BlackRock (BLK) Partners GeoWealth, Enhances Model Offerings

BlackRock Inc. BLK entered into a strategic partnership with GeoWealth, a financial technology firm, to expand its capabilities to cater to the needs of clients in the $37 trillion U.S. wealth market. This move aligns with the company’s growth strategy to boost its offerings.

As of Dec 31, 2023, the GeoWealth platform had more than $28 billion of assets across nearly 180,000 accounts and roughly 200 registered investment advisors. Last year, it expanded its third-party model marketplace to include more than 700 models through over 70 asset managers. In 2021, GeoWealth started offering BlackRock products, including BLK’s standard models, and introduced Aperio and fixed-income separately managed accounts (SMAs) as separate strategies earlier this year.

BLK aims to offer custom models via GeoWealth’s platform, enabling advisors to address client demand for private markets, direct indexing and fixed-income SMAs alongside traditional ETFs and mutual funds, all within a single account.

Eve Cout, head of Portfolio Design & Solutions of BlackRock’s U.S. Wealth Advisory business, said, “By combining BlackRock’s portfolio design expertise with GeoWealth’s implementation platform, we will make it easier for advisors to build a models-based practice and enable broader access to private markets – one of today’s most sought-after asset classes.”

This strategic alliance will boost BlackRock’s custom model business, which is the fastest-growing model segment, yielding $31 billion in new assets over the past four years. The company has several existing partnerships with numerous wealth platforms that offer the implementation of custom models. Some of the initial custom models that will be accessible on GeoWealth’s platform are likely to include private market strategies alongside ETFs and mutual funds.

“This initiative supports our goal of helping more and more advisors meet the evolving needs of their clients, who increasingly seek more diversified, personalized, and tax-efficient strategies,” Cout further added.

This offering will give advisors a streamlined and scalable solution, which integrates public and private markets within a single portfolio solution. This, thus, will, simplify access to a high-demand yet hard-to-access asset class traditionally.

BLK perceives substantial growth opportunities in the U.S. wealth market and has been engaged in enhancing its position to become an integral, whole portfolio partner to advisors in a rising complicated environment. Overall, the company’s U.S. Wealth Advisory business is a key growth driver, generating roughly 25% of its revenues in 2023.

BlackRock remains optimistic regarding the pursuit of opportunistic acquisition to further diversify its offerings and deepen its market share. In May 2024, the company acquired the remaining 75% stake in SpiderRock to augment its SMA offerings. Further, it agreed to acquire Global Infrastructure Partners this January. Additionally, in 2023, it acquired Kreos Capital and formed a strategic joint venture with Jio Financial Services Limited, Jio BlackRock.

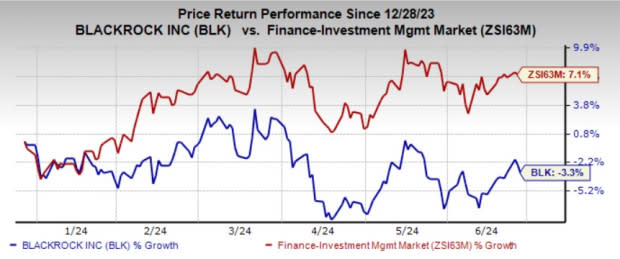

Over the past six months, shares of the company have lost 3.3% against the industry’s growth of 7.1%.

Image Source: Zacks Investment Research

BlackRock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Financial Services Firms Taking Similar Steps

Earlier this month, AssetMark Financial Holdings Inc.’s AMK wholly-owned subsidiary AssetMark Inc. entered into a strategic coalition with Morningstar Wealth. The transaction, approved by the board of directors of both companies, is expected to be closed in the second half of 2024, subject to regulatory approvals.

AssetMark will acquire roughly $12 billion in assets from Morningstar Wealth Turnkey Asset Management Platform ("TAMP") as part of the alliance. AssetMark’s platform, which offers top-tier service, advisor technology, business consulting and a diligently selected group of investment strategists, will be accessible to financial advisors and clients on Morningstar Wealth’s TAMP.

Similarly, Stifel Financial Corp. SF and Lord Abbett, LLC entered into a joint agreement to establish a leveraged lending joint venture — SBLA Private Credit. This new entity will concentrate on the origination and management of existing loans to small and mid-sized portfolio companies of financial sponsors, thus augmenting the existing capabilities of both firms.

SBLA Private Credit integrates two of the industry’s most established brands, offering extensive middle-market coverage and is known for its strategic growth and disciplined risk management. Given the combination of SF’s robust full-service platform and established direct lending proficiency with Lord Abbett’s solid leveraged credit presence and substantial capital base, SBLA Private Credit remains uniquely poised for success in the existing origination market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Stifel Financial Corporation (SF) : Free Stock Analysis Report

AssetMark Financial Holdings, Inc. (AMK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance