The BIOREM Share Price Has Gained 15% And Shareholders Are Hoping For More

BIOREM Inc. (CVE:BRM) shareholders might be concerned after seeing the share price drop 13% in the last month. But at least the stock is up over the last five years. However we are not very impressed because the share price is only up 15%, less than the market return of 22%.

See our latest analysis for BIOREM

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, BIOREM actually saw its EPS drop 11% per year. Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. The falling EPS doesn’t correlate with the climbing share price, so it’s worth taking a look at other metrics.

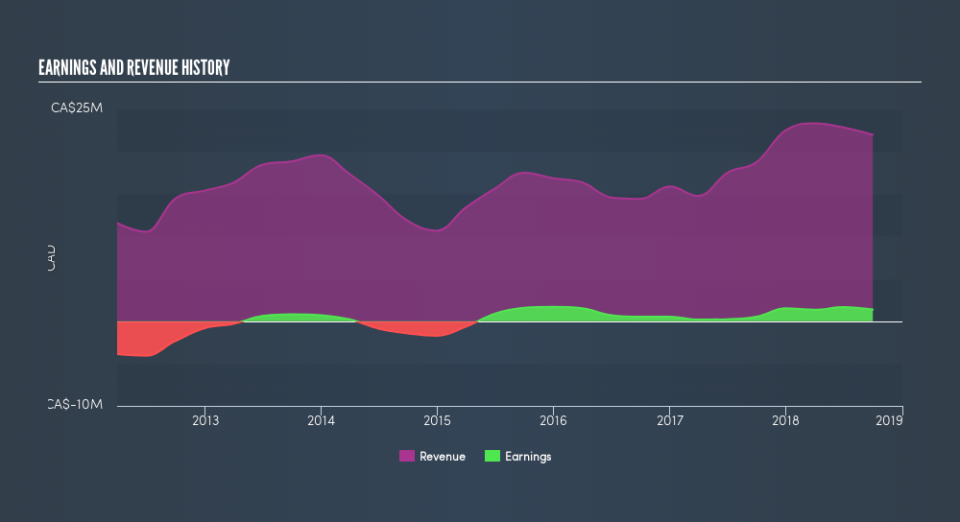

On the other hand, BIOREM’s revenue is growing nicely, at a compound rate of 7.2% over the last five years. It’s quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

BIOREM shareholders are down 13% for the year, but the market itself is up 4.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2.8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on BIOREM you might want to consider these 3 valuation metrics.

We will like BIOREM better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance