400 billion, which is greater than the annual GDP of its home country, Denmark! Meanwhile, EPS is set to grow from $4 to ~$8 by 2026 – massive for a company of this size.

Image Source: Zacks Investment Research

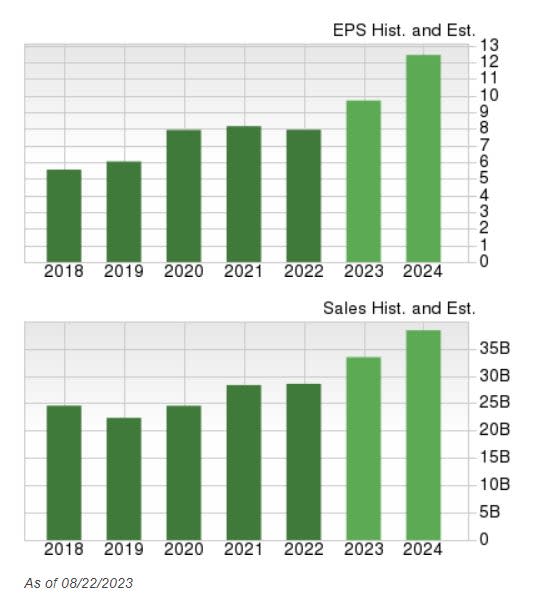

Eli Lilly (LLY), one of the world’s largest pharmaceutical companies, is launching two massive multi-billion-dollar drugs in 2023 – Donanemab (for Alzheimer’s disease) and Lebrikizumab (for eczema). Like NVO, Zacks Consensus Estimates suggest steady and consistent top and bottom-line growth in the coming quarters.

Image Source: Zacks Investment Research

AbbVie (ABBV) is launching Epcoritamab (for large B-cell lymphoma). ABBV has been a consistent winner since its inception.

Image Source: TradingView

Bottom Line

Regarding biotech investing, seek quality companies with deep liquidity, strong profitability, and long “runways.” Stocks like NVO, LLY, and ABBV allow investors to do just that.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance