At Blackstone’s $339 Billion Property Arm, the Honeymoon Is Over

(Bloomberg) -- Nadeem Meghji was on honeymoon in late 2022 when the biggest storm to have rocked Blackstone Inc.’s property business hit its peak.

Most Read from Bloomberg

Russia Is Storing Up a Crime Wave When Its War on Ukraine Ends

CDK Hackers Want Millions in Ransom to End Car Dealership Outage

Dubai Real Estate’s Resilience May Signal End of Boom-Bust Cycle

Wall Street’s Smart-Trade Brigade Thrashed Again on Stock Boom

Global Investors Turn Cautious on Once Favorite Japanese Stocks

The private equity behemoth had just capped withdrawals from the Blackstone Real Estate Income Trust (BREIT), a fund at the vanguard of its money-spinning push to win the hearts of retail investors. As head of the firm’s US property division, Meghji was at the eye of the tempest — newlywed or not.

From a lakeside resort on New Zealand’s South Island surrounded by snow-capped mountains he toiled through the night, helping broker a deal with the University of California to inject $4 billion into the fund as a show of confidence. Next morning he chatted with Blackstone President Jon Gray, another real-estate luminary who happened to be holidaying nearby.

“I promised my wife that this would be the exception rather than the rule in our marriage,” Meghji recalls in an interview with Bloomberg.

Whether he keeps that pledge isn’t entirely in his hands. Meghji has since then been put in charge of the firm’s entire $339 billion global property arm, the world’s biggest real-estate investor, alongside ex-Goldman Sachs Group Inc. staffer Kathleen McCarthy. With his industry reeling from higher-for-longer interest rates, the promotion couldn’t have come at a harder time.

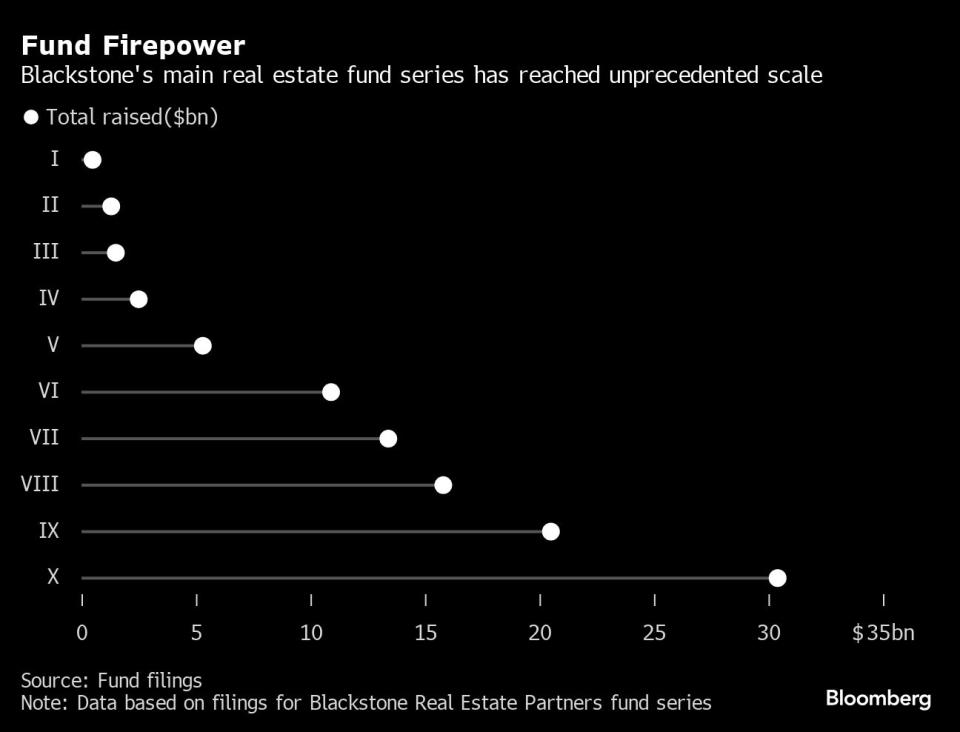

BREIT’s situation has dominated headlines lately, including its sweetening of a student-dorm sale by offering financing support to the buyer. But the huge opportunistic real-estate funds with which Blackstone made its name, and which remain at the core of its business, are also facing their own epochal challenge. Awash with cheap money, these funds — and those of fellow private equity titans — conquered global property markets in past decades. Central bankers have demolished that era’s certainties.

As McCarthy and Meghji begin to deploy $65 billion of dry powder on deals, an unmatched sum for this industry, they’re doing so in an environment where Blackstone’s No.1 advantage — its sheer size — no longer guarantees success.

Blackstone made its first real-estate fortune by buying up distressed buildings and fixing them. Later it started using its ever-more massive cash piles, and close Wall Street ties, to make punts on enormous property portfolios safe in the knowledge that near-zero rates lifted all boats, even if some assets weren’t as seaworthy as others. The waters are far more treacherous now.

If the winners of the last era were firms with capital-markets savvy and heft, then the victors today might be those with old-school property skills, ones who know how to spot a prize location and how to squeeze rents from it.

“This isn’t a time to be a macro player, it’s a time to really understand the real estate,” says Dean Shapiro, global head of development at Oxford Properties, an arm of Canada’s OMERS pension fund, speaking generally about private equity’s tactics. “You have to understand the local market.”

For their part, Blackstone’s leadership duo are optimistic after doing a blizzard of deals lately, though they acknowledge the need to tread carefully as rates stay high and political turmoil runs rampant. Looking at the real-estate crisis, Meghji says it’s a moment to “focus on fundamentals and look past the near-term noise and sentiment, which is in our view overly negative.”

“We see the bad news as already being priced in,” McCarthy adds. “We see us moving past the peak of inflation; and the capital markets are recovering.”

The darkest clouds are over US offices, prompting Blackstone to constantly talk up its lack of exposure to that market. But it made its name grabbing bargains in periods of maximum fear, and it’s toning down the anti-office rhetoric.

“We’ll be very selective,” McCarthy says. “Buying cheap isn’t a strategy.”

With two property mainstays, offices and shops, largely off the menu even as its coffers swell, Blackstone has switched attention to much less mature niches such as logistics, student housing and life-sciences sites. It says a collapse in construction work in these areas will restrict future supply, pushing up values of the assets it has been buying. Yet its recent march into the virgin territory of data centers means doing riskier building and development work itself.

Property investors will have to be “more selective and that will make it more difficult for private equity firms because they always want to deploy huge amounts of capital,” says Henning Koch, chief executive officer of Commerz Real AG. With real estate at a historic inflection point — imposed by higher rates and technological disruption — Blackstone’s ability to be both biggest beast and choosy deal picker is about to be tested to the extreme.

“Where you invest matters,” says Ken Caplan, the previous Blackstone property boss who’s been promoted to co-chief investment officer, in an interview at the firm’s London office. It’s crucial to be “in the sectors and geographies with stronger underlying fundamentals and macro trends.”

Big Was Beautiful

Blackstone’s property roots go back to a few New York financiers who snapped up troubled assets and made a turn, but its real-estate arm’s modern guise is a global giant that employs thousands of asset managers and dozens of data scientists. While it scored some impressive wins from its big is beautiful strategy in recent years, repeating those feats won’t be easy.

In the decade after the financial crisis, it became known for quickly assembling large “platforms” — essentially a property company owned by its funds — such as Logicor, a warehouse landlord it sold to China’s wealth fund for €12.25 billion ($13.1 billion). In 2022 it pulled off a €21 billion recapitalization of Mileway, another warehouse group, bringing in new money from sovereign funds in Abu Dhabi and Singapore plus a sizeable slug from BREIT.

These funds, chasing any kind of yield in a negative-rate world, were happy to pay chunky premiums to buy into such platforms. It was a way to deploy hefty pots of capital into a granular asset class. At Mileway, Blackstone assembled 1,700 properties through 220 transactions, all done by a small London team.

The conviction that tight supply and demand for warehouses close to population centers would turbocharge rents proved correct. “It’s much easier to invest with the wind at your back,” says Meghji.

But it wasn’t just rising rents that enabled the firm’s monster returns.

For four decades starting in 1981, the cost of government borrowing was driven relentlessly lower, providing rocket fuel to a real-estate boom. Commercial property values are derived both from how much rent a building brings in and the multiple of that rent an investor is willing to pay, a metric known as the yield. When sovereign-bond yields fell, property yields did the same as investors swallowed skinnier returns more broadly.

The upshot: Real-estate values soared. Even if landlords did nothing to improve buildings or increase rent, their valuations rose. This was manna from heaven for debt-fueled buyers with capital-markets knowhow and deep pockets.

Blackstone was no slouch. An investor letter seen by Bloomberg shows a European urban-logistics portfolio in which one of its funds invested €325 million was sold for €1.6 billion, and a UK portfolio on which it spent €108 million exited at a €631 million value. Those standouts more than made up for laggards such as a deal to buy homes from Spanish bank BBVA.

Key to the success of Mileway and others was that private equity firms were winning all ways as rents rose and yields plunged. “Opportunistic investors could buy portfolios that had some good assets and some bad and just hope for yield compression,” says Koch, speaking generally about PE funds.

With real-estate yields following interest rates and government bond yields much higher lately, that side of the trade has run out of road. Finding a source of expandable, bulletproof rents — the holy grail of this industry — is the optimal route to profit right now.

“Anybody can go buy anything and benefit from broad market-yield compression and be made to look like a bit of a hero,” says Toby Courtauld, CEO of London office landlord Great Portland Estates Plc. “If you want to generate rent growth, you actually have to know what you’re doing.”

This will mean picking or developing the best buildings, choosing the right location and creating places where people want to be. It’s the dirty work of managing real estate and it needs boots on the ground.

“Being able to really operate well is going to be critical,” Caplan concurs.

The rent grab is evident in Blackstone’s flurry of dealmaking this year, including a $10 billion purchase of Apartment Income REIT and the acquisition of Tricon Residential Inc., an owner of single-family rentals. Shorter lease durations in these markets and plunging construction should let it jack up rents.

Future Shock

In autumn 2016, futurologist Ray Kurzweil warned a ballroom of real-estate executives gathered at the Westin Paris Vendome hotel that technological change was advancing exponentially. The implications on how and where humans lived, worked and shopped would be profound and those changes were going to start impacting the built environment more and more quickly, he said.

Many present poured scorn on the idea, arguing that there would always be strong demand for space in top malls, for example. The wisdom of that rejection is reflected in the share price of Europe’s then biggest landlord, Unibail-Rodamco-Westfield. It was €240 a share at the time. Now it’s about €74.

“Two core sectors of global institutional real estate have been turned upside down by technological change,” says Tim Leckie, a managing director at Panmure Gordon in London, referring to cratering demand for brick-and-mortar shops and office space.

Blackstone was nimbler than many in adjusting, pushing hard into healthcare, movie studios, logistics and other fresher fields. “When I started at Blackstone in 1997 we were predominantly investing in office buildings and hotels,” Caplan says. “Buy, fix, sell. When we went public back in 2007, we were about 60% traditional US office. Today that’s less than 2% of our global portfolio.”

And yet the rise of e-commerce and WFH has left scars among the people who bought the offices and shops from private equity firms, and that could make things awkward as the latter search for future exits. Acquirers will be much warier of any other novel technology’s threat to large property bets. Might materials innovations suddenly change data centers, driverless cars shift ideal locations for logistics hubs or 3-D printing upend where manufacturing is done?

“Secular trends driven by technology are propelling individual asset classes in a way we haven’t seen before,” says Meghji.

Platform sales are already trickier because of a lack of ready buyers. In early 2020, before Covid upended property markets, Blackstone bought student-housing business IQ in the UK’s biggest real-estate deal. As it starts to ponder an exit, bankers say an initial public offering is likelier than a sale.

“Our preference is for all-cash exits,” McCarthy says. “But if the public markets are valuing something more attractively, we’ll pursue that.”

Investors have been reminded too of property’s illiquid nature, a fear magnified by rapid technology changes. At BREIT, redemption requests have consistently exceeded what it’s taking in each quarter since the end of 2022.

Suburban Drama

Even though investors made a killing on real estate when money was pretty much free, the underlying perils were brutally laid bare by that era’s abrupt end. And Blackstone wasn’t immune. Some deals were exposed where it had failed to increase occupancy or drive rents higher.

In spring 2023, a default was declared on a loan secured against a portfolio of Finnish properties owned by Blackstone. The sites were a sub-portfolio of Sponda Oy, a company the firm bought in 2018. Much of it was small, dated office buildings in suburban locations, Sponda’s lowest-quality assets.

Blackstone had wanted to gradually sell the offices and repay the €531 million used to finance them, but Finland’s strict Covid rules and Russia’s Ukraine war made the timing bad. When it defaulted, about 45% of the portfolio was vacant.

After Blackstone presented its proposal for a debt extension, some bondholders doubted whether it could do the hard yards needed to dispose of remaining properties at a lofty enough price, people with knowledge of the matter say. Eventually it persuaded creditors of a plan to make the properties sellable. It was given an extension until 2027, and a higher interest bill.

While harsher monetary conditions create problems for Blackstone and peers, it isn’t holding off on spending. It’s doubling down on warehouses and rental housing. Its boldest move is data centers, a hot market amid the AI hype, and for that it’s shouldering a different type of risk: construction.

Blackstone has refitted buildings or done limited works to add value to properties before, but this is a rare foray into the hazardous task of vast ground-up construction. It has to do this because the server farms of the future aren’t built yet, hence its purchase of data-center landlord and developer QTS.

It also shows the pressure on private equity to chase higher returns from untested strategies when investors can get decent yields on US Treasuries. Blackstone is buying a site for £20 million ($25.5 million) in Northumberland, in northern England, to build a data center. It could ultimately entail investment of up to £10 billion. Never before has it risked that kind of capital spending.

McCarthy says these risks are manageable because “you really don’t invest meaningful capital until you have a lease. They’re long-term in nature, with superhigh-quality, high-credit tenants.”

Still, snagging prime tenants isn’t always a guarantee. Blackstone was trying to sell Cargo, a gleaming office block in London’s Canary Wharf that’s fully leased at stellar rents to topnotch clients. It’s halted the effort because sentiment about the neighborhood’s future is so poor — a stark illustration of why it zeroes in on sectors like data centers where demand is raging.

The deeper question for Blackstone on offices is whether it wants to seize the greatest opportunity on distressed prices since Lehman Brothers’ collapse. But its executives have been so damning of the sector lately, unlike fierce rival Brookfield Corp., that changing course would be jarring. Meantime, it has been dipping a toe back into shops via luxury sites in Paris and London.

And as it hunts for ways to put $65 billion to profitable use in a beleaguered market, it is holding onto the belief that pure firepower still gives it an edge. “We’ve been investing in real estate for 33 years,” McCarthy says. “We have huge advantages thanks to our scale, and unparalleled access to data.”

--With assistance from Lucca De Paoli.

(Updates with Real Estate Returns chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance