Bill Ackman's Pershing Square Cuts Lowe's Stake by Over 80%

Insights from the Latest 13F Filing Reveal Significant Portfolio Adjustments

Bill Ackman (Trades, Portfolio), the renowned activist investor and head of Pershing Square Capital Management, has made notable changes to his investment portfolio in the fourth quarter of 2023. Ackman, who began his career in real estate before founding Gotham Partners LP and later Pershing Square in November 2003, is known for his strategy of buying undervalued stocks and advocating for corporate changes to unlock shareholder value. His latest 13F filing sheds light on his investment moves, including a substantial reduction in Lowe's Companies Inc and an increase in Howard Hughes Holdings Inc.

Key Position Increases

During the quarter, Ackman's Pershing Square increased its stake in one particular stock:

Howard Hughes Holdings Inc (NYSE:HHH) saw an addition of 2,045,156 shares, bringing the total to 18,852,064 shares. This move represents a significant 12.17% increase in share count, a 1.68% impact on the current portfolio, and a total value of $1,612,794,080.

Key Position Reductions

Ackman's portfolio adjustments also included reductions in several holdings:

Lowe's Companies Inc (NYSE:LOW) was reduced by 5,821,108 shares, resulting in an 82.37% decrease in shares and an 11.53% impact on the portfolio. The stock traded at an average price of $202.7 during the quarter and has returned 12.77% over the past three months and 2.48% year-to-date.

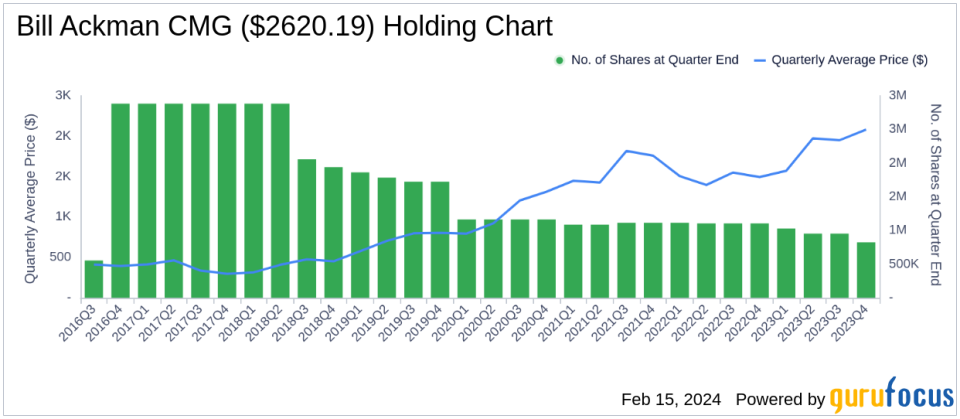

Chipotle Mexican Grill Inc (NYSE:CMG) was reduced by 128,610 shares, leading to a 13.49% reduction in shares and a 2.25% impact on the portfolio. The stock traded at an average price of $2,080.46 during the quarter and has returned 20.97% over the past three months and 14.57% year-to-date.

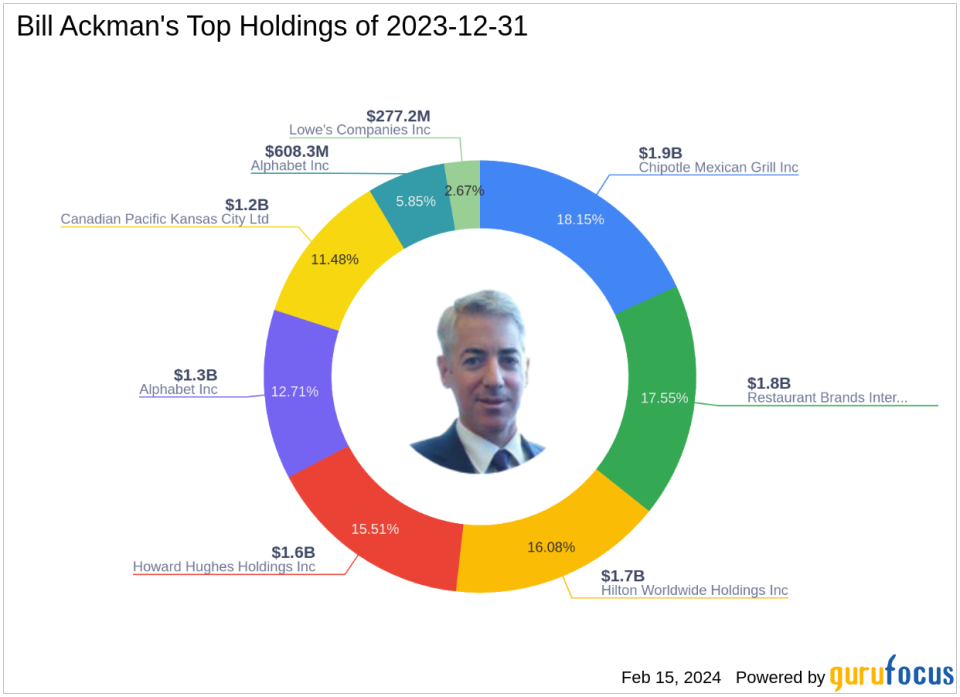

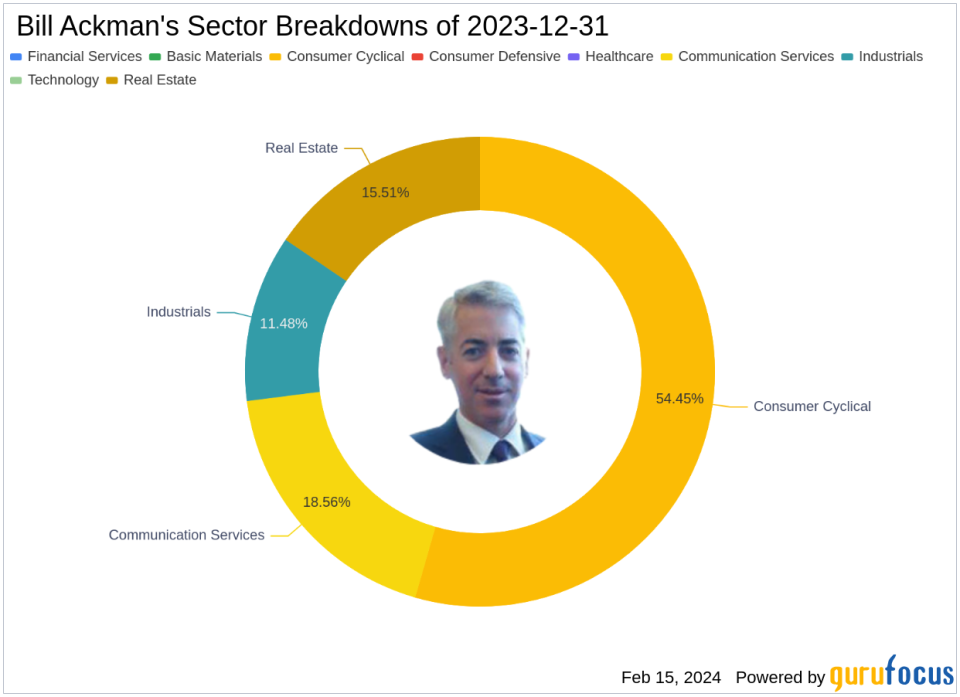

Portfolio Overview

As of the fourth quarter of 2023, Bill Ackman (Trades, Portfolio)'s portfolio comprised 8 stocks, with top holdings including 18.15% in Chipotle Mexican Grill Inc (NYSE:CMG), 17.55% in Restaurant Brands International Inc (NYSE:QSR), 16.08% in Hilton Worldwide Holdings Inc (NYSE:HLT), 15.51% in Howard Hughes Holdings Inc (NYSE:HHH), and 12.71% in Alphabet Inc (NASDAQ:GOOG). The holdings are mainly concentrated in four industries: Consumer Cyclical, Communication Services, Real Estate, and Industrials, reflecting Ackman's strategic focus on these sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance