Blackstone (BX) Q1 Earnings Meet Estimates, AUM Increases Y/Y

Blackstone’s BX first-quarter 2024 distributable earnings of 98 cents per share were in line with the Zacks Consensus Estimate. The figure reflects a rise of 1% from the prior-year quarter.

Results have benefited from a rise in segment revenues and improvement in the assets under management (AUM) balance. However, higher GAAP expenses have hurt the results to some extent.

Net income attributable to Blackstone was $847.4 million compared with $85.8 million in the year-ago quarter.

Segment Revenues Improve, GAAP Expenses Rise

Total segment revenues were $2.55 billion, up 3% year over year. The top line outpaced the Zacks Consensus Estimate of $2.51 billion.

On a GAAP basis, revenues were $3.69 billion, up significantly year over year.

Total expenses (GAAP basis) were $1.79 billion, up 51% year over year. Our estimate for expenses was $1.69 billion.

As of Mar 31, 2024, Blackstone had $8.4 billion in total cash, cash equivalents and corporate treasury investments, and $17.3 billion in cash and net investments. The company has a $4.3-billion undrawn credit revolver.

AUM Rises

Fee-earning AUM grew 7% year over year to $781.4 billion as of Mar 31, 2024. Our estimate for the metric was $754.1 billion.

The total AUM amounted to $1.06 trillion as of the same date, up 7% year over year. The rise in total AUM was primarily driven by $34 billion in inflows in the reported quarter. Our estimate for the total AUM was $1.02 trillion.

As of Mar 31, 2024, the undrawn capital available for investment was $191.2 billion.

Our Take

Blackstone is well-poised for top-line growth, supported by a continued rise in AUM. The company is expected to keep gaining from its fund-raising ability. However, high expenses and a challenging operating backdrop are expected to hurt the bottom line in the near term.

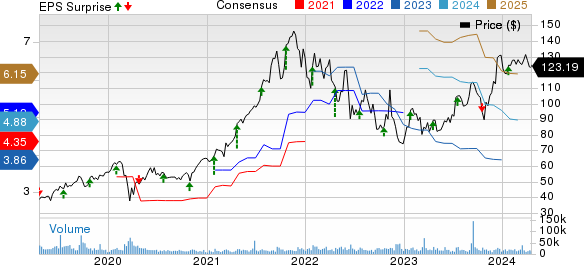

Blackstone Inc. Price, Consensus and EPS Surprise

Blackstone Inc. price-consensus-eps-surprise-chart | Blackstone Inc. Quote

Currently, Blackstone carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Release Date of Other Asset Managers

BlackRock, Inc.’s BLK first-quarter 2024 adjusted earnings of $9.81 per share handily surpassed the Zacks Consensus Estimate of $9.42. The figure reflects a jump of 24% from the year-ago quarter.

BLK’s results benefited from a rise in revenues and higher non-operating income. Further, the AUM balance witnessed an improvement, driven by net inflows. However, higher expenses acted as a dampener.

Invesco IVZ is scheduled to report first-quarter 2024 results on Apr 23.

Over the past seven days, the Zacks Consensus Estimate for IVZ’s quarterly earnings has been unchanged at 40 cents. The estimate indicates a rise of 5.3% from the prior-year quarter’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackstone Inc. (BX) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance