Biogen (BIIB) to Buy HI-Bio to Expand Rare Disease Pipeline

Biogen BIIB entered into a definitive agreement to acquire private biotech, HI-Bio, for a $1.15 billion upfront payment.

The acquisition will expand Biogen’s rare disease pipeline by adding Hi-Bio’s lead candidate, felzartamab, a promising late-stage ready asset with potential application across a range of rare immune-mediated diseases. Felzartamab, a fully human anti-CD38 monoclonal antibody, has demonstrated an impact on key biomarkers and clinical endpoints in three renal diseases.

Felzartamab is being developed in a phase II study for IgA nephropathy (IgAN), a chronic kidney disease. Also, phase II studies are completed in two other kidney diseases — primary membranous nephropathy (PMN) and antibody-mediated rejection (AMR) in kidney transplant recipients. HI-Bio has plans to advance felzartamab into phase III for all indications.

HI-Bio has received Breakthrough Therapy Designation and Orphan Drug Designation (ODD) from the FDA for the PMN indication. It has received ODD for AMR in kidney transplant disease.

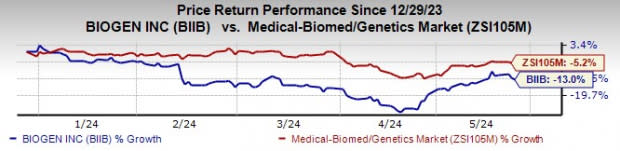

Biogen’s stock has declined 13% so far this year compared with a decrease of 5.2% for the industry.

Image Source: Zacks Investment Research

HI-Bio’s pipeline also includes zastobart/HIB210, an anti-C5aR1 antibody, which is in phase I development. This candidate has the potential to be developed across a range of complement-mediated diseases.

In addition to the upfront payment, Biogen will be entitled to make up to $650 million in potential milestone payments to HI-Bio for a total potential deal value of $1.8 billion. The transaction is not expected to impact Biogen’s 2024 financial guidance and is expected to close in the third quarter of 2024.

The acquisition looks like a strategic fit for Biogen, which is grappling with fierce competition for its multiple sclerosis drugs and slow sales of a new Alzheimer’s drug, Leqembi. The company needs to diversify its portfolio beyond the risky neuroscience field to other therapeutic areas like immunology.

HI-Bio in-licensed exclusive rights to develop and commercialize felzartamab across all indications in all countries and territories, excluding China, from Germany-based global biopharmaceutical company MorphoSys AG MOR.

MorphoSys AG originally developed felzartamab for treating multiple myeloma. MorphoSys AG is due to be acquired by Novartis NVS for €68 per share or an aggregate of €2.7 billion. The acquisition will add late-stage oncology candidate pelabresib to Novartis’ pipeline.

Zacks Rank and Stock to Consider

Biogen currently has a Zacks Rank #3 (Hold).

Biogen Inc. Price and Consensus

Biogen Inc. price-consensus-chart | Biogen Inc. Quote

A better-ranked stock in the healthcare sector is Atara Biotherapeutics ATRA, which has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the Zacks Consensus Estimate for Atara Biotherapeutics’ 2024 loss per share has narrowed from $1.78 per share to $1.22 per share. Estimates for 2025 have narrowed from 95 cents per share to 58 cents per share. This year, shares of Atara Biotherapeutics have risen 36.5%.

Earnings of Atara Biotherapeutics beat estimates in two of the last four quarters while missing in the other two. ATRA delivered a four-quarter average earnings surprise of 9.17%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report

MorphoSys AG Unsponsored ADR (MOR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance