The Biggest Reason You Should Buy Barrick Gold Corp. Today

Rising gold prices in recent months has shifted investors? attention back to gold stocks. Barrick Gold Corp. (TSX:ABX)(NYSE:ABX) hasn?t gotten too much love though, with shares of the gold-mining giant dropping 6% in the past three months and a whopping 20% year to date.

Take heart, because Barrick Gold just revealed something big that should make you want to add the stock to your portfolio right now.

On the right track

Barrick Gold just presented at the Denver Gold Forum, and some of the things the company said make for a compelling bull case for its stock, the most important being its debt-reduction goals.

Barrick is on track to reduce its debt to US$5 billion by next year. That?s a significant number when you read it alongside the following two figures:

Barrick started 2017 with nearly US$7.9 billion in debt.

In 2014, its debt has shot up to US$13.1 billion.

To put it simply, if Barrick can meet its US$5 billion debt target next year, it will have cut down its debt by a staggering 60% in just four years.

This aggressive deleveraging should lay the foundation for a strong future, more so because Barrick isn?t losing sight of the need to grow cash flows as well.

Two key areas Barrick stands out

Given how vulnerable the gold-mining business is to the prices of the yellow metal, having a tight grip on costs and building a strong balance sheet becomes a prerequisite for survival. Barrick is doing a great job on both ends. It is already the lowest-cost producer among the publicly listed gold companies, with a projected all-in sustaining cost (AISC) of only US$745 per ounce at the midpoint for 2017. Rival Goldcorp Inc. (TSX:G)(NYSE:GG), for instance, expects its 2017 AISC to be around US$825 per ounce of gold.

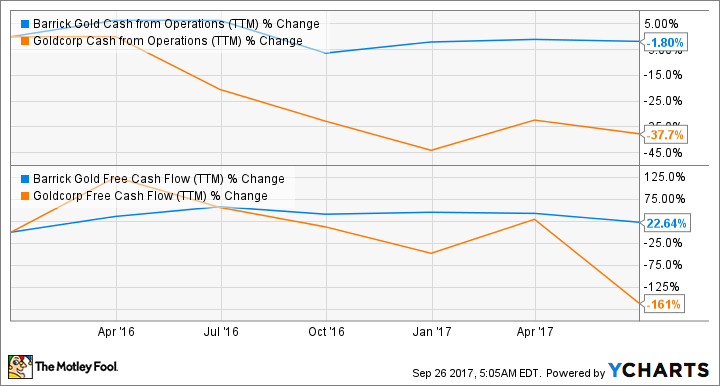

During the Denver Forum, Barrick also reaffirmed its target of free cash flow breakeven cost at gold prices of US$1,000 per ounce. Here too, Barrick has been able to grow its cash from operations and free cash flows at a much faster clip than Goldcorp in recent years.

ABX Cash from Operations (TTM) data by YCharts

Barrick intends to use its strong cash flows and cash balance ? which was around US$2.9 billion at the end of the second quarter ? to pare down debt. In an interview to Bloomberg, Barrick?s president Kelvin Dushnisky also revealed that the company is open to divesting stakes in non-core assets, such as Australia?s Kalgoorlie Super Pit mine, to raise more funds for deleveraging if required.

Growth catalysts outweigh the risks

Of course, Barrick isn?t free from risks, and the ongoing tax dispute between Tanzania and Acacia Mining, which is largely owned by Barrick, remains a key concern. That said, Barrick?s intent focus on reducing costs while strengthening its balance sheet and boosting cash flows should also help it ride any storms that may strike from Tanzania or elsewhere.

Meanwhile, Barrick?s move to increase is dividend by 50% earlier this year reflects management?s confidence in future cash flow growth. At a price-to-cash flow ratio of only 6.8 times, Barrick looks like a compelling buy for the long run.

1 Massive Dividend Stock to Buy Today (7.8% Yield!) - The Dividend Giveaway

The Motley Fool Canada's top dividend expert and lead adviser of Dividend Investor Canada, Bryan White, recently released a premium "buy report" on a dividend giant he thinks everyone should own. Not only that - but he's created a must-have, exclusive report that outlines all the alarming traits of dividend stocks that are about to blow up - and how you can avoid them.

For this limited time only, we're not only taking 57% off Dividend Investor Canada, but we're offering you special access to two brand-new reports, free of charge upon signing up. They will outline everything you need to know so you steer clear of dividend burn-outs AND take advantage of the dividend giants in the Canadian market.

While this offer is still available, you can find out how to get a copy of these brand-new reports by simply clicking here.

More reading

Rising Rates and the Threat of War: Where Will Gold and Silver Go?

The Latest Pullback in Gold Makes Now the Time to Buy This Senior Gold Miner

Fool contributor Neha Chamaria has no position in any stocks mentioned.

1 Massive Dividend Stock to Buy Today (7.8% Yield!) - The Dividend Giveaway

The Motley Fool Canada's top dividend expert and lead adviser of Dividend Investor Canada, Bryan White, recently released a premium "buy report" on a dividend giant he thinks everyone should own. Not only that - but he's created a must-have, exclusive report that outlines all the alarming traits of dividend stocks that are about to blow up - and how you can avoid them.

For this limited time only, we're not only taking 57% off Dividend Investor Canada, but we're offering you special access to two brand-new reports, free of charge upon signing up. They will outline everything you need to know so you steer clear of dividend burn-outs AND take advantage of the dividend giants in the Canadian market.

While this offer is still available, you can find out how to get a copy of these brand-new reports by simply clicking here.

Fool contributor Neha Chamaria has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance