BioMarin (BMRN) Beats on Q1 Earnings, Voxzogo Drives Sales

BioMarin Pharmaceutical Inc. BMRN reported first-quarter 2024 adjusted earnings per share of 71 cents, beating the Zacks Consensus Estimate of 60 cents. The reported earnings rose 18.3% year over year, as higher sales were partially offset by rising R&D expenses.

Total revenues were $648.8 million in the reported quarter, up 9% year over year on a reported basis and 13% on a constant currency basis. Strong sales of Voxzogo drove revenues. The top line, however, missed the Zacks Consensus Estimate of $649.8 million.

Quarter in Detail

Product revenues (including Aldurazyme) totaled $637.8 million, up 8.8% year over year. Product revenues from BioMarin's marketed brands (excluding Aldurazyme) increased 9.1% year over year to $602.5 million on higher revenues from Voxzogo and Palynziq. This was offset by lower sales from Naglazyme and Kuvan. Royalty and other revenues totaled $11 million, up 10.3% year over year.

Voxzogo, approved for achondroplasia, generated sales of $152.9 million, up 74% year over year and 4.9% quarter over quarter, driven by strong demand. Higher sales of Voxzogo were fueled by the U.S. label expansion to younger age groups (under five years). This label expansion was received last year in October.

Voxzogo sales beat the Zacks Consensus Estimate and our model estimate of $150.6 million and $149.6 million, respectively.

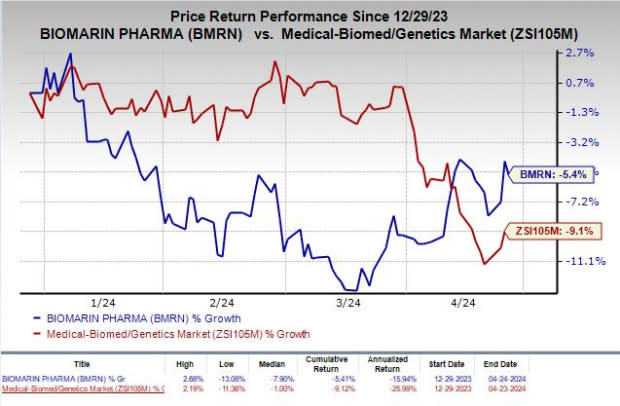

Shares of BioMarin have lost 5.4% year to date, compared with the industry’s 9.1% decline.

Image Source: Zacks Investment Research

Vimizim sales rose 2% year over year to $192.6 million. The drug’s sales beat the Zacks Consensus Estimate and our model estimate of $183.5 million and $186.3 million, respectively.

Palynziq injection sales grossed $75.7 million in the quarter, up 21% year over year, driven by higher sales volume in the United States. The drug’s sales missed the Zacks Consensus Estimate of $77.2 million but beat our model estimates of $71 million.

Naglazyme sales fell 14% year over year to $105.6 million due to unfavorable timing of large government orders from some countries of the Middle East. Brineura generated sales of $39 million, which remained flat year over year.

New gene therapy, Roctavian, generated $0.8 million in sales during the first quarter compared with $2.7 million in the previous quarter. Sales declined sequentially owing to reimbursement and market access challenges.

In the phenylketonuria franchise, Kuvan revenues declined 29% to $35.9 million due to generic competition.

Product revenues from Aldurazyme totaled $35.3 million, up 3% from that recorded in the prior year quarter. Sales increased due to the favorable timing of order fulfillment to Sanofi.

2024 Guidance

BioMarin maintained the total revenue guidance for 2024 it provided earlier this year. The company continues to expect total revenues in the range of $2.7-$2.8 billion. The Zacks Consensus Estimate for full-year 2024 revenues stands at around $2.73 billion.

However, adjusted operating margin is now expected to be between 24% and 25% compared with the earlier projection of 23% and 24%.

BioMarin also expects adjusted earnings per share to be in the range of $2.75-$2.95, compared with the earlier expectation of $2.60-$2.80. Adjusted earnings per share guidance was raised due to the expected reduction in research and development (R&D) costs resulting from the discontinuation of the four pipeline programs, including BMN 331, BMN 255, BMN 355 and BMN 365.

Recent Updates

BioMarin is planning to begin a pivotal registrational program on Voxzogo for a new indication, hypochondroplasia, a condition characterized by impaired bone growth. The company is also preparing to initiate two additional clinical programs evaluating Voxzogo in idiopathic short stature and genetic short stature conditions, respectively. Enrollment in all three programs is expected to begin later in 2024.

In January 2024, BMRN started a strategic portfolio review of all R&D programs to determine which pipeline programs should be selected and advanced for further development.

As a result of this strategic review of R&D programs, the company is prioritizing the development of BMN 333, a long-acting CNP for multiple growth-disorders, BMN 349, a first-in-class, oral therapeutic for AATD-associated liver disease, and BMN 351, a next-generation oligonucleotide for Duchenne muscular dystrophy.

BioMarin Pharmaceutical Inc. Price, Consensus and EPS Surprise

BioMarin Pharmaceutical Inc. price-consensus-eps-surprise-chart | BioMarin Pharmaceutical Inc. Quote

Zacks Rank & Stocks to Consider

BioMarin currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are ADMA Biologics, Inc. ADMA, Ligand Pharmaceuticals Incorporated LGND and ANI Pharmaceuticals, Inc. ANIP, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Year to date, shares of ADMA have rallied 42.9%.

ADMA’s earnings beat estimates in three of the trailing four quarters and met the same once, the average surprise being 85.00%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have decreased 0.6%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have improved from $4.12 to $4.43. Year to date, shares of ANIP have jumped 18.7%.

Earnings of ANIP beat estimates in each of the trailing four quarters, the average surprise being 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance