Bitcoin (BTC) Rebounds to $30,000 as Investors Ignore Gensler Warnings

Key Insights:

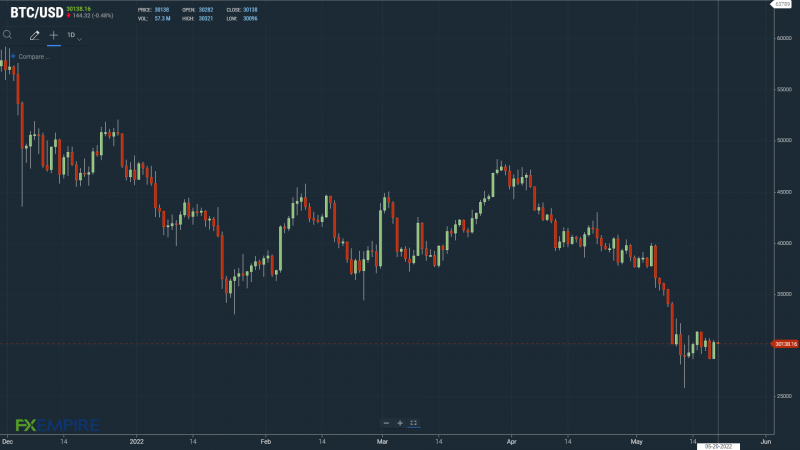

On Thursday, bitcoin (BTC) rallied by 5.63% to return to $30,000. The upside came despite the US equity markets seeing red.

SEC Chair Gary Gensler also failed to reverse early gains despite the warning of more coin collapses.

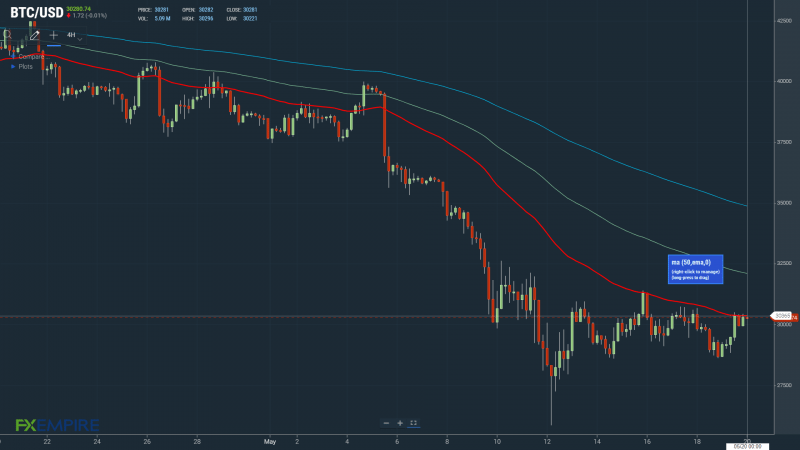

Bitcoin (BTC) technical indicators flash red, with bitcoin sitting at the 50-day EMA.

Bitcoin (BTC) rallied by 5.63% on Thursday, the breakout coming despite SEC Chair Gary Gensler’s warnings of more crypto pain. Reversing a 5.75% loss from Wednesday, bitcoin ended the day at $30,282.

A bullish session saw bitcoin strike a mid-afternoon high of $30,505 before easing back. Bitcoin broke through the First Major Resistance Level at $30,024 to test resistance at the 50-day EMA before ending the day at sub-$30,300.

Bearish sentiment from the US equity markets failed to hit the crypto market, with investors now looking beyond Terra LUNA and TerraUSD (UST).

SEC Chair Gary Gensler also failed to spook investors despite the warnings of more crypto failures.

On Thursday, Gensler talked of other cryptos mirroring Terra’s demise to harm investors. The SEC Chair didn’t predict a few failures but many.

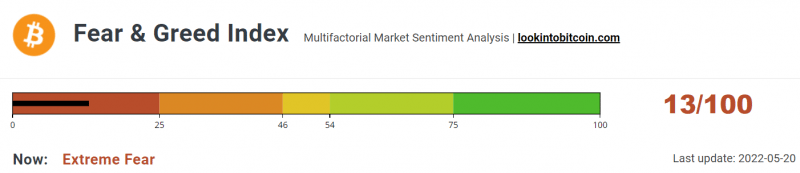

The Bitcoin Fear & Greed Index Remains Deep in the Extreme Fear Zone

This morning, the Fear & Greed Index held steady at 13/100. While up from Tuesday’s 8/100, the Index remained in the “Extreme Fear” zone, reflecting the bearish sentiment across the crypto market.

Investors took little notice of the Index on Thursday. The bitcoin rally came despite the index sitting deep in the “Extreme Fear” zone, with the return to $30,000 having a muted impact on the Index this morning. Bitcoin and the broader market also ignored movements across the US equity markets.

The NASDAQ reversed gains from the session to end the day down 0.26%.

Bitcoin (BTC) Price Action

At the time of writing, BTC was down 0.48% to $30,138.

Technical Indicators

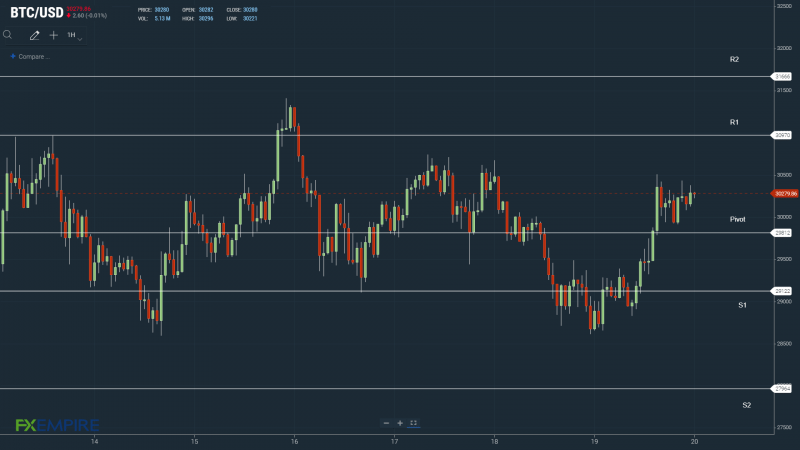

BTC will need to avoid the $29,812 pivot to target the First Major Resistance Level at $30,970.

BTC would need the broader crypto market to support a breakout from $30,500 levels.

An extended rally would test the Second Major Resistance Level at $31,666 and resistance at $32,000. The Third Major Resistance Level sits at $33,517.

A fall through the pivot would test the First Major Support Level at $29,122. Barring another extended sell-off, BTC should steer clear of sub-$28,000 levels. The Second Major Support Level sits at $27,964.

Looking at the EMAs and the 4-hourly candlestick chart (below), it is a bearish signal. BTC sits below the 50-day EMA, currently at $30,365. This morning, the 50-day flattened on the 100-day EMA. The 100-day EMA fell back from the 200-day EMA; BTC negative.

A move through the 50-day EMA would support a run at $32,500.

This article was originally posted on FX Empire

More From FXEMPIRE:

JPMorgan targets more of Germany’s Mittelstand economic engine

China’s April Saudi oil imports soar 38% on yr, Russian oil up 4%

Musk denies he sexually harassed flight attendant on private jet

Zurich Insurance to exit Russian market, sell business to local team

Ukraine says it gets $530 million in U.S., UK grants from World Bank fund

Yahoo Finance

Yahoo Finance